Symantec 2011 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Senior Notes. In the second quarter of fiscal 2011, we issued $350 million in principal amount of

2.75% Notes due September 15, 2015 and $750 million in principal amount of 4.20% Notes due September 15,

2020, for an aggregate principal amount of $1.1 billion.

Revolving Credit Facility. In the second quarter of fiscal 2011, we also entered into a $1 billion senior

unsecured revolving credit facility that expires in September 2014. Under the terms of this credit facility, we must

comply with certain financial and non-financial covenants, including a covenant to maintain a specified ratio of debt

to EBITDA (earnings before interest, taxes, depreciation and amortization). As of April 1, 2011, we were in

compliance with all required covenants, and there was no outstanding balance on the credit facility.

In addition, in the second quarter of fiscal 2011, we terminated our previous $1 billion senior unsecured

revolving credit facility that we entered into in July 2006. At the time of termination, there was no outstanding

balance on the credit facility. The original expiration date for this credit facility was July 2011.

We believe that our existing cash and investment balances, our borrowing capacity, our ability to issue new

debt instruments, and cash generated from operations will be sufficient to meet our working capital and capital

expenditures requirements for at least the next 12 months.

Uses of Cash

Our principal cash requirements include working capital, capital expenditures and payments of principal and

interest on our debt and taxes. In addition, we regularly evaluate our ability to repurchase stock and acquire other

businesses.

Acquisition-related. In fiscal 2011, we acquired the identity and authentication business of VeriSign, as well

as PGP, GuardianEdge and two other companies for an aggregate amount of $1.5 billion, net of cash acquired. In

fiscal 2010, we acquired two companies for an aggregate payment of $31 million, net of cash acquired. For fiscal

2009, we acquired MessageLabs, PC Tools, SwapDrive, and several other companies for an aggregate payment of

$1.1 billion, net of cash acquired.

Convertible Senior Notes. In June 2006, we issued $1.1 billion principal amount of 0.75% Notes due June 15,

2011, and $1.0 billion principal amount of 1.00% Notes due June 15, 2013, to initial purchasers in a private offering

for resale to qualified institutional buyers pursuant to SEC Rule 144A. In fiscal 2011, we repurchased $500 million

of aggregate principal amount of our 0.75% Notes in privately negotiated transactions for approximately

$510 million. Concurrently with the repurchase, we sold a proportionate share of the note hedges that we entered

into at the time of the issuance of the Convertible Senior Notes back to the note hedge counterparties for

approximately $13 million. The net cost of the repurchase of the 0.75% Notes and the concurrent sale of the note

hedges was $497 million in cash. We did not pay any amount of the 0.75% Notes or the 1.00% Notes other than the

related interest costs in either of fiscal 2010 or 2009.

Stock Repurchases. We repurchased 57 million, 34 million, and 42 million shares for $872 million,

$553 million, and $700 million during fiscal 2011, 2010, and 2009, respectively. As of April 1, 2011, we had

$877 million remaining under the plan authorized for future repurchases.

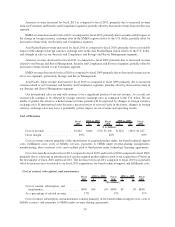

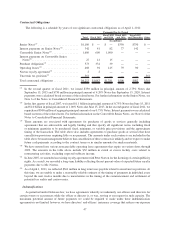

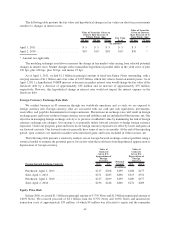

Cash Flows

The following table summarizes, for the periods indicated, selected items in our Consolidated Statements of

Cash Flows:

2011 2010 2009

Fiscal

(In millions)

Net cash provided by (used in):

Operating activities .................................... $1,794 $1,693 $1,671

Investing activities ..................................... (1,760) (65) (961)

Financing activities .................................... (184) (441) (677)

45