Symantec 2011 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements

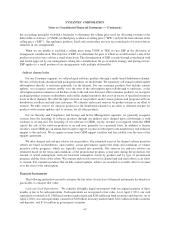

Note 1. Summary of Significant Accounting Policies

Business

Symantec Corporation (“we,” “us,” “our,” and “the Company” refer to Symantec Corporation and all of its

subsidiaries) is a provider of security, storage and systems management solutions that help businesses and

consumers secure and manage their information and identities. We provide customers worldwide with software

and services that protect, manage and control information risks related to security, data protection, storage,

compliance, and systems management. We help our customers manage cost, complexity and compliance by

protecting their IT infrastructure as they seek to maximize value from their IT investments.

Principles of Consolidation

The accompanying consolidated financial statements of Symantec Corporation and its wholly-owned sub-

sidiaries are prepared in conformity with generally accepted accounting principles in the United States (“U.S.”). All

significant intercompany accounts and transactions have been eliminated. Certain prior year amounts have been

reclassified to conform to the current presentation with no impact on previously reported net income.

In fiscal 2011, we completed the acquisition of the identity and authentication business of VeriSign, Inc.

(“VeriSign”), including a controlling interest in its subsidiary VeriSign Japan K.K. (“VeriSign Japan”), a publicly

traded company on the Tokyo Stock Exchange. Given the Company’s majority ownership interest of approximately

54% in VeriSign Japan, the accounts of VeriSign Japan have been consolidated with the accounts of the Company,

and a noncontrolling interest has been recorded for the noncontrolling investors’ interests in the equity and

operations of VeriSign Japan. See Note 3 for further detail.

Fiscal Calendar

We have a 52/53-week fiscal year ending on the Friday closest to March 31. Unless otherwise stated,

references to years in this report relate to fiscal years rather than calendar years.

Fiscal Year Ended Weeks

2011 April 1, 2011 52

2010 April 2, 2010 52

2009 April 3, 2009 53

Our 2012 fiscal year will consist of 52 weeks and will end on March 30, 2012.

Use of Estimates

The preparation of consolidated financial statements in conformity with generally accepted accounting

principles in the U.S. requires management to make estimates and assumptions that affect the amounts reported in

the consolidated financial statements and accompanying notes. Estimates are based upon historical factors, current

circumstances and the experience and judgment of management. Management evaluates its assumptions and

estimates on an ongoing basis and may engage outside subject matter experts to assist in its valuations. Actual

results could differ from those estimates. Significant items subject to such estimates and assumptions include those

related to the allocation of revenue between recognized and deferred amounts, fair value of financial instruments,

valuation of goodwill, intangible assets and long-lived assets, valuation of stock-based compensation, contingen-

cies and litigation, and the valuation allowance for deferred income taxes.

Foreign Currency Translation

The functional currency of our foreign subsidiaries is generally the local currency. Assets and liabilities

denominated in foreign currencies are translated using the exchange rate on the balance sheet dates. Revenues and

expenses are translated using monthly average exchange rates prevailing during the year. The translation

67