Symantec 2011 Annual Report Download - page 171

Download and view the complete annual report

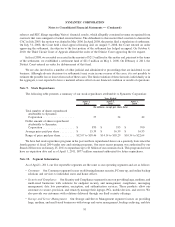

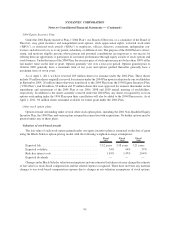

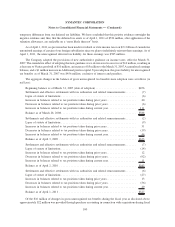

Please find page 171 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2011. This gross liability is reduced by offsetting tax benefits associated with the correlative effects of potential

transfer pricing adjustments, interest deductions, and state income taxes, as well as payments made to date.

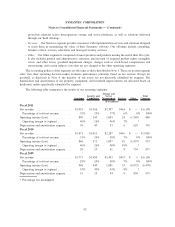

Of the total unrecognized tax benefits at April 1, 2011, $516 million, if recognized, would favorably affect the

Company’s effective tax rate, while $11 million would affect the cumulative translation adjustments. However, one

or more of these unrecognized tax benefits could be subject to a valuation allowance if and when recognized in a

future period, which could impact the timing of any related effective tax rate benefit.

Our policy to include interest and penalties related to gross unrecognized tax benefits within our provision for

income taxes did not change upon the adoption of the new authoritative guidance on income taxes. At April 1, 2011,

before any tax benefits, we had $91 million of accrued interest and accrued penalties on unrecognized tax benefits.

Interest included in our provision for income taxes was approximately $6 million for the year ended April 1, 2011. If

the accrued interest and penalties do not ultimately become payable, amounts accrued will be reduced in the period

that such determination is made, and reflected as a reduction of the overall income tax provision.

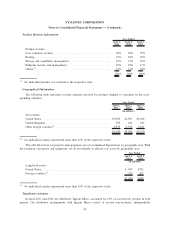

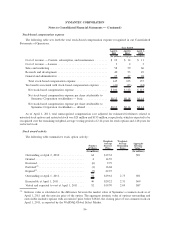

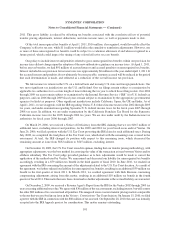

We file income tax returns in the U.S. on a federal basis and in many U.S. state and foreign jurisdictions. Our

two most significant tax jurisdictions are the U.S. and Ireland. Our tax filings remain subject to examination by

applicable tax authorities for a certain length of time following the tax year to which those filings relate. Our 2002

through 2009 tax years remain subject to examination by the Internal Revenue Service (“IRS”) for U.S. federal tax

purposes, and our 2006 through 2009 fiscal years remain subject to examination by the appropriate governmental

agencies for Irish tax purposes. Other significant jurisdictions include California, Japan, the UK and India. As of

April 1, 2011, we are in appeals with the IRS regarding Veritas U.S. federal income taxes for the 2002 through 2005

tax years, and under examination regarding Symantec U.S. federal income taxes for the fiscal years 2005 through

2008 tax years. In addition, we are under examination by the California Franchise Tax Board for the Symantec

California income taxes for the 2005 through 2006 tax years. We are also under audit by the Indian income tax

authorities for fiscal years 2006 through 2007.

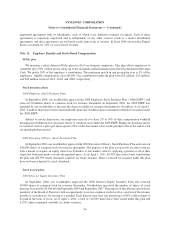

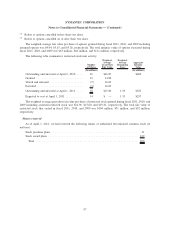

On March 29, 2006, we received a Notice of Deficiency from the IRS claiming that we owe $867 million of

additional taxes, excluding interest and penalties, for the 2000 and 2001 tax years based on an audit of Veritas. On

June 26, 2006, we filed a petition with the U.S. Tax Court protesting the IRS claim for such additional taxes. During

July 2008, we completed the trial phase of the Tax Court case, which dealt with the remaining issue covered in the

assessment. At trial, the IRS changed its position with respect to this remaining issue, which decreased the

remaining amount at issue from $832 million to $545 million, excluding interest.

On December 10, 2009, the U.S. Tax Court issued its opinion, finding that our transfer pricing methodology, with

appropriate adjustments, was the best method for assessing the value of the transaction at issue between Veritas and its

offshore subsidiary. The Tax Court judge provided guidance as to how adjustments would be made to correct the

application of the method used by Veritas. We remeasured and decreased our liability for unrecognized tax benefits

accordingly, resulting in a $79 million tax benefit in the third quarter of fiscal 2010. In June 2010, we reached an

agreement with the IRS concerning the amount of the adjustment related to the U.S. Tax Court decision. As a result of

the agreement, we further reduced our liability for unrecognized tax benefits, resulting in an additional $39 million tax

benefit in the first quarter of fiscal 2011. In March 2011, we reached agreement with Irish Revenue concerning

compensating adjustments arising from this matter, resulting in an additional $10 million tax benefit in the fourth

quarter of fiscal 2011. This matter has now been closed and no further adjustments to the accrued liability are warranted.

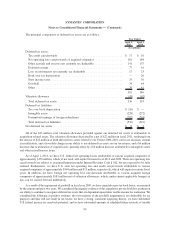

On December 2, 2009, we received a Revenue Agent’s Report from the IRS for the Veritas 2002 through 2005 tax

years assessing additional taxes due. We agree with $30 million of the tax assessment, excluding interest, but will contest

the other $80 million of tax assessed and all penalties. The unagreed issues concern transfer pricing matters comparable

to the one that was resolved in our favor in the Veritas v. Commissioner Tax Court decision. On January 15, 2010, we filed

a protest with the IRS in connection with the $80 million of tax assessed. On September 28, 2010, the case was formally

accepted into the IRS Appeals process for consideration. This matter remains outstanding.

101

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)