Symantec 2011 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

temporary differences from our deferred tax liabilities. We have concluded that this positive evidence outweighs the

negative evidence and, thus, that the deferred tax assets as of April 1, 2011 of $536 million, after application of the

valuation allowances, are realizable on a “more likely than not” basis.

As of April 1, 2011, no provision has been made for federal or state income taxes on $2.1 billion of cumulative

unremitted earnings of certain of our foreign subsidiaries since we plan to indefinitely reinvest these earnings. As of

April 1, 2011, the unrecognized deferred tax liability for these earnings was $585 million.

The Company adopted the provisions of new authoritative guidance on income taxes, effective March 31,

2007. The cumulative effect of adopting this new guidance was a decrease in tax reserves of $16 million, resulting in

a decrease to Veritas goodwill of $10 million, an increase of $5 million to the March 31, 2007 Accumulated earnings

balance, and a $1 million increase in Additional paid-in capital. Upon adoption, the gross liability for unrecognized

tax benefits as of March 31, 2007 was $456 million, exclusive of interest and penalties.

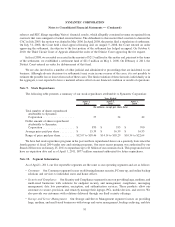

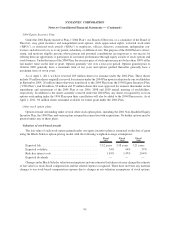

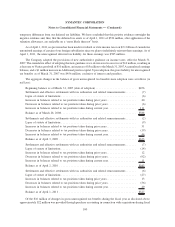

The aggregate changes in the balance of gross unrecognized tax benefits since adoption were as follows (in

millions):

Beginning balance as of March 31, 2007 (date of adoption) .......................... $456

Settlements and effective settlements with tax authorities and related remeasurements. ...... (7)

Lapse of statute of limitations ................................................ (6)

Increases in balances related to tax positions taken during prior years................... 40

Decreases in balances related to tax positions taken during prior years .................. (6)

Increases in balances related to tax positions taken during current year.................. 111

Balance as of March 28, 2008 ................................................ $588

Settlements and effective settlements with tax authorities and related remeasurements. ...... (2)

Lapse of statute of limitations ................................................ (9)

Increases in balances related to tax positions taken during prior years................... 31

Decreases in balances related to tax positions taken during prior years .................. (19)

Increases in balances related to tax positions taken during current year.................. 44

Balance as of April 3, 2009 ................................................. $633

Settlements and effective settlements with tax authorities and related remeasurements. ...... (7)

Lapse of statute of limitations ................................................ (14)

Increases in balances related to tax positions taken during prior years................... 12

Decreases in balances related to tax positions taken during prior years .................. (92)

Increases in balances related to tax positions taken during current year.................. 11

Balance as of April 2, 2010 ................................................. $543

Settlements and effective settlements with tax authorities and related remeasurements. ...... (6)

Lapse of statute of limitations ................................................ (27)

Increases in balances related to tax positions taken during prior years................... 13

Decreases in balances related to tax positions taken during prior years .................. (36)

Increases in balances related to tax positions taken during current year.................. 40

Balance as of April 1, 2011 ................................................. $527

Of the $16 million of changes in gross unrecognized tax benefits during the fiscal year as disclosed above,

approximately $22 million was provided through purchase accounting in connection with acquisitions during fiscal

100

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)