Symantec 2011 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

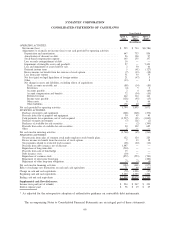

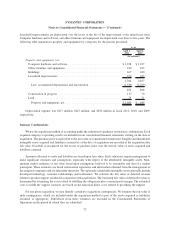

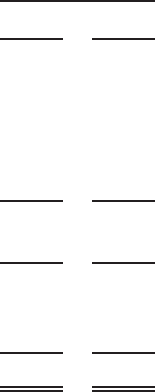

Leasehold improvements are depreciated over the lesser of the life of the improvement or the initial lease term.

Computer hardware and software, and office furniture and equipment are depreciated over three to five years. The

following table summarizes property and equipment by categories for the periods presented:

April 1,

2011

April 2,

2010

As of

(In millions)

Property and equipment, net:

Computer hardware and software ................................. $1,458 $ 1,237

Office furniture and equipment ................................... 189 185

Buildings ................................................... 467 440

Leasehold improvements........................................ 270 245

2,384 2,107

Less: accumulated depreciation and amortization .................... (1,530) (1,299)

854 808

Construction in progress ........................................ 117 70

Land ...................................................... 79 71

Property and equipment, net: ................................... $1,050 $ 949

Depreciation expense was $257 million, $247 million, and $250 million in fiscal 2011, 2010, and 2009,

respectively.

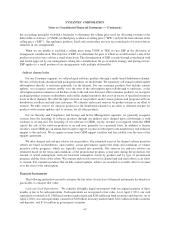

Business Combinations

We use the acquisition method of accounting under the authoritative guidance on business combinations. Each

acquired company’s operating results are included in our consolidated financial statements starting on the date of

acquisition. The purchase price is equivalent to the fair value of consideration transferred. Tangible and identifiable

intangible assets acquired and liabilities assumed as of the date of acquisition are recorded at the acquisition date

fair value. Goodwill is recognized for the excess of purchase price over the net fair value of assets acquired and

liabilities assumed.

Amounts allocated to assets and liabilities are based upon fair values. Such valuations require management to

make significant estimates and assumptions, especially with respect to the identifiable intangible assets. Man-

agement makes estimates of fair value based upon assumptions believed to be reasonable and that of a market

participant. These estimates are based on historical experience and information obtained from the management of

the acquired companies and are inherently uncertain. The separately identifiable intangible assets generally include

developed technology, customer relationships and tradenames. We estimate the fair value of deferred revenue

related to product support assumed in connection with acquisitions. The estimated fair value of deferred revenue is

determined by estimating the costs related to fulfilling the obligations plus a normal profit margin. The estimated

costs to fulfill the support contracts are based on the historical direct costs related to providing the support.

For any given acquisition, we may identify certain pre-acquisition contingencies. We estimate the fair value of

such contingencies, which are included under the acquisition method as part of the assets acquired or liabilities

assumed, as appropriate. Differences from these estimates are recorded in the Consolidated Statements of

Operations in the period in which they are identified.

72

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)