Symantec 2011 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

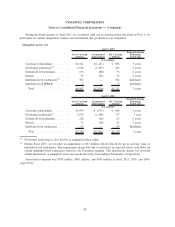

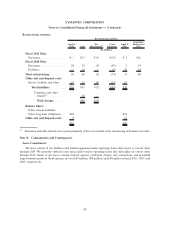

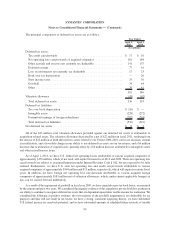

The following is a schedule by years of minimum future rentals on noncancelable operating leases as of

April 1, 2011(in millions):

2012 .................................................................. $ 94

2013 .................................................................. 78

2014 .................................................................. 67

2015 .................................................................. 48

2016 .................................................................. 31

Thereafter............................................................... 90

Total minimum future lease payments: ......................................... $408

Less: sublease income...................................................... 7

Total minimum future lease payments, net:

(1)

..................................... $401

(1)

The total minimum future lease payments, net include $32 million related to restructuring activities. For more

information, see Note 7.

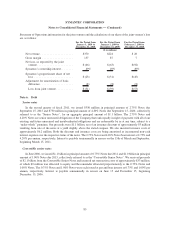

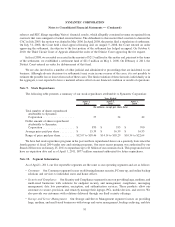

Purchase Obligations

We have purchase obligations of $373 million as of April 1, 2011 that are associated with agreements for

purchases of goods or services. Management believes that cancellation of these contracts is unlikely and we expect

to make future cash payments according to the contract terms.

Indemnification

As permitted under Delaware law, we have agreements whereby we indemnify our officers and directors for

certain events or occurrences while the officer or director is, or was, serving at our request in such capacity. The

maximum potential amount of future payments we could be required to make under these indemnification

agreements is not limited; however, we have directors’ and officers’ insurance coverage that reduces our exposure

and may enable us to recover a portion of any future amounts paid. We believe the estimated fair value of these

indemnification agreements in excess of applicable insurance coverage is minimal.

We provide limited product warranties and the majority of our software license agreements contain provisions

that indemnify licensees of our software from damages and costs resulting from claims alleging that our software

infringes the intellectual property rights of a third party. Historically, payments made under these provisions have

been immaterial. We monitor the conditions that are subject to indemnification to identify if a loss has occurred.

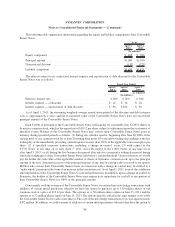

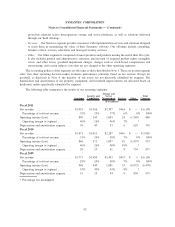

Litigation Contingencies

For a discussion of our pending tax litigation with the Internal Revenue Service relating to the 2000 and 2001

tax years of Veritas, see Note 12.

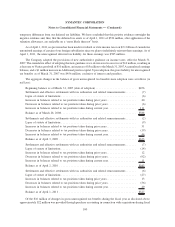

On July 7, 2004, a purported class action complaint entitled Paul Kuck, et al. v. Veritas Software Corporation,

et al. was filed in the United States District Court for the District of Delaware. The lawsuit alleges violations of

federal securities laws in connection with Veritas’ announcement on July 6, 2004 that it expected results of

operations for the fiscal quarter ended June 30, 2004 to fall below earlier estimates. The complaint generally seeks

an unspecified amount of damages. Subsequently, additional purported class action complaints have been filed in

Delaware federal court, and, on March 3, 2005, the Court entered an order consolidating these actions and

appointing lead plaintiffs and counsel. A consolidated amended complaint (“CAC”), was filed on May 27, 2005,

expanding the class period from April 23, 2004 through July 6, 2004. The CAC also named another officer as a

defendant and added allegations that Veritas and the named officers made false or misleading statements in press

90

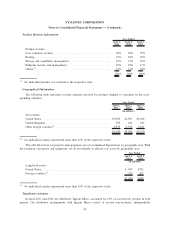

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)