PNC Bank 2005 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

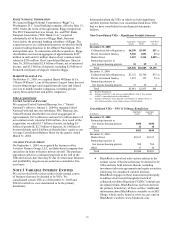

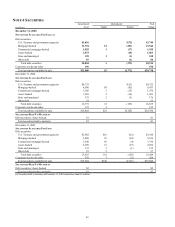

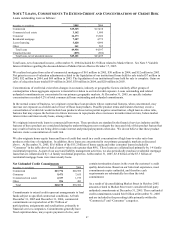

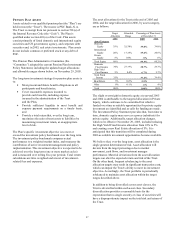

NOTE 7 LOANS, COMMITMENTS TO EXTEND CREDIT AND CONCENTRATIONS OF CREDIT RISK

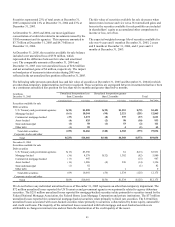

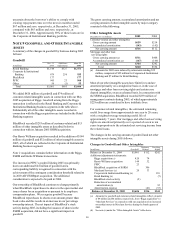

Loans outstanding were as follows:

December 31

-

in mi

llions

2005

2004

Commercial $19,325 $17,438

Commercial real estate 3,162 1,980

Consumer 16,173 15,606

Residential mortgage 7,307 4,772

Lease financing 3,628 4,096

Other 341 505

Total loans

49,936

44,397

Unearned income (835) (902)

Total loans, net of unearned income $49,101 $43,495

Total loans, net of unearned income, at December 31, 2004 included $2.3 billion related to Market Street. See Note 3 Variable

Interest Entities regarding the deconsolidation of Market Street effective October 17, 2005.

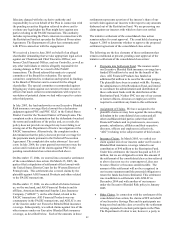

We realized net gains from sales of commercial mortgages of $61 million in 2005, $50 million in 2004, and $52 million in 2003.

Net gains in excess of valuation adjustments related to the liquidation of our institutional loans held for sale totaled $7 million in

2005, $52 million in 2004, and $69 million in 2003. The liquidation of our institutional loans held for sale is complete. Gains on

sales of education loans totaled $19 million in 2005, $30 million in 2004, and $20 million in 2003.

Concentrations of credit risk exist when changes in economic, industry or geographic factors similarly affect groups of

counterparties whose aggregate exposure is material in relation to our total credit exposure. Loans outstanding and related

unfunded commitments are concentrated in our primary geographic markets. At December 31, 2005, no specific industry

concentration exceeded 4.2% of total commercial loans outstanding and unfunded commitments.

In the normal course of business, we originate or purchase loan products whose contractual features, when concentrated, may

increase our exposure as a holder and servicer of those loan products. Possible product terms and features that may create a

concentration of credit risk would include loan products whose terms permit negative amortization, a high loan-to-value ratio,

features that may expose the borrower to future increases in repayments above increases in market interest rates, below-market

interest rates and interest-only loans, among others.

We originate interest-only loans to commercial borrowers. These products are standard in the financial services industry and the

features of these products are considered during the underwriting process to mitigate the increased risk of this product feature that

may result in borrowers not being able to make interest and principal payments when due. We do not believe that these product

features create a concentration of credit risk.

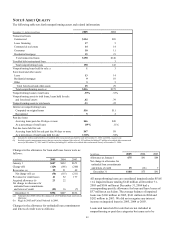

We also originate home equity loans and lines of credit that result in a credit concentration of high loan-to-value ratio loan

products at the time of origination. In addition, these loans are concentrated in our primary geographic markets as discussed

above. At December 31, 2005, $5.6 billion of the $15.2 billion of home equity and other consumer loans (included in

“Consumer” in the table above) had a loan-to-value ratio greater than 80%. These loans are collateralized primarily by 1-4 family

residential properties. As part of our asset and liability management activities, we also periodically purchase residential mortgage

loans that are collateralized by 1-4 family residential properties. At December 31, 2005, $3.8 billion of the $7.3 billion of

residential mortgage loans were interest-only loans.

