Symantec 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

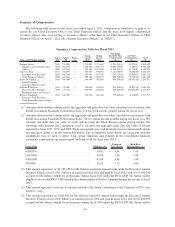

plan at 130% of the plan target amount. For purposes of calculating achievements under these goals, foreign

exchange movements were held constant at plan rates, pursuant to the terms of the plans. In general, business unit

performance was above target for each of our named executive officers whose award included a business unit

performance goal. Our NEOs’ fiscal 2011 total payout as percentage of target opportunity and total payout amounts

are provided in the table below:

Total Payout as

% of Target

Payout

Amount ($)

Enrique Salem ........................................... 105 1,181,250

James A. Beer ........................................... 104 652,050

Janice D. Chaffin ......................................... 95 425,250

William T. Robbins ....................................... 108 410,400

Rebecca Ranninger ........................................ 101 253,260

Long Term Incentive Plan (LTIP)

In May 2010, the Compensation Committee approved our LTIP for fiscal 2011. Under the terms of the FY11

LTIP, named executive officers are eligible to receive performance-based compensation based upon the level of

attainment of target operating cash flow for the fiscal year ending April 1, 2011. The Compensation Committee

implemented the FY11 LTIP to provide an ongoing retention and performance incentive by balancing option and

restricted stock unit vesting periods (four years each) with a component that will enhance the alignment to long-

term financial performance. The FY11 LTIP was adopted pursuant to the SEIP most recently approved by our

stockholders in 2008.

FY11 LTIP Target Opportunities: The target bonus amounts under the FY11 LTIP were $2,000,000 for

Enrique Salem and $300,000 for each of the other named executive officers.

FY11 LTIP Performance Measure and Target Setting: Under the FY11 LTIP, the long-term incentive

metric is measured at the end of the one-year performance period (i.e., the end of fiscal 2011) and, subject to the

meeting of the performance target(s) and satisfaction of continuing service requirements, will be paid following the

last day of the second fiscal year following the end of the performance period (i.e., the end of fiscal 2013). We

believe the combination of these performance goals and this time-based vesting period provide appropriate

performance incentives and promote the long-term retention of our executive officers. By basing the FY11 LTIP

payout on operating cash flow, the plan focuses on a specific, measurable corporate goal that is aligned with

generating stockholder value, and provides performance-based compensation based upon the actual achievement of

the goal. We believe that the exclusive metric of operating cash flow, as opposed to revenue or EPS, appropriately

focuses our executives on tangible growth and cost reduction opportunities. Operating cash flow is also a direct

measure of business success and balances the annual plan measures that are not subject to some of the timing issues

associated with the accounting rules relating to revenue and EPS, which can lead to fluctuations in results that are

not necessarily directly tied to our business success.

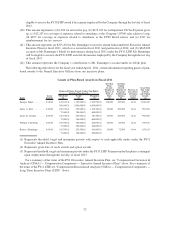

A participant is eligible for 25% of the target FY11 LTIP award if at least 85% of budgeted operating cash flow

target is achieved with respect to the performance period and for up to 200% of the target FY11 LTIP award if at

least 120% of budgeted operating cash flow is attained with respect to the performance period. The following table

presents the threshold, target and maximum performance levels of the operating cash flow target as a percentage of

the performance target and the relative payout at each level as a percentage of the applicable target opportunity

under the FY11 LTIP:

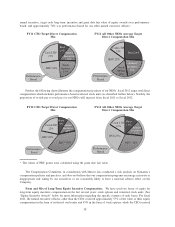

Performance as

% of Target

Payout as

% of Target

Cash Flow from Operations

Threshold .............................................. 85 25

Target................................................. 100 100

Maximum .............................................. 120 200

42