Symantec 2011 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

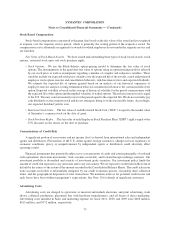

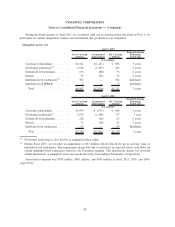

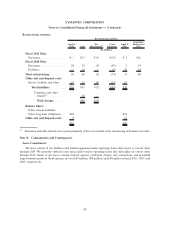

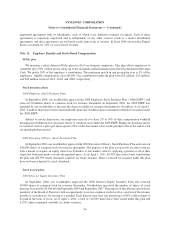

Statement of Operations information for the joint venture and the calculation of our share of the joint venture’s loss

are as follows:

For the Period from

January 1, 2010 to

December 31, 2010

For the Period from

January 1, 2009 to

December 31, 2009

For the Period from

February 5, 2008 to

December 31, 2008

($ in millions)

Net revenue ..................... $370 $224 $ 28

Gross margin .................... 157 87 7

Net loss, as reported by the joint

venture ....................... $(46) $ (63) $(92)

Symantec’s ownership interest........ 49% 49% 49%

Symantec’s proportionate share of net

loss ......................... $(23) $ (31) $(45)

Adjustment for amortization of basis

difference ..................... (8) (8) (8)

Loss from joint venture ........... $(31) $ (39) $(53)

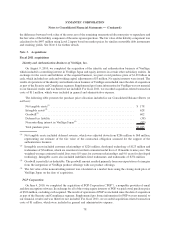

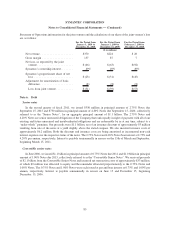

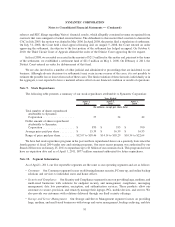

Note 6. Debt

Senior notes

In the second quarter of fiscal 2011, we issued $350 million in principal amount of 2.75% Notes due

September 15, 2015 and $750 million in principal amount of 4.20% Notes due September 15, 2020, collectively

referred to as the “Senior Notes”, for an aggregate principal amount of $1.1 billion. The 2.75% Notes and

4.20% Notes are senior unsecured obligations of the Company that rank equally in right of payment with all of our

existing and future unsecured and unsubordinated obligations and are redeemable by us at any time, subject to a

“make-whole” premium. Our proceeds were $1.1 billion, net of an issuance discount of approximately $3 million

resulting from sale of the notes at a yield slightly above the stated coupons. We also incurred issuance costs of

approximately $6.2 million. Both the discount and issuance costs are being amortized as incremental non-cash

interest expense over the respective terms of the notes. The 2.75% Notes and 4.20% Notes bear interest at 2.75% and

4.20% per annum, respectively. Interest is payable semiannually in arrears on the 15th of March and September,

beginning March 15, 2011.

Convertible senior notes

In June 2006, we issued $1.1 billion in principal amount of 0.75% Notes due 2011 and $1.0 billion in principal

amount of 1.00% Notes due 2013, collectively referred to as the “Convertible Senior Notes”. We received proceeds

of $2.1 billion from the Convertible Senior Notes and incurred net transaction costs of approximately $33 million,

of which $9 million was allocated to equity and the remainder allocated proportionately to the 0.75% Notes and

1.00% Notes. The 0.75% Notes and 1.00% Notes were each issued at par and bear interest at 0.75% and 1.00% per

annum, respectively. Interest is payable semiannually in arrears on June 15 and December 15, beginning

December 15, 2006.

85

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)