Symantec 2011 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

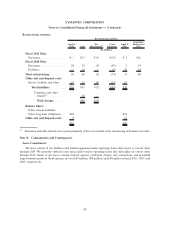

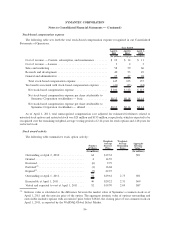

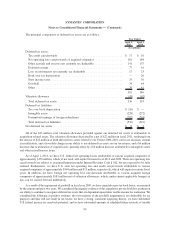

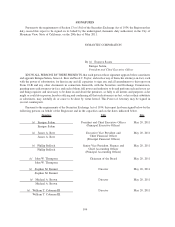

The principal components of deferred tax assets are as follows:

April 1,

2011

April 2,

2010

Year Ended

(In millions)

Deferred tax assets:

Tax credit carryforwards ......................................... $ 17 $ 16

Net operating loss carryforwards of acquired companies . ................. 181 148

Other accruals and reserves not currently tax deductible . ................. 141 137

Deferred revenue ............................................... 77 61

Loss on investments not currently tax deductible ....................... 17 23

Book over tax depreciation ....................................... — 20

State income taxes.............................................. 35 36

Goodwill ..................................................... 34 64

Other ....................................................... 79 81

581 586

Valuation allowance .............................................. (45) (67)

Total deferred tax assets ......................................... 536 519

Deferred tax liabilities:

Tax over book depreciation ....................................... $ (26) $ —

Intangible assets ............................................... (228) (272)

Unremitted earnings of foreign subsidiaries ........................... (282) (244)

Total deferred tax liabilities ....................................... (536) (516)

Net deferred tax assets ............................................ $ 0 $ 3

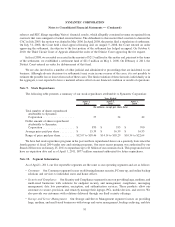

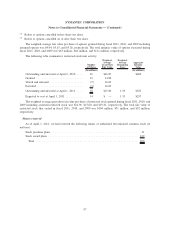

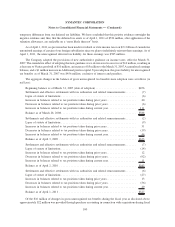

All of the $45 million total valuation allowance provided against our deferred tax assets is attributable to

acquisition-related assets. The valuation allowance decreased by a net of $22 million in fiscal 2011, resulting from

the release of $22 million of Irish deferred tax assets related to our Veritas 2000-2001 court case decision, current

year utilization, and a favorable change in our ability to use deferred tax assets on our tax returns; and a $6 million

decrease due to utilization of capital losses, partially offset by a $6 million increase attributable to intangible assets

and other miscellaneous items.

As of April 1, 2011, we have U.S. federal net operating losses attributable to various acquired companies of

approximately $170 million, which, if not used, will expire between fiscal 2012 and 2029. These net operating loss

carryforwards are subject to an annual limitation under Internal Revenue Code § 382, but are expected to be fully

realized. Furthermore, we have U.S. state net operating loss and credit carryforwards attributable to various

acquired companies of approximately $344 million and $13 million, respectively, which will expire in various fiscal

years. In addition, we have foreign net operating loss carryforwards attributable to various acquired foreign

companies of approximately $583 million net of valuation allowances, which, under current applicable foreign tax

law, can be carried forward indefinitely.

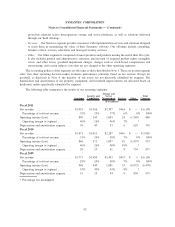

As a result of the impairment of goodwill in fiscal year 2009, we have cumulative pre-tax book losses, as measured

by the current and prior two years. We considered the negative evidence of this cumulative pre-tax book loss position on

our ability to continue to recognize deferred tax assets that are dependent upon future taxable income for realization. We

considered the following as positive evidence: the vast majority of the goodwill impairment is not deductible for tax

purposes and thus will not result in tax losses; we have a strong, consistent taxpaying history; we have substantial

U.S. federal income tax carryback potential; and we have substantial amounts of scheduled future reversals of taxable

99

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)