PNC Bank 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

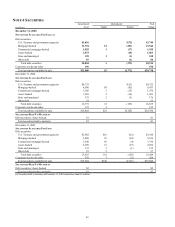

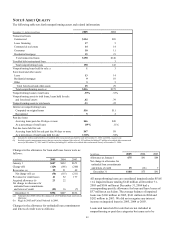

Securities represented 23% of total assets at December 31,

2005 compared with 21% at December 31, 2004 and 23% at

December 31, 2003.

At December 31, 2005 and 2004, our most significant

concentration of credit risk related to investments issued by the

US Government and its agencies. This exposure amounted to

$3.7 billion at December 31, 2005 and $4.7 billion at

December 31, 2004.

At December 31, 2005, the securities available for sale balance

included a net unrealized loss of $370 million, which

represented the difference between fair value and amortized

cost. The comparable amounts at December 31, 2004 and

December 31, 2003 were net unrealized losses of $102 million

and net unrealized gains of $4 million, respectively. The impact

on bond prices of increases in interest rates during 2005 was

reflected in the net unrealized loss position at Decemb er 31, 2005.

The fair value of securities available for sale decreases when

interest rates increase and vice versa. Net unrealized gains and

losses in the securities available for sale portfolio are included

in shareholders’ equity as accumulated other comprehensive

income or loss, net of tax.

The expected weighted-average life of securities available for

sale was 4 years and 1 month at December 31, 2005, 2 years

and 8 months at December 31, 2004, and 2 years and 11

months at December 31, 2003.

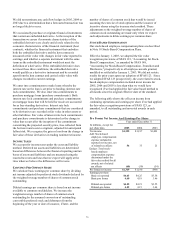

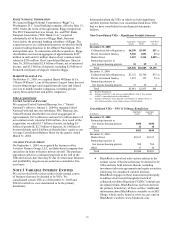

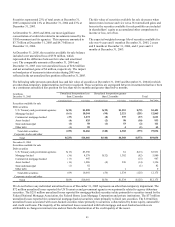

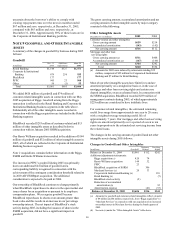

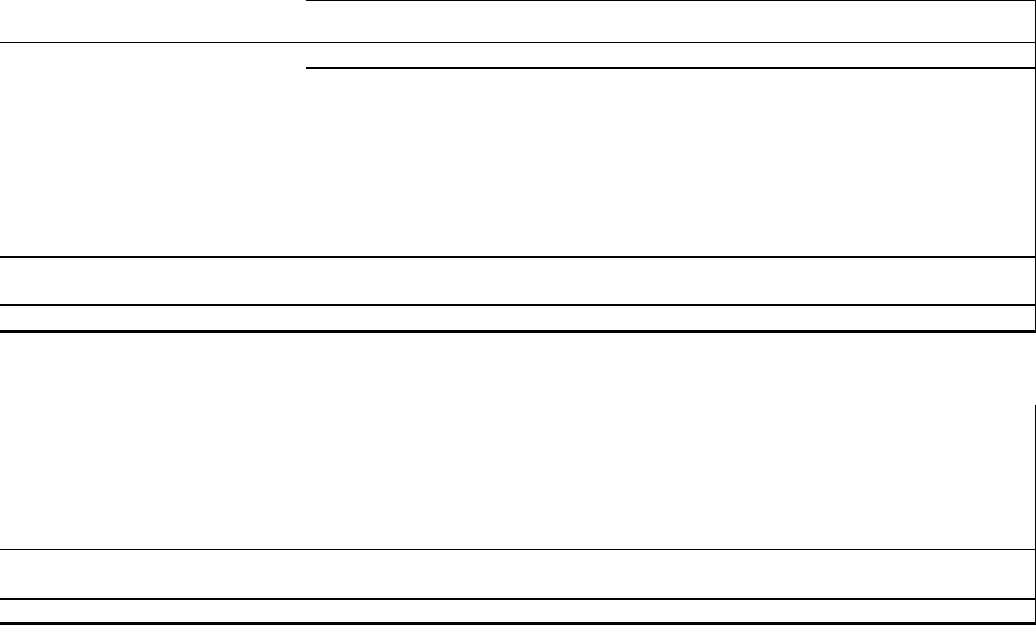

The following table presents unrealized loss and fair value of securities at December 31, 2005 and December 31, 2004 for which

an other-than-temporary impairment has not been recognized. These securities are segregated between investments that have been

in a continuous unrealized loss position for less than twelve months and greater than twelve months.

In millions

December 31, 2005

Unrealized loss position less

than 12 months

Unrealized loss position greater

than 12 months Total

Unrealized Loss Fair Value Unrealized Loss Fair Value Unrealized Loss Fair Value

Securities available for sale

Debt securities

U.S. Treasury and government agencies $(33) $1,898 $(39) $1,553 $(72) $3,451

Mortgage-backed (161) 10,544 (90) 2,321 (251) 12,865

Commercial mortgage-backed (29) 1,272 (8) 339 (37) 1,611

Asset-backed (8) 835 (2) 98 (10) 933

State and municipal (1) 58 (1) 53 (2) 111

Other debt (1) 59 4 (1) 63

Total debt securities (233) 14,666 (140) 4,368 (373) 19,034

Corporate stocks and other

Total $(233) $14,666 $(140) $4,368 $(373) $19,034

December 31, 2004

Securities available for sale

Debt securities

U.S. Treasury and government agencies $(13) $3,930 $1 $(13) $3,931

Mortgage-backed (30) 4,578 $(52) 1,302 (82) 5,880

Commercial mortgage-backed (15) 947 (15) 947

Asset-backed (10) 1,096 (4) 230 (14) 1,326

State and municipal (1) 82 (1) 82

Other debt 8 1 9

Total debt securities (69) 10,641 (56) 1,534 (125) 12,175

Corporate stocks and other

Total $(69) $10,641 $(56) $1,534 $(125) $12,175

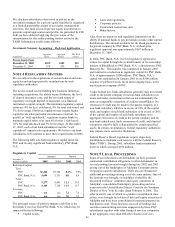

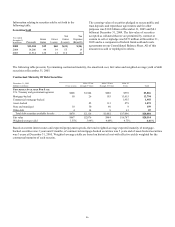

We do not believe any individual unrealized loss as of December 31, 2005 represents an other-than-temporary impairment. The

$72 million unrealized losses reported for US Treasuries and government agencies were primarily related to agency debenture

securities. The $251 million unrealized losses reported for mortgage-backed securities relate primarily to securities issued by the

Federal National Mortgage Association, the Federal Home Loan Mortgage Corporation and private institutions. The $37 million

unrealized losses reported for commercial mortgage-backed securities relate primarily to fixed rate securities. The $10 million

unrealized losses associated with asset-backed securities relate primarily to securities collateralized by home equity, automobile

and credit card loans. The majority of the unrealized losses associated with both mortgage and asset-backed securities are

attributable to changes in interest rates and not from the deterioration of the credit quality of the issuer.