Symantec 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Long-Lived Assets (including Assets Held for Sale). We assess long-lived assets to be held and used for

impairment whenever events or changes in circumstances indicate that the carrying value of the long-lived assets

may not be recoverable. Based on the existence of one or more indicators of impairment, we assess recoverability of

long-lived assets based on a projected undiscounted cash flow method using assumptions determined by man-

agement to be commensurate with the risk inherent in our current business model. If an asset is not recoverable,

impairment is measured as the difference between the carrying amount and its fair value. Our estimates of cash

flows require significant judgment based on our historical and anticipated results and are subject to many factors

which could change and cause a material impact to our operating results or financial condition. We record

impairment charges on long-lived assets held for sale when we determine that the carrying value of the long-lived

assets may not be recoverable. In determining fair value, we obtain and consider market value appraisal information

from third-parties.

Fair Value of Financial Instruments

The assessment of fair value for our financial instruments is based on the authoritative guidance on fair value

measurements which establishes a fair value hierarchy that is based on three levels of inputs and requires an entity to

maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value.

We use inputs such as actual trade data, benchmark yields, broker/dealer quotes and other similar data which

are obtained from independent pricing vendors, quoted market prices or other sources to determine the ultimate fair

value of our assets and liabilities. We use such pricing data as the primary input, to which we have not made any

material adjustments, to make our assessments and determinations as to the ultimate valuation of our investment

portfolio, and we are ultimately responsible for the financial statements and underlying estimates. The fair value

and inputs are reviewed for reasonableness, may be further validated by comparison to publicly available

information and could be adjusted based on market indices or other information that we deem material to the

estimated fair value of our investment portfolio.

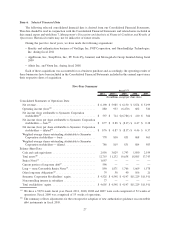

As of April 1, 2011, our financial instruments measured at fair value on a recurring basis included $2.0 billion

of assets which consists of cash equivalents invested in money market funds and bank securities. Investments

totalling $1.9 billion were classified as Level 1 and $204 million were classified as Level 2, which are comprised

solely of money market funds and bank securities, respectively.

Valuations for Level 1 securities were based on quoted prices for identical securities in active markets.

Determining fair value for Level 1 instruments generally does not require significant management judgment.

Valuations for Level 2 securities were based on either (1) the fair value of similar securities or (2) pricing models

with all significant inputs derived from or corroborated by observable market prices for identical securities in

markets with insufficient volume or infrequent transactions (less active markets).

While determining the fair value for Level 2 instruments does not necessarily require significant management

judgment, it generally involves the following degree of judgment and subjectivity: (1) an assessment of an active

market for marketable securities generally takes into consideration whether a trading market exists for a given

instrument or the level of trading volume for each instrument type and (2) when observable market prices for

identical securities or similar securities are not available, we may price marketable securities using: non-binding

market consensus prices that are corroborated with observable market data; or pricing models, such as discounted

cash flow approaches, with all significant inputs derived from or corroborated with observable market data. The

majority of our Level 2 financial instruments were classified as such due to either low trading activity in active

markets or no active market existing. For certain financial instruments, identical securities were used to determine

fair value. For those securities where no active market existed, amortized cost was used as it approximates their fair

value because of their short maturities.

As of April 1, 2011, we had no financial instruments with unobservable inputs classified in Level 3 under the

hierarchy set forth under the authoritative guidance on fair value measurements. Level 3 instruments generally

would include those for which unobservable inputs used in the valuation methodology are significant to the

measurement of fair value of assets or liabilities. The determination of fair value for Level 3 instruments requires the

most management judgment and subjectivity.

33