Symantec 2011 Annual Report Download - page 120

Download and view the complete annual report

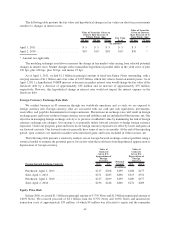

Please find page 120 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.allocated proportionately to the 0.75% Notes and 1.00% Notes. The 0.75% Notes and 1.00% Notes were each issued

at par and bear interest at 0.75% and 1.00% per annum, respectively. Interest is payable semiannually in arrears on

June 15 and December 15. Concurrent with the issuance of the 0.75% Notes and 1.00% Notes, the Company entered

into note hedge transactions with affiliates of certain initial purchasers whereby the Company has the option to

purchase up to 110 million shares of Symantec common stock at a price of $19.12 per share. The cost of the note

hedge transactions was approximately $592 million.

In September 2010, we repurchased $500 million aggregate principal amount of our 0.75% Notes. Concur-

rently with this repurchase, we sold a proportionate share of the initial note hedges back to the note hedge

counterparties for approximately $13 million. These transactions resulted in a loss from extinguishment of debt of

approximately $16 million, which represents the difference between book value of the notes net of the remaining

unamortized discount prior to repurchase and the fair value of the liability component of the notes upon repurchase.

The net cost of the repurchase of the 0.75% Notes and the concurrent sale of the note hedges was $497 million in

cash.

The Convertible Senior Notes have a fixed annual interest rate and therefore, we do not have economic interest

rate exposure on the Convertible Senior Notes. However, the values of the Convertible Senior Notes are exposed to

interest rate risk. Generally, the fair market value of our fixed interest rate Convertible Senior Notes will increase as

interest rates fall and decrease as interest rates rise. In addition, the fair values of our Convertible Senior Notes are

affected by our stock price. The carrying value of the 0.75% Notes was $596 million as of April 1, 2011. This

represents the liability component of the $600 million principal balance as of April 1, 2011. The total estimated fair

value of our 0.75% Notes at April 1, 2011 was $618 million and the fair value was determined based on the closing

trading price per $100 of the 0.75% Notes as of the last day of trading for the fourth quarter of fiscal 2011, which was

$103.00. The carrying value of the 1.00% Notes was $890 million as of April 1, 2011. This represents the liability

component of the $1.0 billion principal balance as of April 1, 2011. The total estimated fair value of our

1.00% Notes at April 1, 2011 was $1.2 billion and the fair value was determined based on the closing trading price

per $100 of the 1.00% Notes as of the last day of trading for the fourth quarter of fiscal 2011, which was $120.81.

For business and strategic purposes, we also hold equity interests in several privately held companies, many of

which can be considered to be in the start-up or development stages. These investments are inherently risky and we

could lose a substantial part or our entire investment in these companies. These investments are recorded at cost and

classified as Other long-term assets in the Consolidated Balance Sheets. As of April 1, 2011, these investments had

an aggregate carrying value of $30 million.

50