Symantec 2011 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the accounting principles establish a hierarchy to determine the selling price used for allocating revenue to the

deliverables as follows: (i) VSOE, (ii) third-party evidence of selling price (“TPE”) and (iii) the best estimate of the

selling price (“ESP”). Our appliance products, SaaS and certain other services are considered to be non-software

elements in our arrangements.

When we are unable to establish a selling price using VSOE or TPE, we use ESP in the allocation of

arrangement consideration. The objective of ESP is to determine the price at which we would transact a sale if the

product or service were sold on a stand-alone basis. The determination of ESP is made through consultation with

and formal approval by our management, taking into consideration the go-to-market strategy and pricing factors.

ESP applies to a small portion of our arrangements with multiple deliverables.

Indirect channel sales

For our Consumer segment, we sell packaged software products through a multi-tiered distribution channel.

We also sell electronic download and packaged products via the Internet. We separately sell annual content update

subscriptions directly to end-users primarily via the Internet. For our consumer products that include content

updates, we recognize revenue ratably over the term of the subscription upon sell-through to end-users, as the

subscription period commences on the date of sale to the end-user. For most other consumer products, we recognize

packaged product revenue on distributor and reseller channel inventory that is not in excess of specified inventory

levels in these channels. We offer the right of return of our products under various policies and programs with our

distributors, resellers, and end-user customers. We estimate and record reserves for product returns as an offset to

revenue. We fully reserve for obsolete products in the distribution channel as an offset to deferred revenue for

products with content updates and to revenue for all other products.

For our Security and Compliance and Storage and Server Management segments, we generally recognize

revenue from the licensing of software products through our indirect sales channel upon sell-through or with

evidence of an end-user. For licensing of our software to OEMs, royalty revenue is recognized when the OEM

reports the sale of the software products to an end-user, generally on a quarterly basis. In addition to license

royalties, some OEMs pay an annual flat fee and/or support royalties for the right to sell maintenance and technical

support to the end-user. We recognize revenue from OEM support royalties and fees ratably over the term of the

support agreement.

We offer channel and end-user rebates for our products. Our estimated reserves for channel volume incentive

rebates are based on distributors’ and resellers’ actual performance against the terms and conditions of volume

incentive rebate programs, which are typically entered into quarterly. Our reserves for end-user rebates are

estimated based on the terms and conditions of the promotional program, actual sales during the promotion, the

amount of actual redemptions received, historical redemption trends by product and by type of promotional

program, and the value of the rebate. We estimate and record reserves for channel and end-user rebates as an offset

to revenue. For consumer products that include content updates, rebates are recorded as a ratable offset to revenue

over the term of the subscription.

Financial Instruments

The following methods were used to estimate the fair value of each class of financial instruments for which it is

practicable to estimate that value:

Cash and Cash Equivalents. We consider all highly liquid investments with an original maturity of three

months or less to be cash equivalents. Cash equivalents are recognized at fair value. As of April 1, 2011, our cash

equivalents consisted of $1.9 billion in money market funds and $204 million in bank securities and deposits. As of

April 2, 2010, our cash equivalents consisted of $2.0 billion in money market funds, $216 million in bank securities

and deposits, and $116 million in government securities.

69

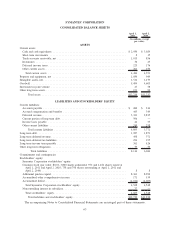

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)