Symantec 2011 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

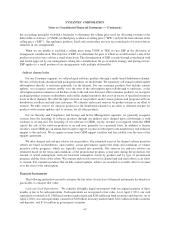

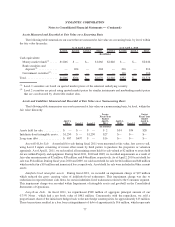

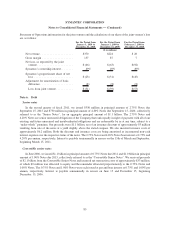

Assets Measured and Recorded at Fair Value on a Recurring Basis

The following table summarizes our assets that are measured at fair value on a recurring basis, by level, within

the fair value hierarchy:

Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

As of April 1, 2011 As of April 2, 2010

(In millions)

Cash equivalents:

Money market funds

(1)

. . . . . $1,866 $ — $— $1,866 $2,046 $ — $— $2,046

Bank securities and

deposits

(2)

............ — 204 — 204 — 216 — 216

Government securities

(2)

. . . . — — — — — 116 — 116

Total .................... $1,866 $204 $— $2,070 $2,046 $332 $— $2,378

(1)

Level 1 securities are based on quoted market prices of the identical underlying security.

(2)

Level 2 securities are priced using quoted market prices for similar instruments and nonbinding market prices

that are corroborated by observable market data.

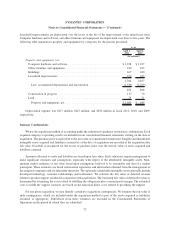

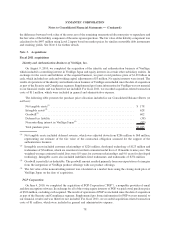

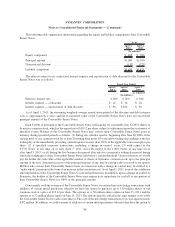

Assets and Liabilities Measured and Recorded at Fair Value on a Nonrecurring Basis

The following table summarizes our assets measured at fair value on a nonrecurring basis, by level, within the

fair value hierarchy:

April 1,

2011 Level 2 Level 3

Losses

Fiscal Year

Ended

April 1,

2011

April 2,

2010 Level 2

Losses

Fiscal Year

Ended

April 2,

2010

(In millions)

Assets held for sale ........... $ — $ — $ — $ 2 $34 $34 $20

Indefinite-lived intangible assets . . $1,250 $ — $1,250 $27 $— $— $—

Long-term debt .............. $ 497 $497 $ — $16 $— $— $—

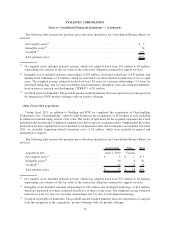

Assets Held for Sale. Assets held for sale during fiscal 2011 were measured at fair value, less costs to sell,

using Level 2 inputs consisting of recent offers made by third parties to purchase the properties or valuation

appraisals. As of April 1, 2011, we reclassified all remaining assets held for sale valued at $2 million to assets held

for use within Property and equipment. During fiscal 2011, 2010 and 2009, we recorded impairments as a result of

fair value measurements of $2 million, $20 million, and $46 million, respectively. As of April 2, 2010 assets held for

sale was $34 million. During fiscal years 2010 and 2009, we sold assets held for sale for $42 million and $40 million

which resulted in a $10 million and immaterial loss, respectively. Assets held for sale were included in Other current

assets.

Indefinite-lived intangible assets. During fiscal 2011, we recorded an impairment charge of $27 million

which reduced the gross carrying value of indefinite-lived tradenames. This impairment charge was due to

reductions in expected future cash flows for certain indefinite-lived tradenames related to the Consumer segment.

This impairment charge was recorded within Impairment of intangible assets and goodwill on the Consolidated

Statements of Operations.

Long-Term Debt. In fiscal 2011, we repurchased $500 million of aggregate principal amount of our

0.75% Notes , which had a net book value of $481 million. Concurrently with the repurchase, we sold a

proportionate share of the initial note hedges back to the note hedge counterparties for approximately $13 million.

These transactions resulted in a loss from extinguishment of debt of approximately $16 million, which represents

77

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)