Symantec 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

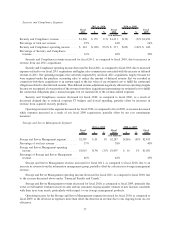

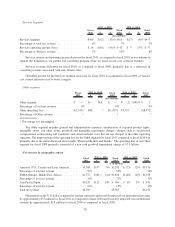

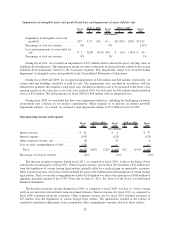

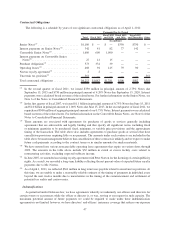

Provision for income taxes

2011 2010 2009

Fiscal

($ in millions)

Provision for income taxes ..................................... $105 $112 $183

Effective tax rate on earnings ................................... 14% 13% (3)%

Our effective tax rate was approximately 14%, 13%, and (3)% in fiscal 2011, fiscal 2010, and 2009,

respectively.

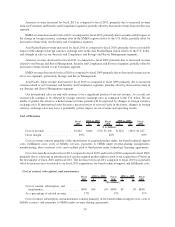

The tax expense in fiscal 2011 was reduced by the following benefits: (1) $49 million arising from the Veritas v

Commissioner Tax Court decision further discussed below, (2) $15 million from the reduction of our valuation

allowance for certain deferred tax assets, and (3) $21 million tax benefit from lapses of statutes of limitation, and

(4) $7 million tax benefit from the conclusion of U.S. and foreign audits.

The tax expense in fiscal 2010 was significantly reduced by the following benefits: (1) $79 million tax benefit

arising from the Veritas v. Commissioner Tax Court decision, (2) $11 million tax benefit from the reduction of our

valuation allowance for certain deferred tax assets, (3) $17 million tax benefit from lapses of statutes of limitation,

(4) $9 million tax benefit from the conclusion of U.S. and foreign audits, (5) $7 million tax benefit to adjust taxes

provided in prior periods, and (6) $6 million tax benefit from current year discrete events. The change in the

valuation allowance follows discussions with Irish Revenue in the third quarter of fiscal 2010, the result of which

accelerates the timing of the use of certain Irish tax loss carryforwards in the future. The tax expense in fiscal 2009

was materially impacted by the inclusion of a $56 million tax benefit associated with the $7.0 billion impairment of

goodwill in the third quarter of fiscal 2009.

The effective tax rates for all periods presented otherwise reflects the benefits of lower-taxed foreign earnings

and losses from our joint venture with Huawei Technologies Co., Limited, domestic manufacturing incentives, and

research and development credits, partially offset by state income taxes. Substantially all of the foreign earnings

were generated by subsidiaries in Ireland and Singapore.

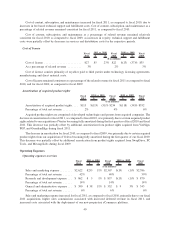

As a result of the impairment of goodwill in fiscal 2009, we have cumulative pre-tax book losses, as measured

by the current and prior two years. We considered the negative evidence of this cumulative pre-tax book loss

position on our ability to continue to recognize deferred tax assets that are dependent upon future taxable income for

realization. Levels of future taxable income are subject to the various risks and uncertainties discussed in Part I,

Item 1A, Risk Factors, set forth in this annual report. We considered the following as positive evidences: the vast

majority of the goodwill impairment is not deductible for tax purposes and thus will not result in tax losses; we have

a strong, consistent taxpaying history; we have substantial U.S. federal income tax carryback potential; and we have

substantial amounts of scheduled future reversals of taxable temporary differences from our deferred tax liabilities.

We have concluded that these positive evidences outweigh the negative evidence and, thus, that the deferred tax

assets as of April 1, 2011of $536 million, after application of the valuation allowances, are realizable on a “more

likely than not” basis.

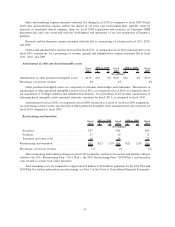

On March 29, 2006, we received a Notice of Deficiency from the IRS claiming that we owe $867 million of

additional taxes, excluding interest and penalties, for the 2000 and 2001 tax years based on an audit of Veritas. On

June 26, 2006, we filed a petition with the U.S. Tax Court, Veritas v Commissioner, protesting the IRS claim for

such additional taxes. During July 2008, we completed the trial phase of the Tax Court case, which dealt with the

remaining issue covered in the assessment. At trial, the IRS changed its position with respect to this remaining issue,

which decreased the remaining amount at issue from $832 million to $545 million, excluding interest.

On December 10, 2009, the U.S. Tax Court issued its opinion, finding that our transfer pricing methodology,

with appropriate adjustments, was the best method for assessing the value of the transaction at issue between Veritas

and its offshore subsidiary. The Tax Court judge provided guidance as to how adjustments would be made to correct

the application of the method used by Veritas. We remeasured and decreased our liability for unrecognized tax

benefits accordingly, resulting in a $79 million tax benefit in the third quarter of fiscal 2010. In June 2010, we

reached an agreement with the IRS concerning the amount of the adjustment related to the U.S. Tax Court decision.

As a result of the agreement, we further reduced our liability for unrecognized tax benefits, resulting in an additional

43