Symantec 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

sustained on audit, including resolution of any related appeals or litigation processes. The second step is to measure

the tax benefit as the largest amount that is more than 50% likely to be realized upon ultimate settlement. We adjust

reserves for our uncertain tax positions due to changing facts and circumstances, such as the closing of a tax audit,

refinement of estimates, or realization of earnings or deductions that differ from our estimates. To the extent that the

final outcome of these matters is different than the amounts recorded, such differences will impact our tax provision

in our Consolidated Statements of Operations in the period in which such determination is made.

We must also assess the likelihood that deferred tax assets will be realized from future taxable income and,

based on this assessment establish a valuation allowance, if required. Our determination of our valuation allowance

is based upon a number of assumptions, judgments, and estimates, including forecasted earnings, future taxable

income, and the relative proportions of revenue and income before taxes in the various domestic and international

jurisdictions in which we operate. To the extent we establish a valuation allowance or change the valuation

allowance in a period, we reflect the change with a corresponding increase or decrease to our tax provision in our

Consolidated Statements of Operations.

In July 2008, we reached an agreement with the IRS concerning our eligibility to claim a lower tax rate on a

distribution made from a Veritas foreign subsidiary prior to the July 2005 acquisition. The distribution was intended

to be made pursuant to the American Jobs Creation Act of 2004, and therefore eligible for a 5.25% effective

U.S. federal rate of tax, in lieu of the 35% statutory rate. The final impact of this agreement remains uncertain since

this relates to the taxability of earnings that are otherwise the subject of the transfer pricing matters at issue in the

IRS examination of Veritas tax years 2002 through 2005. To the extent that we owe taxes as a result of these transfer

pricing matters in years prior to the distribution, we anticipate that the incremental tax due from this negotiated

agreement will decrease. We currently estimate that the most probable outcome from this negotiated agreement will

be that we will owe $13 million or less, for which an accrual has already been made.

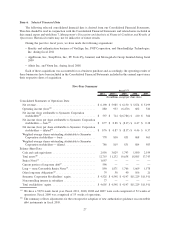

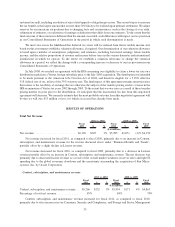

RESULTS OF OPERATIONS

Total Net Revenue

Fiscal

2011 $ %

Fiscal

2010 $ %

Fiscal

2009

2011 vs. 2010 2010 vs. 2009

($ in millions)

Net revenue .......................... $6,190 $205 3% $5,985 $(165) (3)% $6,150

Net revenue increased for fiscal 2011, as compared to fiscal 2010, primarily due to an increase in Content,

subscription, and maintenance revenue for the reasons discussed above under “Financial Results and Trends”,

partially offset by a slight decline in License revenue.

Net revenue decreased for fiscal 2010, as compared to fiscal 2009, primarily due to a decrease in License

revenue partially offset by an increase in Content, subscription, and maintenance revenue. The net decrease was

primarily due to decreased license revenue as a result of the overall market weakness in server sales and tight IT

spending due to the global economic slowdown and the uncertainty surrounding the acquisition of Sun Micro-

systems, Inc. by Oracle Corporation.

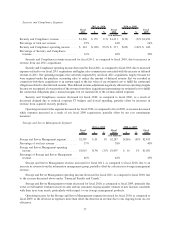

Content, subscription, and maintenance revenue

Fiscal

2011 $ %

Fiscal

2010 $ %

Fiscal

2009

2011 vs. 2010 2010 vs. 2009

($ in millions)

Content, subscription, and maintenance revenue . . $5,266 $232 5% $5,034 $171 4% $4,863

Percentage of total net revenue............... 85% 84% 79%

Content, subscription, and maintenance revenue increased for fiscal 2011, as compared to fiscal 2010,

primarily due to sales increases in our Consumer, Security and Compliance, and Storage and Server Management

35