Symantec 2011 Annual Report Download - page 116

Download and view the complete annual report

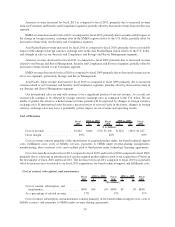

Please find page 116 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operating Activities

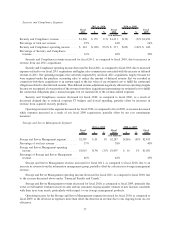

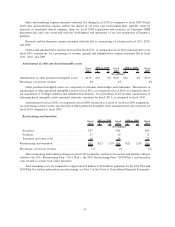

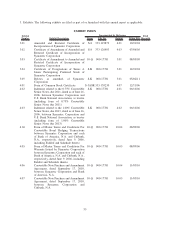

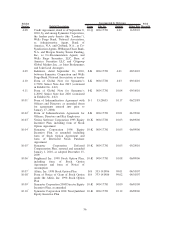

Net cash provided by operating activities was $1.8 billion for fiscal 2011, which resulted from net income of

$593 million adjusted for non-cash items, including depreciation and amortization charges of $743 million and

stock-based compensation expense of $145 million, and an increase in deferred revenue of $442 million. These

amounts were partially offset by a decrease in income taxes payable of $128 million.

Net cash provided by operating activities was $1.7 billion for fiscal 2010, which resulted from net income of

$714 million adjusted for non-cash items, including depreciation and amortization charges of $837 million and

stock-based compensation expense of $155 million. These amounts were partially offset by a decrease in income

taxes payable of $95 million primarily related to the outcome of the Veritas v. Commissioner Tax Court decision; see

Note 12 of the Notes to Consolidated Financial Statements.

Net cash provided by operating activities was $1.7 billion for fiscal 2009, which resulted from non-cash

charges related to depreciation and amortization expenses of $933 million and the $7.4 billion goodwill impairment

charge offset by the net loss of $6.8 billion.

Investing Activities

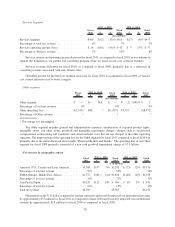

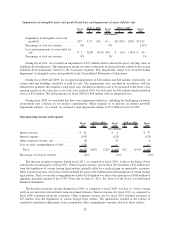

Net cash used in investing activities of $1.8 billion for fiscal 2011 was due to $1.5 billion of payments for our

fiscal 2011 acquisitions, net of cash acquired, and $268 million paid for capital expenditures.

Net cash used in investing activities was $65 million for fiscal 2010 and was primarily due to $248 million paid

for capital expenditures, partially offset by net proceeds from the sale of available-for-sale securities of

$190 million.

Net cash used in investing activities was $1.0 billion for fiscal 2009 and was primarily due to an aggregate

payment of $1.1 billion in cash for acquisitions, net of cash acquired, and $272 million paid for capital expenditures,

partially offset by net proceeds of $336 million from the sale of short-term investments which were used to partially

fund acquisitions.

Financing Activities

Net cash used in financing activities of $184 million for fiscal 2011 was primarily due to repurchases of

common stock of $872 million and repurchases of long-term debt of $510 million, partially offset by proceeds from

debt issuance, net of discount, of $1.1 billion and net proceeds from sales of common stock through employee stock

plans of $122 million.

Net cash used in financing activities of $441 million for fiscal 2010 was due to repurchases of common stock of

$553 million, partially offset by net proceeds from sales of common stock through employee stock plans of

$124 million.

Net cash used in financing activities was $677 million for fiscal 2009 and was primarily due to repurchases of

common stock of $700 million and the repayment of $200 million on our revolving credit facility, partially offset by

net proceeds from sales of common stock through employee stock plans of $229 million.

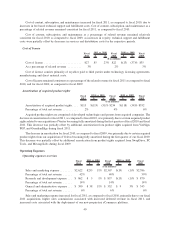

As of April 1, 2011, $1.6 billion of the $3 billion of cash, cash equivalents, and marketable securities was held

by our foreign subsidiaries. We have provided U.S. deferred taxes on a portion of our undistributed foreign earnings

sufficient to address the incremental U.S. tax that would be due if we needed these funds for our operations in the

U.S.

46