Symantec 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

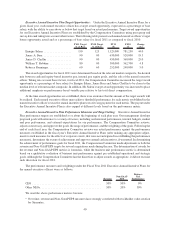

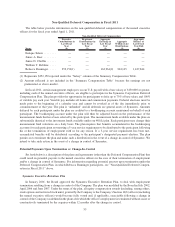

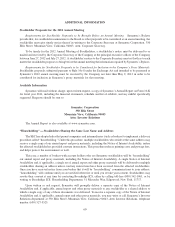

Summary of Compensation

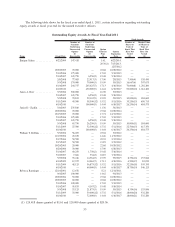

The following table shows for the fiscal year ended April 1, 2011, compensation awarded to or paid to, or

earned by, our Chief Executive Officer, our Chief Financial Officer and the three most highly compensated

executive officers who were serving as executive officers (other than as our Chief Executive Officer or Chief

Financial Officer) at April 1, 2011 (the “Named Executive Officers” or “NEOs”).

Summary Compensation Table for Fiscal 2011

Name and Principal Position

Fiscal

Year

Salary

($)

Bonus

($)

Stock

Awards

($)(1)

Option

Awards

($)(2)

Non-Equity

Incentive Plan

Compensation

($)

All Other

Compensation

($)

Total

($)

Enrique Salem ............. 2011 750,000 — 1,732,800 1,711,658 4,281,250(3) 33,975(4) 8,509,683

President and Chief Executive 2010 625,000 — 2,398,200 2,888,793 3,092,969(5) 17,387(6) 9,022,349

Officer 2009 625,000 — 999,500 1,267,848 1,246,875(7) 15,756(8) 4,154,979

JamesA.Beer.............. 2011 700,000 — 505,400 398,060 1,117,050(9) 19,632(10) 2,740,142

Executive Vice President, 2010 660,000 — 720,040 547,106 747,120(11) 12,949(12) 2,687,215

Chief Financial Officer 2009 660,000 — 599,700 528,270 884,700(13) 8,998(14) 2,681,668

Janice D. Chaffin. . . ......... 2011 500,000 — 505,400 398,060 890,250(15) 60,631(16) 2,354,341

Group President,

Consumer Business Unit

William T. Robbins . ......... 2011 475,000 — 361,000 238,836 875,400(17) 35,427(18) 1,985,663

Executive Vice President, 2010 453,375 — 812,930 684,845 625,800(19) 194,627(20) 2,771,577

Worldwide Sales and Services

Rebecca Ranninger . ......... 2011 420,000 — 346,560 286,603 718,260(21) 6,150(22) 1,777,573

Executive Vice President,

Chief Human Resources Officer

(1) Amounts shown in this column reflect the aggregate full grant date fair value calculated in accordance with

FASB Accounting Standards Codification Topic 718 for stock awards granted during the fiscal year.

(2) Amounts shown in this column reflect the aggregate full grant date fair value calculated in accordance with

FASB Accounting Standards Codification Topic 718 for option awards granted during the fiscal year. We

calculate the grant date fair value of stock options using the Black-Scholes option pricing model. The

following table includes the assumptions used to calculate the aggregate grant date fair value of awards

reported for fiscal 2011, 2010, and 2009. We do not currently pay cash dividends on our common stock and do

not anticipate doing so in the foreseeable future. The assumptions listed below are consistent with the

assumptions that we used to report stock option valuations and expense in the consolidated financial

statements contained in our annual report on Form 10-K for fiscal year 2011:

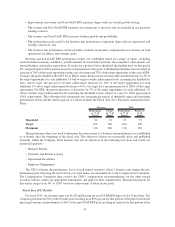

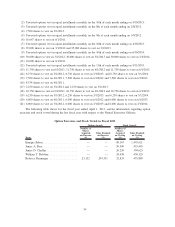

Grant Date Volatility (%)

Expected

Life (Years)

Risk-Free

Interest Rate (%)

6/10/2010 .................................. 34.02 3.51 1.93

5/11/2009 .................................. 43.94 3.38 1.46

4/10/2009 .................................. 43.94 3.38 1.46

5/9/2008 ................................... 34.53 3.12 2.06

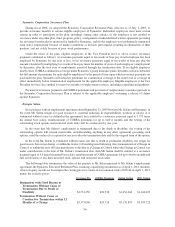

(3) This amount represents (a) $1,181,250 for Mr. Salem’s executive annual bonus under his Executive Annual

Incentive Plan for fiscal 2011, which was earned in fiscal 2011 and paid in fiscal 2012, and (b) $3,100,000

accrued on Mr. Salem’s behalf for performance during fiscal 2011 under the FY11 LTIP. Mr. Salem will be

eligible to receive the FY11 LTIP award if he remains employed by the Company through the last day of fiscal

2013.

(4) This amount represents coverage of expenses related to Mr. Salem’s attendance at the Company’s FY10 sales

achiever’s trip.

(5) This amount represents (a) $292,969 for Mr. Salem’s executive annual bonus under his Executive Annual

Incentive Plan for fiscal 2010, which was earned in fiscal 2010 and paid in fiscal 2011, and (b) $2,800,000

accrued on Mr. Salem’s behalf for performance during fiscal 2010 under the FY10 LTIP. Mr. Salem will be

50