Symantec 2011 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

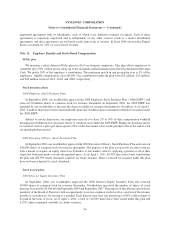

2004 Equity Incentive Plan

Under the 2004 Equity Incentive Plan, (“2004 Plan”) our Board of Directors, or a committee of the Board of

Directors, may grant incentive and nonqualified stock options, stock appreciation rights, restricted stock units

(“RSUs”), or restricted stock awards (“RSAs”) to employees, officers, directors, consultants, independent con-

tractors, and advisors to us, or to any parent, subsidiary, or affiliate of ours. The purpose of the 2004 Plan is to attract,

retain, and motivate eligible persons whose present and potential contributions are important to our success by

offering them an opportunity to participate in our future performance through equity awards of stock options and

stock bonuses. Under the terms of the 2004 Plan, the exercise price of stock options may not be less than 100% of the

fair market value on the date of grant. Options generally vest over a four-year period. Options granted prior to

October 2005 generally have a maximum term of ten years and options granted thereafter generally have a

maximum term of seven years.

As of April 1, 2011, we have reserved 189 million shares for issuance under the 2004 Plan. These shares

include 18 million shares originally reserved for issuance under the 2004 Plan upon its adoption by our stockholders

in September 2004, 26 million shares that were transferred to the 2004 Plan from the 1996 Equity Incentive Plan,

(“1996 Plan”), and 40 million, 50 million and 55 million shares that were approved for issuance thereunder on the

amendment and restatement of the 2004 Plan at our 2006, 2008 and 2010 annual meeting of stockholders,

respectively. In addition to the shares currently reserved under the 2004 Plan, any shares reacquired by us from

options outstanding under the 1996 Plan upon their cancellation will also be added to the 2004 Plan reserve. As of

April 1, 2011, 98 million shares remained available for future grant under the 2004 Plan.

Other stock option plans

Options remain outstanding under several other stock option plans, including the 2001 Non-Qualified Equity

Incentive Plan, the 1996 Plan, and various plans assumed in connection with acquisitions. No further options may be

granted under any of these plans.

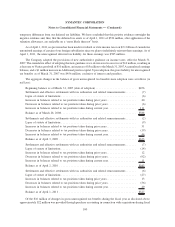

Valuation of stock-based awards

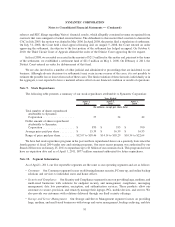

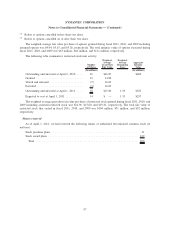

The fair value of each stock option granted under our equity incentive plans is estimated on the date of grant

using the Black-Scholes option-pricing model with the following weighted-average assumptions:

Fiscal

2011

Fiscal

2010

Fiscal

2009

Expected life .................................... 3.52 years 3.38 years 3.21 years

Expected volatility................................ 34% 44% 37%

Risk-free interest rate ............................. 1.85% 1.47% 2.04%

Expected dividends ............................... — — —

Changes in the Black-Scholes valuation assumptions and our estimated forfeiture rate may change the estimate

of fair value for stock-based compensation and the related expense recognized. There have not been any material

changes to our stock-based compensation expense due to changes in our valuation assumptions of stock options.

95

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)