Symantec 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(c)

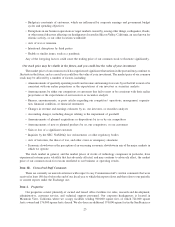

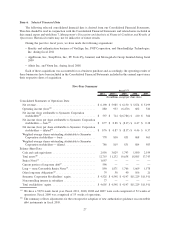

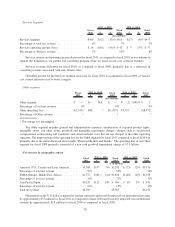

In fiscal 2010, we adopted new authoritative guidance on revenue recognition, which did not have a material

impact on our consolidated financial statements. Our joint venture also adopted this guidance during its period

ended December 31, 2009, which was applied to the beginning of its fiscal year. As a result of the joint venture’s

adoption of the guidance, our net income increased by $12 million during our fiscal 2010.

(d)

During fiscal 2009, we recorded a non-cash goodwill impairment charge of $7.4 billion.

(e)

In fiscal 2011, we issued $350 million in principal amount of 2.75% senior notes (“2.75% Notes”) due

September 15, 2015 and $750 million in principal amount of 4.20% senior notes (“4.20% Notes”) due

September 15, 2020.

(f)

In fiscal 2007, we issued $1.1 billion principal amount of 0.75% convertible senior notes (“0.75% Notes”) and

$1.0 billion principal amount of 1.00% convertible senior notes (“1.00% Notes”). In fiscal 2011, we repurchased

$500 million aggregate principal amount of our 0.75% Notes. Concurrently with this repurchase, we sold a

proportionate share of the initial note hedges back to the note hedge counterparties for approximately

$13 million. These transactions resulted in a loss from extinguishment of debt of approximately $16 million.

(g)

Beginning in fiscal 2008, we entered into OEM placement fee contracts, which is the primary driver for the

increase in liabilities.

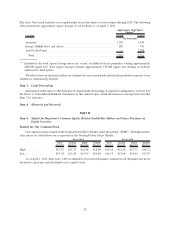

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

OVERVIEW

Our Business

Symantec is a global provider of security, storage and systems management solutions that help businesses and

consumers secure and manage their information and identities.

Fiscal Calendar

We have a 52/53-week fiscal year ending on the Friday closest to March 31. Unless otherwise stated,

references to fiscal years in this report relate to fiscal year and periods ended April 1, 2011, April 2, 2010 and

April 3, 2009. Fiscal 2011 and 2010 each consisted of 52 weeks, while fiscal 2009 consisted of 53 weeks. Our 2012

fiscal year will consist of 52 weeks and will end on March 30, 2012.

Our Operating Segments

Our operating segments are significant strategic business units that offer different products and services,

distinguished by customer needs. Since the fourth quarter of fiscal 2008, we have operated in five operating

segments: Consumer, Security and Compliance, Storage and Server Management, Services, and Other. For further

descriptions of our operating segments, see Note 10 of the Notes to Consolidated Financial Statements in this annual

report. Our reportable segments are the same as our operating segments.

Financial Results and Trends

Revenue increased by $205 million for fiscal 2011 compared to fiscal 2010. In fiscal 2011, we experienced

growth in our Security and Compliance segment primarily as a result of revenue associated with our fiscal 2011

acquisitions. During fiscal 2011, we acquired the identity and authentication business of VeriSign, Inc (“VeriSign”),

PGP Corporation (“PGP”), and GuardianEdge Technologies, Inc. (“GuardianEdge”) for an aggregate amount of

approximately $1.5 billion, net of cash acquired. We expect that these acquisitions will continue to contribute

positively to our revenue in future periods in the Security and Compliance segment. Within our Storage and Server

Management segment, sales of our information management products experienced growth while we experienced

weakness in our storage management solutions. Consumer segment revenues for fiscal 2011 benefited from the

completion of our transition to an internally-developed eCommerce platform for our Norton-branded consumer

products worldwide, excluding Japan, during the first quarter of fiscal 2011. The fees we had previously paid to

Digital River for operating our online store for these products were recorded as an offset to revenue; however, we

28