PNC Bank 2005 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300

|

|

98

The Committee selects investment managers for the Trust

based on the contributions that their respective investment

styles and processes are expected to make to the investment

performance of the overall portfolio. The managers’

Investment Objectives and Guidelines, which are a part of

each manager’ s Investment Management Agreement,

document performance expectations and each manager’ s

role in the portfolio. The Committee uses the Investment

Objectives and Guidelines to establish, guide, control and

measure the strategy and performance for each manager.

The purpose of investment manager guidelines is to:

• Establish the investment objective and performance

standards for each manager,

• Provide the manager with the capability to evaluate

the risks of all financial instruments or other assets

in which the manager’ s account is invested, and

• Prevent the manager from exposing its account to

excessive levels of risk, undesired or inappropriate

risk, or disproportionate concentration of risk.

The guidelines also indicate which investments and

strategies the manager is permitted to use to achieve its

performance objectives, and which investments and

strategies it is prohibited from using.

Where public market investment strategies may include the

use of derivatives and/or currency management, language is

incorporated in the managers’ guidelines to define allowable

and prohibited transactions and/or strategies. Derivatives are

typically employed by investment managers to modify

risk/return characteristics of their portfolio(s), implement

asset allocation changes in a cost-effective manner, or

reduce transaction costs. Under the managers’ investment

guidelines, derivatives may not be used solely for

speculation or leverage. Derivatives are used only in

circumstances where they offer the most efficient economic

means of improving risk/reward profile of the portfolio.

BlackRock, PFPC and our Retail Banking business segment

receive compensation for providing investment management,

trustee and custodial services for the ma jority of the Trust

portfolio. Compensation for such services is paid by PNC.

Non-affiliate service providers for the Trust are compensated

from plan assets.

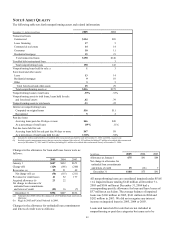

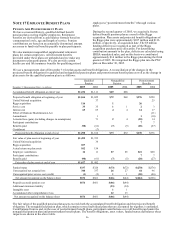

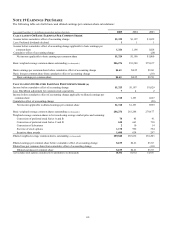

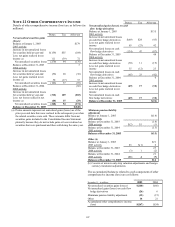

The following table provides information regarding our

estimated future cash flows related to our various plans:

Estimated Cash Flows

Postretirement Benefits

In millions Qualified

Pension

Nonqualified

Pension

Gross PNC

Benefit Payments

Reduction in

PNC Benefit

Payments Due

to Medicare Part

D Subsidy

Estimated 2006

employer

contributions None $7 $25

$2

Estimated future

benefit payments

2006 $97 $7 $25 $2

2007 103 7 25 2

2008 104 7 25 2

2009 111 8 25 2

2010 109 9 25 2

2011 – 2015 592 35 120 9

The qualified pension plan contributions are deposited into

the Trust, and the qualified pension plan benefit payments

are paid from the Trust. For the other plans, total

contributions and the benefit payments are the same and

represent expected benefit amounts, which are paid from

general assets. Postretirement benefits are net of participant

contributions.