Symantec 2011 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Recently Issued and Adopted Authoritative Guidance

In the first quarter of fiscal 2011, we adopted new authoritative guidance which changes the model for

determining whether an entity should consolidate a variable interest entity (“VIE”). The standard replaces the

quantitative-based risks and rewards calculation for determining which enterprise has a controlling financial

interest in a VIE with an approach focused on identifying which enterprise has the power to direct the activities of a

VIE and the obligation to absorb losses of the entity or the right to receive the entity’s residual returns. The adoption

of this guidance did not have an impact on our consolidated financial statements for fiscal 2011.

In the fourth quarter of fiscal 2011, updated authoritative guidance was issued to modify Step 1 of the goodwill

impairment test for reporting units with zero or negative carrying amounts. For those reporting units, an entity is

required to perform Step 2 of the goodwill impairment test if it is more likely than not that a goodwill impairment

exists. In determining whether it is more likely than not that a goodwill impairment exists, we will need to consider

whether there are any adverse qualitative factors indicating that an impairment may exist. The adoption of this

guidance will be effective beginning April 2, 2011, the first quarter of our fiscal 2012. The updated guidance may

require us to perform the step 2 for our Services reporting unit upon adoption. The adoption of this guidance could

potentially result in an impairment of the goodwill recorded in the Services reporting unit of up to $19 million.

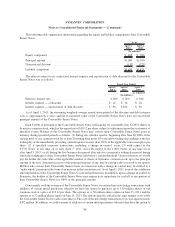

Note 2. Fair Value Measurements

We measure assets and liabilities at fair value based on an expected exit price as defined by the authoritative

guidance on fair value measurements, which represents the amount that would be received on the sale of an asset or

paid to transfer a liability, as the case may be, in an orderly transaction between market participants. As such, fair

value may be based on assumptions that market participants would use in pricing an asset or liability. The

authoritative guidance on fair value measurements establishes a consistent framework for measuring fair value on

either a recurring or nonrecurring basis whereby inputs, used in valuation techniques, are assigned a hierarchical

level. The following are the hierarchical levels of inputs to measure fair value:

•Level 1: Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active

markets.

•Level 2: Observable inputs that reflect quoted prices for identical assets or liabilities in markets that are not

active; quoted prices for similar assets or liabilities in active markets; inputs other than quoted prices that are

observable for the assets or liabilities; or inputs that are derived principally from or corroborated by

observable market data by correlation or other means.

•Level 3: Unobservable inputs reflecting our own assumptions incorporated in valuation techniques used to

determine fair value. These assumptions are required to be consistent with market participant assumptions

that are reasonably available.

76

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)