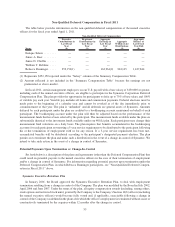

Symantec 2011 Annual Report Download - page 54

Download and view the complete annual report

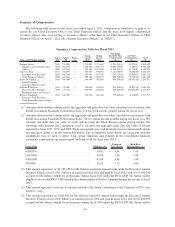

Please find page 54 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50% to 150% of one-half of the eligible shares (plus any eligible shares not earned on March 29, 2013 if less than

100% of the TSR goal is achieved for the two-year period then ended) may be earned based on the achievement of

the TSR goal for the three years ended March 28, 2014. Subject to certain exceptions (including acceleration of

vesting upon a change in control of the company under the terms of the Symantec Executive Retention Plan, as

amended), the award shall vest, if at all, only at the end of the third year of the performance period (i.e., fiscal 2014),

and the named executive officer must be employed by us at the end of such period in order to vest in the award.

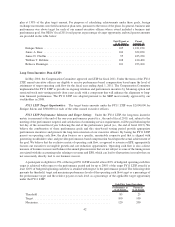

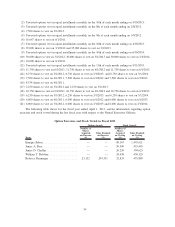

Burn Rate and Dilution: We closely manage how we use our equity to compensate employees. We think of

“gross burn rate” as the total number of shares granted under all of our equity incentive plans during a period divided

by the weighted average number of shares of common stock outstanding during that period and expressed as a

percentage. We think of “net burn rate” as the total number of shares granted under all of our equity incentive plans

during a period, minus the total number of shares returned to such plans through awards cancelled during that

period, divided by the weighted average number of shares of common stock outstanding during that period, and

expressed as a percentage. “Overhang” we think of as the total number of shares underlying options and awards

outstanding plus shares available for issuance under all of our equity incentive plans at the end of a period divided by

the weighted average number of shares of common stock outstanding during that period and expressed as a

percentage. For purposes of these calculations, each full-value award grant (e.g., restricted stock unit) is treated as

the equivalent of the grant of two options in order to recognize the economic difference in the equity vehicle types.

The Compensation Committee determines the percentage of equity to be made available for our equity programs

with reference to the companies in our market composite. In addition, the Compensation Committee considers the

accounting costs that will be reflected in our financial statements when establishing the forms of equity to be

granted and the size of the overall pool available. For fiscal 2011, our gross burn rate was 3.5%, our net burn rate was

3.28%, and our overhang was 23.43%. Our burn rate was somewhat higher than our historical average in fiscal 2011

largely due to the equity awards granted to employees in connection with our acquisition of the identity and

authentication business of VeriSign.

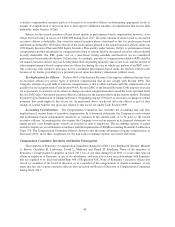

Equity Grant Practices: The Compensation Committee generally approves grants to the named executive

officers at its first meeting of each fiscal year, or thereafter through subsequent action. The grant date for all stock

options and RSUs granted to employees, including the named executive officers, is generally the 10th day of the

month following the applicable meeting. If the 10th day is not a business day, the grant is generally made on the

previous business day. The exercise price for stock options is the closing price of our common stock, as reported on

the Nasdaq Global Select Market, on the date of grant. The Compensation Committee does not coordinate the

timing of equity awards with the release of material nonpublic information. RSUs may be granted from time to time

throughout the year, but all RSUs generally vest on either March 1, June 1, September 1 or December 1 for

administrative reasons.

Change of Control and Severance Arrangements: The vesting of certain stock options and RSUs held by

our named executive officers will accelerate if they experience an involuntary (including constructive) termination

of employment under certain circumstances. For additional information about these arrangements, see “— Other

Benefits — Change of Control and Severance Arrangements” below and “Potential Payments Upon Termination or

Change in Control,” below.

Retention and Other Awards

Certain business conditions may warrant using additional compensation approaches to attract, retain or

motivate executives. Such conditions include acquisitions and divestitures, attracting or retaining specific or unique

talent, and recognition for exceptional contributions. In these situations, the Compensation Committee considers

the business needs and the potential costs and benefits of special rewards. No retention awards were provided to our

named executive officers in fiscal 2011 as the overall composition and amount of other reward elements was judged

to be sufficient to provide an appropriate incentive and retention level.

Other Benefits

All named executive officers are eligible to participate in our 401(k) plan (which includes our matching

contributions), health and dental coverage, life insurance, disability insurance, paid time off, and paid holidays on

45