Symantec 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

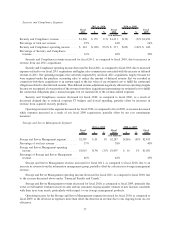

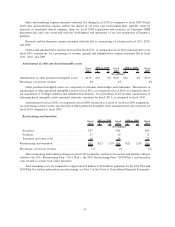

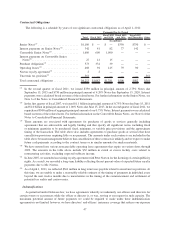

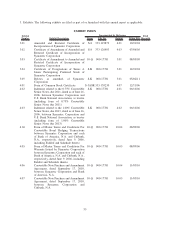

Contractual Obligations

The following is a schedule by years of our significant contractual obligations as of April 1, 2011:

Total Fiscal 2012

Fiscal 2013

and 2014

Fiscal 2015

and 2016

Fiscal 2017

and Thereafter Other

Payments Due by Period

(In millions)

Senior Notes

(1)

.......................... $1,100 $ — $ — $350 $750 $ —

Interest payments on Senior Notes

(1)

.......... 342 41 82 77 142 —

Convertible Senior Notes

(2)

................. 1,600 600 1,000 — — —

Interest payments on Convertible Senior

Notes

(2)

.............................. 27 12 15 — — —

Purchase obligations

(3)

.................... 373 334 39 — — —

Operating leases

(4)

....................... 408 94 145 79 90 —

Norton royalty agreement

(5)

................ 2 2 — — — —

Uncertain tax positions

(6)

.................. 361 — — — — 361

Total contractual obligations ................ $4,213 $1,083 $1,281 $506 $982 $361

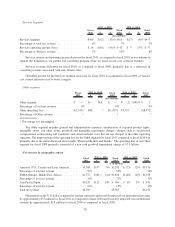

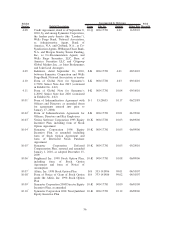

(1)

In the second quarter of fiscal 2011, we issued $350 million in principal amount of 2.75% Notes due

September 15, 2015 and $750 million in principal amount of 4.20% Notes due September 15, 2020. Interest

payments were calculated based on terms of the related notes. For further information on the Senior Notes, see

Note 6 of the Notes to Consolidated Financial Statements.

(2)

In the first quarter of fiscal 2007, we issued $1.1 billion in principal amount of 0.75% Notes due June 15, 2011

and $1.0 billion in principal amount of 1.00% Notes due June 15, 2013. In the second quarter of fiscal 2011, we

repurchased $500 million of aggregate principal amount of our 0.75% Notes. Interest payments were calculated

based on terms of the related notes. For further information on the Convertible Senior Notes, see Note 6 of the

Notes to Consolidated Financial Statements.

(3)

These amounts are associated with agreements for purchases of goods or services generally including

agreements that are enforceable and legally binding and that specify all significant terms, including fixed

or minimum quantities to be purchased; fixed, minimum, or variable price provisions; and the approximate

timing of the transaction. The table above also includes agreements to purchase goods or services that have

cancellation provisions requiring little or no payment. The amounts under such contracts are included in the

table above because management believes that cancellation of these contracts is unlikely and we expect to make

future cash payments according to the contract terms or in similar amounts for similar materials.

(4)

We have entered into various noncancelable operating lease agreements that expire on various dates through

2029. The amounts in the table above include $32 million in exited or excess facility costs related to

restructuring activities, excluding expected sublease income.

(5)

In June 2007, we amended an existing royalty agreement with Peter Norton for the licensing of certain publicity

rights. As a result, we recorded a long-term liability reflecting the net present value of expected future royalty

payments due to Mr. Norton.

(6)

As of April 1, 2011, we reflected $361 million in long term taxes payable related to uncertain tax positions. At

this time, we are unable to make a reasonably reliable estimate of the timing of payments in individual years

beyond the next twelve months due to uncertainties in the timing of the commencement and settlement of

potential tax audits and controversies.

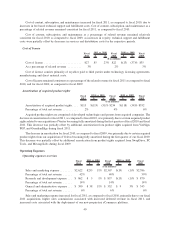

Indemnifications

As permitted under Delaware law, we have agreements whereby we indemnify our officers and directors for

certain events or occurrences while the officer or director is, or was, serving at our request in such capacity. The

maximum potential amount of future payments we could be required to make under these indemnification

agreements is not limited; however, we have directors’ and officers’ insurance coverage that reduces our exposure

47