PNC Bank 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

We also have subsidiaries that invest in and act as the

investment manager for a private equity fund that is organized

as a limited partnership as part of our equity management

activities. The fund invests in private equity investments to

generate capital appreciation and profits. As permitted by FIN

46R, we have deferred applying the provisions of the

interpretation for this entity pending further action by the

FASB. Information on this entity follows:

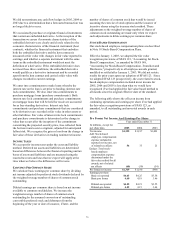

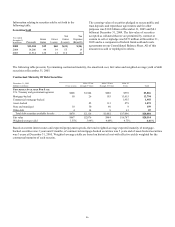

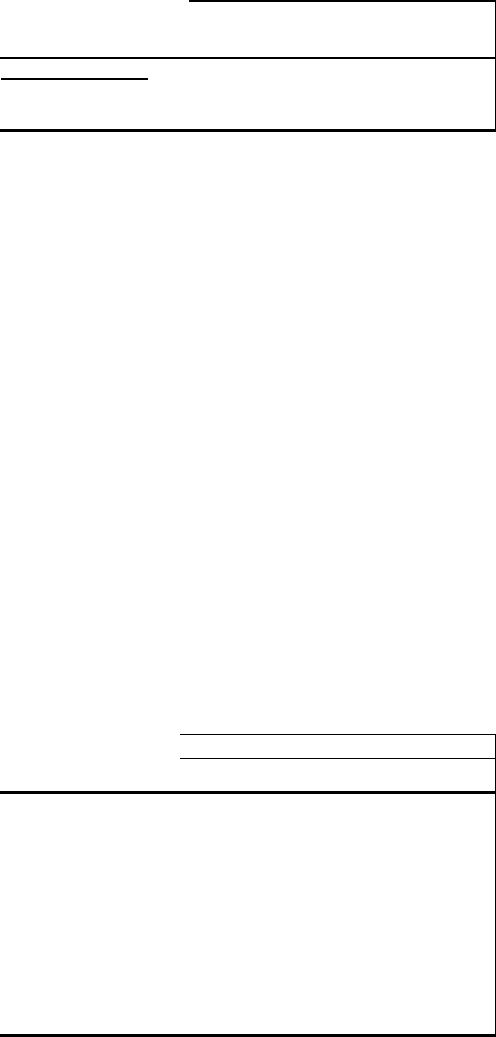

Investment Company Accounting – Deferred Application

In millions

Aggregate

Assets

Aggregate

Equity

PNC Risk

of Loss

Private Equity Fund

December 31, 2005 $109 $109 $25

December 31, 2004 $78 $76 $20

NOTE 4 REGULATORY MATTERS

We are subject to the regulations of certain federal and state

agencies and undergo periodic examinations by such

regulatory authorities.

The access to and cost of funding new business initiatives

including acquisitions, the ability to pay dividends, the level

of deposit insurance costs, and the level and nature of

regulatory oversight depend, in large part, on a financial

institution’ s capital strength. The minimum regulatory capital

ratios are 4% for tier 1 risk-based, 8% for total risk-based and

3% for leverage. However, regulators may require higher

capital levels when particular circumstances warrant. To

qualify as “well capitalized,” regulators require banks to

maintain capital ratios of at least 6% for tier 1 risk-based,

10% for total risk-based and 5% for leverage. At December

31, 2005, each of our bank subsidiaries met the “well

capitalized” capital ratio requirements. We believe our bank

subsidiaries will continue to meet these requirements in 2006.

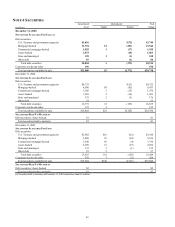

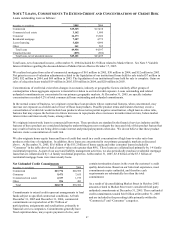

The following table sets forth regulatory capital ratios for

PNC and its only significant bank subsidiary, PNC Bank,

N.A.

Regulatory Capital

Amount Ratios

December 31

Dollars in millions 2005 2004

2005

2004

Risk-based capital

Tier 1

PNC $6,364 $5,794 8.3%

9.0%

PNC Bank, N.A. 5,694 5,151 8.0 8.4

Total

PNC 9,277 8,401 12.1 13.0

PNC Bank, N.A. 8,189 7,158 11.5 11.7

Leverage

PNC n/a n/a

7.2 7.6

PNC Bank, N.A. n/a n/a

7.0 7.2

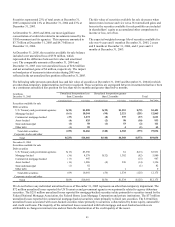

The principal source of parent company cash flow is the

dividends it receives from PNC Bank, N.A., which may be

impacted by the following:

• Capital needs,

• Laws and regulations,

• Corporate policies,

• Contractual restrictions, and

• Other factors.

Also, there are statutory and regulatory limitations on the

ability of national banks to pay dividends or make other capital

distributions. The amount available for dividend payments to

the parent company by PNC Bank, N.A. without prior

regulatory approval was approximately $567 million at

December 31, 2005.

In 2004, PNC Bank, N.A. received regulatory approval to

reduce its capital through the in-kind transfer of its ownership

interest in BlackRock to PNC Bank, N.A.’ s direct parent, PNC

Bancorp, Inc. This transfer was completed in January 2005

and resulted in a reduction in regulatory capital for PNC Bank,

N.A. of approximately $500 million. PNC Bank, N.A.’ s

capital was replenished in January 2005 by its $500 million

issuance of preferred stock, on an intercompany basis, to the

top tier parent company of PNC.

Under federal law, bank subsidiaries generally may not extend

credit to the parent company or its non-bank subsidiaries on

terms and under circumstances that are not substantially the

same as comparable extensions of credit to nonaffiliates. No

extension of credit may be made to the parent company or a

non-bank subsidiary which is in excess of 10% of the capital

stock and surplus of such bank subsidiary or in excess of 20%

of the capital and surplus of such bank subsidiary as to

aggregate extensions of credit to the parent company and its

non-bank subsidiaries. Such extensions of credit, with limited

exceptions, must be fully collateralized by certain specified

assets. In certain circumstances, federal regulatory authorities

may impose more restrictive limitations.

Federal Reserve Board regulations require depository

institutions to maintain cash reserves with the Federal Reserve

Bank (“FRB”). During 2005, subsidiary banks maintained

reserves which averaged $196 million.

NOTE 5 LEGAL PROCEEDINGS

Some of our subsidiaries are defendants (or have potential

contractual contribution obligations to other defendants) in

several pending lawsuits brought during late 2002 and 2003

arising out of the bankruptcy of Adelphia Communications

Corporation and its subsidiaries. There also are threatened

additional proceedings arising out of the same matters. One of

the lawsuits was brought, on Adelphia’ s behalf by the

unsecured creditors’ committee and equity committee in

Adelphia’ s consolidated bankruptcy proceeding and was

removed to the United States District Court for the Southern

District of New York by order dated February 9, 2006. The

other lawsuits, one of which is a putative consolidated class

action, were brought by holders of debt and equity securities of

Adelphia and have been consolidated for pretrial purposes in

that district court. These lawsuits arise out of lending and

securities underwriting activities engaged in by these PNC

subsidiaries together with other financial services companies.

In the aggregate, more than 400 other financial services