Symantec 2011 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the difference between book value of the notes net of the remaining unamortized discount prior to repurchase and

the fair value of the liability component of the notes upon repurchase. The fair value of the liability component was

calculated to be $497 million using Level 2 inputs based on market prices for similar convertible debt instruments

and resulting yields. See Note 6 for further details.

Note 3. Acquisitions

Fiscal 2011 acquisitions

Identity and Authentication Business of VeriSign, Inc.

On August 9, 2010, we completed the acquisition of the identity and authentication business of VeriSign,

which included a controlling interest in VeriSign Japan and equity interests in certain other subsidiary entities. In

exchange for the assets and liabilities of the acquired business, we paid a total purchase price of $1.29 billion in

cash, which included net cash and working capital adjustments of $3 million. No equity interests were issued. The

results of operations of the identity and authentication business of VeriSign are included since the date of acquisition

as part of the Security and Compliance segment. Supplemental pro forma information for VeriSign was not material

to our financial results and was therefore not included. For fiscal 2011, we recorded acquisition-related transaction

costs of $11 million, which were included in general and administrative expense.

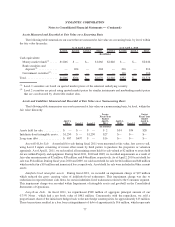

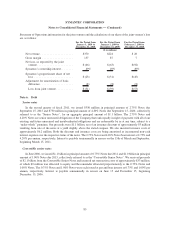

The following table presents the purchase price allocation included in our Consolidated Balance Sheets (in

millions):

Net tangible assets

(1)

..................................................... $ 178

Intangible assets

(2)

....................................................... 628

Goodwill

(3)

............................................................ 602

Deferred tax liability ..................................................... (38)

Noncontrolling interest in VeriSign Japan

(4)

.................................... (85)

Total purchase price ...................................................... $1,285

(1)

Net tangible assets included deferred revenue, which was adjusted down from $286 million to $68 million,

representing our estimate of the fair value of the contractual obligation assumed for the support of the

authentication business.

(2)

Intangible assets included customer relationships of $226 million, developed technology of $123 million and

tradenames of $5 million, which are amortized over their estimated useful lives of 18 months to nine years. The

weighted-average estimated useful lives were 8.0 years for customer relationships and 9.0 years for developed

technology. Intangible assets also included indefinite-lived tradenames and trademarks of $274 million.

(3)

Goodwill is partially tax deductible. The goodwill amount resulted primarily from our expectation of synergies

from the integration of VeriSign product offerings with our product offerings.

(4)

The fair value of the noncontrolling interest was calculated on a market basis using the closing stock price of

VeriSign Japan on the date of acquisition.

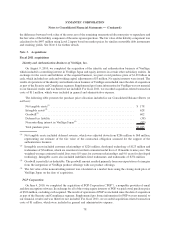

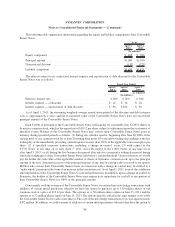

PGP Corporation

On June 4, 2010, we completed the acquisition of PGP Corporation (“PGP”), a nonpublic provider of email

and data encryption software. In exchange for all of the voting equity interests of PGP, we paid a total purchase price

of $306 million, excluding cash acquired. The results of operations of PGP are included since the date of acquisition

as part of the Security and Compliance segment. Supplemental pro forma information for PGP was not material to

our financial results and was therefore not included. For fiscal 2011, we recorded acquisition-related transaction

costs of $1 million, which were included in general and administrative expense.

78

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)