Symantec 2011 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178

|

|

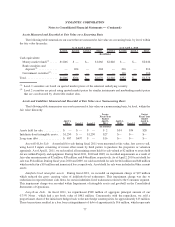

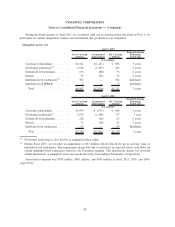

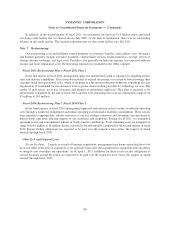

During the fourth quarter of fiscal 2011, in accordance with our accounting policy described in Note 1, we

performed our annual impairment analysis and determined that goodwill was not impaired.

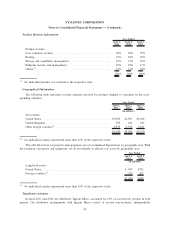

Intangible assets, net

Gross Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Weighted-Average

Remaining

Useful Life

April 1, 2011

($ in millions)

Customer relationships........... $2,121 $(1,227) $ 894 3 years

Developed technology

(1)

......... 1,810 (1,567) 243 4 years

Definite-lived tradenames......... 136 (80) 56 4 years

Patents ...................... 75 (62) 13 2 years

Indefinite-lived tradenames

(2)

...... 302 — 302 Indefinite

Indefinite-lived IPR&D .......... 3 — 3 Indefinite

Total ...................... $4,447 $(2,936) $1,511 3 years

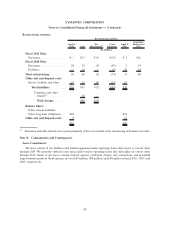

Gross Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Weighted-Average

Remaining

Useful Life

April 2, 2010

($ in millions)

Customer relationships........... $1,839 $ (973) $ 866 4 years

Developed technology

(1)

......... 1,635 (1,458) 177 1 year

Definite-lived tradenames......... 128 (66) 62 5 years

Patents ...................... 75 (54) 21 3 years

Indefinite-lived tradenames ....... 53 — 53 Indefinite

Total ...................... $3,730 $(2,551) $1,179 3 years

(1)

Developed technology is also known as acquired product rights.

(2)

During fiscal 2011, we recorded an impairment of $27 million which reduced the gross carrying value of

indefinite-lived tradenames. This impairment charge was due to reductions in expected future cash flows for

certain indefinite-lived tradenames related to the Consumer segment. This impairment charge was recorded

within Impairment of intangible assets and goodwill on the Consolidated Statements of Operations.

Amortization expense was $385 million, $481 million, and $585 million in fiscal 2011, 2010, and 2009,

respectively.

83

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)