Symantec 2011 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

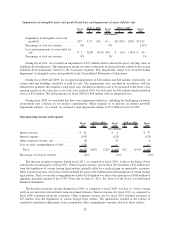

$39 million tax benefit in the first quarter of fiscal 2011. In March 2011, we reached agreement with Irish Revenue

concerning compensating adjustments arising from this matter, resulting in an additional $10 million tax benefit in

the fourth quarter of fiscal 2011. This matter has now been closed and no further adjustments to the accrued liability

are warranted.

On December 2, 2009, we received a Revenue Agent’s Report from the IRS for the Veritas 2002 through 2005

tax years assessing additional taxes due. We agree with $30 million of the tax assessment, excluding interest, but

will contest the other $80 million of tax assessed and all penalties. The unagreed issues concern transfer pricing

matters comparable to the one that was resolved in our favor in the Veritas v. Commissioner Tax Court decision. On

January 15, 2010 we filed a protest with the IRS in connection with the $80 million of tax assessed. On

September 28, 2010, the case was formally accepted into the IRS Appeals process for consideration. This matter

remains outstanding.

We continue to monitor the progress of ongoing tax controversies and the impact, if any, of the expected tolling

of the statute of limitations in various taxing jurisdictions.

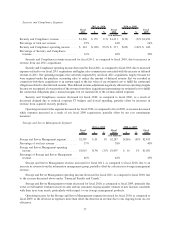

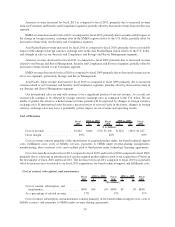

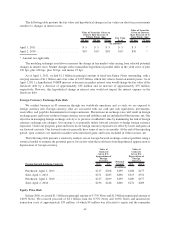

Loss from joint venture

Fiscal

2011 $ %

Fiscal

2010 $ %

Fiscal

2009

2011 vs. 2010 2010 vs. 2009

($ in millions)

Loss from joint venture ................. $31 $(8) (21)% $39 $(14) (26)% $53

Percentage of total net revenue ............ 1% 1% 1%

On February 5, 2008, Symantec formed Huawei-Symantec, Technologies Co., Limited (“joint venture”) with a

subsidiary of Huawei Technologies Co., Limited (“Huawei”). The joint venture is domiciled in Hong Kong with

principal operations in Chengdu, China. The joint venture develops, manufactures, markets and supports security

and storage appliances for global telecommunications carriers and enterprise customers.

For fiscal 2011, we recorded a loss of approximately $31 million related to our share of the joint venture’s net

loss incurred for the period from January 1, 2010 to December 31, 2010. For fiscal 2010, we recorded a loss of

approximately $39 million related to our share of the joint venture’s net loss incurred for the period from January 1,

2009 to December 31, 2009. For fiscal 2009, we recorded a loss of approximately $53 million related to our share of

the joint venture’s net loss incurred for the period from February 5, 2008 (its date of inception) to December 31,

2008.

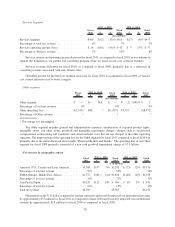

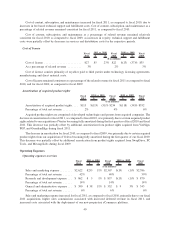

Loss attributable to noncontrolling interest

In fiscal 2011, we completed the acquisition of the identity and authentication business of VeriSign, Inc.

(“VeriSign”), including a controlling interest in its subsidiary VeriSign Japan K.K. (“VeriSign Japan”), a publicly

traded company on the Tokyo Stock Exchange. Given the Company’s majority ownership interest of approximately

54% in VeriSign Japan, the accounts of VeriSign Japan have been consolidated with the accounts of the Company,

and a noncontrolling interest has been recorded for the noncontrolling investors’ interests in the equity and

operations of VeriSign Japan. For fiscal 2011, the loss attributable to the noncontrolling interest in VeriSign Japan

was $4 million.

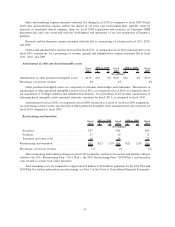

LIQUIDITY AND CAPITAL RESOURCES

Sources of Cash

We have historically relied on cash flow from operations, borrowings under a credit facility, and issuances of

debt and equity securities for our liquidity needs. As of April 1, 2011, we had cash and cash equivalents of $3 billion

resulting in a net liquidity position of approximately $4 billion, which is defined as cash and cash equivalents and

unused availability of the credit facility.

44