Symantec 2011 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Stock-Based Compensation

Stock-based compensation is measured at the grant date based on the fair value of the award and is recognized

as expense over the requisite service period, which is generally the vesting period of the respective award. No

compensation cost is ultimately recognized for awards for which employees do not render the requisite service and

are forfeited.

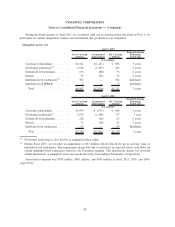

Fair Value of Stock-Based Awards. We have issued and outstanding three types of stock-based awards: stock

options, restricted stock units and stock purchase rights.

•Stock Options. We use the Black-Scholes option-pricing model to determine the fair value of stock

options. The determination of the grant date fair value of options using an option-pricing model is affected

by our stock price as well as assumptions regarding a number of complex and subjective variables. These

variables include our expected stock price volatility over the expected life of the awards, actual and projected

employee stock option exercise and cancellation behaviors, risk-free interest rates and expected dividends.

We estimate the expected life of options granted based on an analysis of our historical experience of

employee exercise and post-vesting termination behavior considered in relation to the contractual life of the

option. Expected volatility is based on the average of historical volatility for the period commensurate with

the expected life of the option and the implied volatility of traded options. The risk free interest rate is equal

to the U.S. Treasury constant maturity rates for the period equal to the expected life. We do not currently pay

cash dividends on our common stock and do not anticipate doing so in the foreseeable future. Accordingly,

our expected dividend yield is zero.

•Restricted Stock Units. The fair value of each Restricted Stock Unit (“RSU”) is equal to the market value

of Symantec’s common stock on the date of grant.

•Stock Purchase Rights. The fair value of each Employee Stock Purchase Plan (“ESPP”) right is equal to the

15% discount on the shares on the date of purchase.

Concentrations of Credit Risk

A significant portion of our revenue and net income (loss) is derived from international sales and independent

agents and distributors. Fluctuations of the U.S. dollar against foreign currencies, changes in local regulatory or

economic conditions, piracy, or nonperformance by independent agents or distributors could adversely affect

operating results.

Financial instruments that potentially subject us to concentrations of credit risk consist principally of cash and

cash equivalents, short-term investments, trade accounts receivable, and forward foreign exchange contracts. Our

investment portfolio is diversified and consists of investment grade securities. Our investment policy limits the

amount of credit risk exposure to any one issuer and to any one country. We are exposed to credit risks in the event of

default by the issuers to the extent of the amount recorded in the Consolidated Balance Sheets. The credit risk in our

trade accounts receivable is substantially mitigated by our credit evaluation process, reasonably short collection

terms, and the geographical dispersion of sales transactions. We maintain reserves for potential credit losses and

such losses have been within management’s expectations. See Note 10 for details of significant customers.

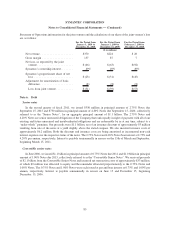

Advertising Costs

Advertising costs are charged to operations as incurred and include electronic and print advertising, trade

shows, collateral production, placement fees with hardware manufacturers, and all forms of direct marketing.

Advertising costs included in Sales and marketing expense for fiscal 2011, 2010, and 2009 were $668 million,

$615 million, and $572 million, respectively.

75

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)