PNC Bank 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 35

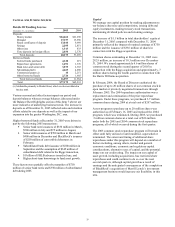

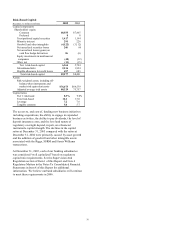

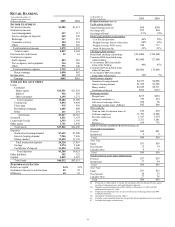

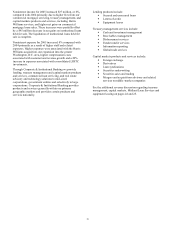

Retail Banking’ s earnings increased $72 million, or 12%, for

2005 compared with 2004. Continued organic customer

growth and the expansion into the greater Washington, D.C.

area drove a growing balance sheet and a corresponding

revenue increase of 6%. A sustained focus on expense

management and improving credit quality also contributed to

the 12% earnings growth.

Highlights of Retail Banking’ s performance during 2005

include:

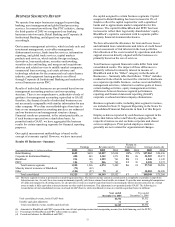

• Consumer and small business checking relationships

increased by 172,000, or 10%, compared with December

31, 2004.

• Consumer-related new checking relationships increased

10%, average consumer demand deposits increased 7%

and home equity loans increased 15% compared with the

comparable prior year amounts.

• The small business area continued its positive momentum

with strong customer and balance sheet growth. Average

small business loans increased 19% over 2004 on the

strength of increased demand from both existing

customers and new relationships. Small business deposits

increased 6% over the same period and new checking

relationships increased 8%.

• The wealth management business sustained solid growth

over 2004 as asset management fees increased $20

million as a result of pricing enhancements, certain one-

time fees and the expansion into the greater Washington,

D.C. area. Assets under management totaled $49 billion

at December 31, 2005 compared with $50 billion at

December 31, 2004.

• Our expansion into the greater Washington, D.C. area in

the second quarter of 2005 has resulted in solid growth,

with checking relationships increasing by 11% during the

last six months of 2005.

• In the fourth quarter of 2005, we completed the

acquisition of an additional 20% interest in our Merchant

Services business from First Data. This transaction gives

us a 60% ownership interest and positions us to take

advantage of the payment revenue sources from small

business customers. Results of this business are now

consolidated in our financial statements.

• Noninterest expense increased $44 million compared with

2004 and reflected the expansion into the greater

Washington, D.C. area. Retail Banking’ s efficiency ratio

improved to 60% compared with 62% a year earlier.

• Credit quality remained strong and stable. Net charge-

offs as a percentage of average loan outstandings were

.23% for 2005 compared with .32% in 2004.

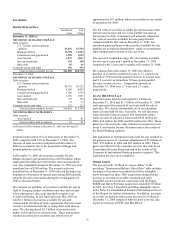

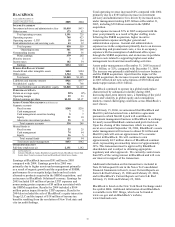

Total revenue for 2005 was $2.857 billion compared with

$2.694 billion for the same period last year. Taxable-

equivalent net interest income of $1.582 billion increased

$111 million, or 8%, compared with 2004 due to a 10%

increase in average deposits and a 14% increase in average

loan balances. The net interest income growth has been

somewhat mitigated by a narrower spread between loan yields

and deposit costs.

Noninterest income increased $52 million, or 4%, compared

with 2004 primarily driven by increased asset management

revenue, service charges on deposits and consumer service

fees. Growth in the latter two areas can be attributed mainly

to a growing customer base. Increases in noninterest income

were partially offset by:

• A decrease in gains from sales of education loans of

$11 million compared with 2004;

• A $10 million pretax gain from the sale of certain

investment consulting activities of Hawthorn

recognized in 2004; and

• Lower ATM surcharge revenue in 2005 from

changing customer behaviors and a strategic decision

to reduce the out-of-footprint ATM network.

The provision for credit losses declined $9 million in 2005

compared with 2004 primarily due to a one-time impact in the

first quarter of 2004 associated with the decision to change the

charge-off policy related to smaller nonperforming

commercial loans. Overall credit quality remained strong as

evidenced by the decline in nonperforming loans as a

percentage of total loans to .33% as of December 31, 2005

compared with .41% at the same time last year. We expect

that the provision for credit losses will increase with loan

growth. We have not been and we do not expect to be

materially impacted by the recent changes in the federal

bankruptcy laws.

Noninterest expense in 2005 totaled $1.715 billion, an

increase of $44 million, or 3%, compared with 2004. Retail

Banking incurred approximately $74 million in operating

costs as a result of the expansion into the greater Washington,

D.C. area in 2005 and recognized $11 million in nonrecurring

costs in 2004 associated with the United National acquisition.

Excluding the impact of these expenses, noninterest expense

declined $19 million compared with 2004. This decline was

reflected primarily in staff expense as a result of One PNC

initiatives.

Full-time employees at December 31, 2005 totaled 11,703, a

decline of 97 from December 31, 2004. The expansion into

the greater Washington, D.C. area accounted for an increase in

full-time employees of 621 at December 31, 2005. Excluding

the impact of this expansion on full-time employees, the

number of Retail Banking full-time employees at December

31, 2005 declined 6% compared with December 31, 2004.

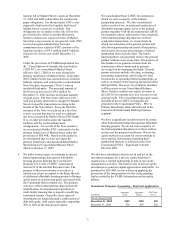

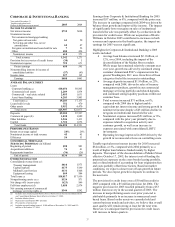

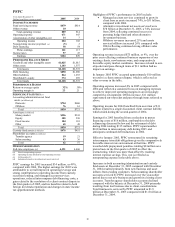

We have adopted a relationship-based lending strategy to

target specific customer sectors (homeowners, small

businesses and auto dealerships) while seeking to maintain a

moderate risk profile in the loan portfolio.

• Average home equity loans grew by $1.7 billion, or

15%, compared with 2004. The increase was

attributable to $1.3 billion from organic loan growth,

$.3 billion from expansion into the greater

Washington, D.C. area and $.1 billion from portfolio

purchases. Consumer loan demand is starting to slow

as a result of the rising rate environment.

• Average commercial loans grew 14% on the strength

of increased loan demand from existing small

business customers and the acquisition of new

relationships through our sales efforts. New loan

volume in the small business arena increased 16%

over 2004.