Symantec 2011 Annual Report Download - page 118

Download and view the complete annual report

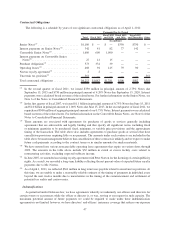

Please find page 118 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and may enable us to recover a portion of any future amounts paid. We believe the estimated fair value of these

indemnification agreements in excess of applicable insurance coverage is minimal.

We provide limited product warranties and the majority of our software license agreements contain provisions

that indemnify licensees of our software from damages and costs resulting from claims alleging that our software

infringes the intellectual property rights of a third party. Historically, payments made under these provisions have

been immaterial. We monitor the conditions that are subject to indemnification to identify if a loss has occurred.

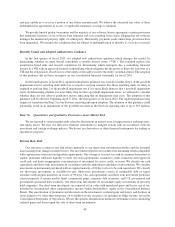

Recently Issued and Adopted Authoritative Guidance

In the first quarter of fiscal 2011, we adopted new authoritative guidance which changes the model for

determining whether an entity should consolidate a variable interest entity (“VIE”). The standard replaces the

quantitative-based risks and rewards calculation for determining which enterprise has a controlling financial

interest in a VIE with an approach focused on identifying which enterprise has the power to direct the activities of a

VIE and the obligation to absorb losses of the entity or the right to receive the entity’s residual returns. The adoption

of this guidance did not have an impact on our consolidated financial statements for fiscal 2011.

In the fourth quarter of fiscal 2011, updated authoritative guidance was issued to modify Step 1 of the goodwill

impairment test for reporting units with zero or negative carrying amounts. For those reporting units, an entity is

required to perform Step 2 of the goodwill impairment test if it is more likely than not that a goodwill impairment

exists. In determining whether it is more likely than not that a goodwill impairment exists, we will need to consider

whether there are any adverse qualitative factors indicating that an impairment may exist. The adoption of this

guidance will be effective beginning April 2, 2011, the first quarter of our fiscal 2012. The updated guidance may

require us to perform the Step 2 for our Services reporting unit upon adoption. The adoption of this guidance could

potentially result in an impairment of the goodwill recorded in the Services reporting unit of up to $19 million.

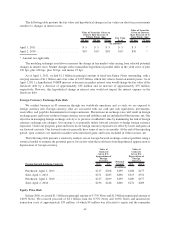

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

We are exposed to various market risks related to fluctuations in interest rates, foreign currency exchange rates,

and equity prices. We may use derivative financial instruments to mitigate certain risks in accordance with our

investment and foreign exchange policies. We do not use derivatives or other financial instruments for trading or

speculative purposes.

Interest Rate Risk

Our exposure to interest rate risk relates primarily to our short-term investment portfolio and the potential

losses arising from changes in interest rates. Our investment objective is to achieve the maximum return compatible

with capital preservation and our liquidity requirements. Our strategy is to invest our cash in a manner that preserves

capital, maintains sufficient liquidity to meet our cash requirements, maximizes yields consistent with approved

credit risk, and limits inappropriate concentrations of investment by sector, credit, or issuer. We classify our cash

equivalents and short-term investments in accordance with the authoritative guidance on investments. We consider

investments in instruments purchased with an original maturity of 90 days or less to be cash equivalents. We classify

our short-term investments as available-for-sale. Short-term investments consist of marketable debt or equity

securities with original maturities in excess of 90 days. Our cash equivalents and short-term investment portfolios

consist primarily of money market funds, commercial paper, corporate debt securities, and U.S. government and

government-sponsored debt securities. Our short-term investments do not include equity investments in privately

held companies. Our short-term investments are reported at fair value with unrealized gains and losses, net of tax,

included in Accumulated other comprehensive income within Stockholders’ equity in the Consolidated Balance

Sheets. The amortization of premiums and discounts on the investments, realized gains and losses, and declines in

value judged to be other-than-temporary on available-for-sale securities are included in Other income, net in the

Consolidated Statements of Operations. We use the specific identification method to determine cost in calculating

realized gains and losses upon the sale of short-term investments.

48