Symantec 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Stock Options: Stock options provide an incentive for executives to drive long-term share price appreciation

through the development and execution of effective long-term strategies. Stock option value is only realized if the

trading price of our common stock increases so that option holder interests are therefore aligned with stockholder

interests. Stock options are issued with exercise prices at 100% of the grant-date fair market value to assure that

executives will receive a benefit only when the trading price increases. Stock option awards generally have value for

the executive only if the executive remains employed with us for the period required for the shares to vest. Stock

options granted in fiscal 2011 vest 25% after the first year and on a monthly basis thereafter for the next 36 months,

and, if not exercised, expire in a maximum of seven years (or earlier in the case of termination of employment).

Providing for four-year option vesting creates retention value and is in line with market practices among companies

in our market composite. (Details of stock options granted to the named executive officers in fiscal 2011 are

disclosed in the Summary Compensation Table and Grants of Plan-Based Awards table included on pages 50 and

52, respectively.)

Restricted Stock Units (RSUs): RSUs represent the right to receive one share of Symantec common stock for

each RSU vested upon the settlement date, which is the date on which certain conditions, such as continued

employment with us for a pre-determined length of time, are satisfied. The Compensation Committee believes that

RSUs align the interests of the named executive officers with the interests of the stockholders because the value of

these awards appreciate if the trading price of our common stock appreciates, and also have retention value even

during periods in which our trading price does not appreciate, which supports continuity in the senior management

team.

Shares of our stock are issued to RSU holders as the awards vest. The vesting schedule for RSUs granted to our

named executive officers in fiscal 2011 provided that each award vests in four equal annual installments. (Details of

RSUs granted to the named executive officers in fiscal 2011 are disclosed in the Summary Compensation Table and

Grants of Plan-Based Awards table on pages 50 and 52, respectively.)

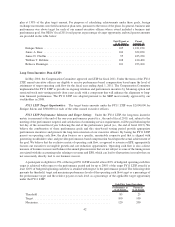

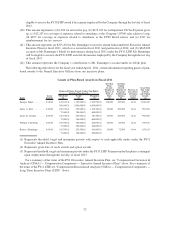

The following table summarizes the value of our NEOs’ total target long-term incentive compensation

awarded (sum of stock option and RSU grant date fair value and LTIP target award) in fiscal 2011 and 2010. With

the exception of Janice Chaffin, our NEOs’ total target long-term incentive compensation value declined in fiscal

2011, both because they received comparatively fewer options and RSUs in fiscal 2011 and because the grant date

value of Symantec’s stock was slightly lower in fiscal 2011 than in fiscal 2010. Ms. Chaffin’s total target long-term

incentive compensation value increased because she received a larger equity grant in fiscal year 2011 as a result of

the strong performance of the consumer business unit during fiscal 2010, which included the successful launch of

the Company’s new eCommerce store.

FY11 ($) FY10 ($) Change (%)

Enrique Salem ................................... 5,444,458 7,286,993 ⫺25.3

James A. Beer ................................... 1,203,460 1,597,146 ⫺24.6

Janice D. Chaffin ................................. 1,203,460 1,093,548 10.1

William T. Robbins................................ 899,836 1,827,775 ⫺50.8

Rebecca Ranninger ................................ 933,163 1,062,418 ⫺12.2

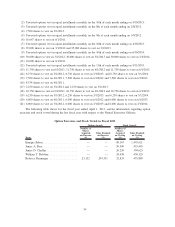

Performance-based Restricted Stock Units (PRUs): For fiscal 2012, the Compensation Committee granted

PRUs for the first time in furtherance of our pay for performance philosophy. These PRU grants were in lieu of the

stock options that we have historically awarded as a part of our annual executive compensation program. While this

development did not impact compensation decisions during fiscal 2011, implementation of this program represents

an important step taken by our Compensation Committee to continue to drive a pay-for-performance culture with a

component explicitly linked to total stockholder return. Unlike our restricted stock unit awards, the shares

underlying the PRUs awarded for fiscal 2012 are eligible to be earned only if we achieve the same non-GAAP EPS

goal for the FY12 Executive Annual Incentive Plan for fiscal 2012. Depending on our achievement of this goal, 0%

to 133% of the target shares will be eligible to be earned at the end of fiscal 2013 and 2014, based on, and subject to

further adjustment as a result of, the achievement of the total stockholder return (“TSR”) ranking for our company

as compared to the S&P 500. If any target shares become eligible (the “eligible shares”) to be earned in fiscal 2013

and 2014 as a result of achievement of the non-GAAP EPS goal for fiscal 2012, then 50% to 150% of one-half of the

eligible shares may be earned based on the achievement of the TSR goal for the two years ended March 29, 2013 and

44