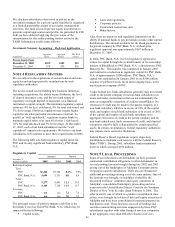

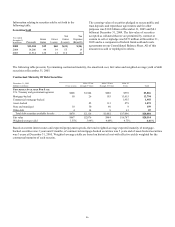

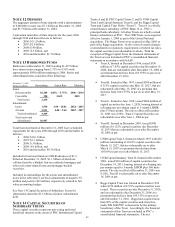

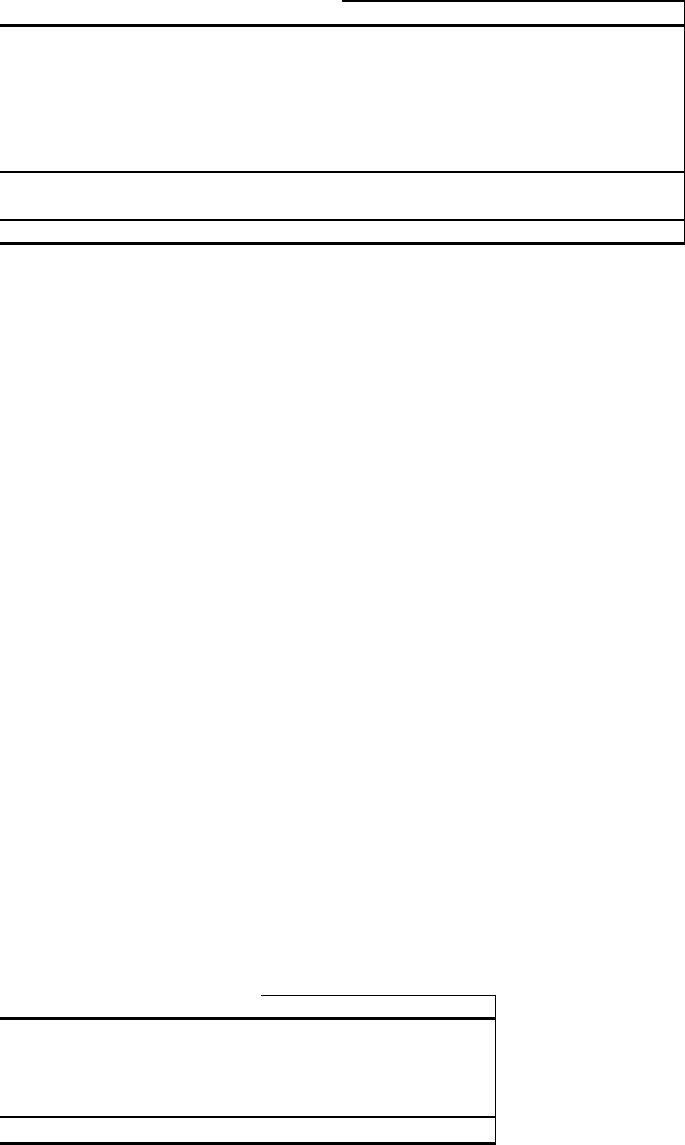

Net Unfunded Credit Commitments

December 31

-

in millions

2005

2004

Commercial $27,774 $20,969

Consumer 9,471 7,655

Commercial real estate 2,337 1,199

Other 596 483

Total $40,178 $30,306

Commitments to extend credit represent arrangements to lend

funds subject to specified contractual conditions. At both

December 31, 2005 and December 31, 2004, commercial

commitments are reported net of $6.7 billion of

participations, assignments and syndications, primarily to

financial services companies. Commitments generally have

fixed expiration dates, may require payment of a fee, and

contain termination clauses in the event the customer’ s credit

quality deteriorates. Based on our historical experience, most

commitments expire unfunded, and therefore cash

requirements are substantially less than the total

commitment.

As a result of deconsolidating Market Street in October 2005,

amounts related to Market Street were considered third party

unfunded commitments at December 31, 2005. These unfunded

credit commitments totaled $4.6 billion at December 31, 2005

and are included in the preceding table primarily within the

“Commercial” and “Consumer” categories.