PNC Bank 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

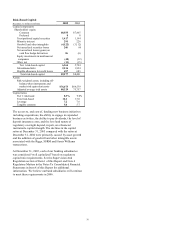

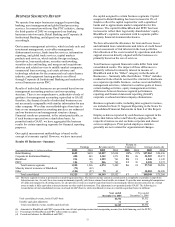

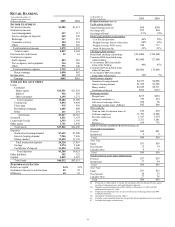

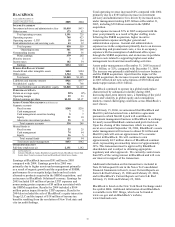

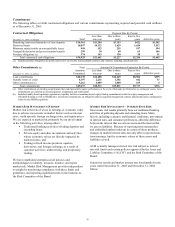

PFPC

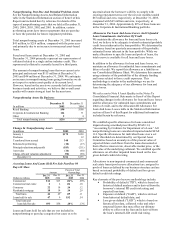

Year ended December 31

Dollars in millions except as noted 2005 2004

INCOME STATEMENT

Fund servicing revenue $879 $814

Other revenue 10

Total operating revenue 889 814

Operating expense 671 643

Amortization of other intangibles, net 14 3

Operating income 204 168

Nonoperating income (expense) (a) (5) 3

Debt financing 38 54

Pretax earnings 161 117

Income taxes 57 47

Earnings $104 $70

PERIOD-END BALANCE SHEET

Goodwill and other intangible assets $1,025 $1,015

Other assets 1,103 1,557

Total assets $2,128 $2,572

Debt financing $890 $1,050

Other liabilities 864 1,253

Shareholder’ s equity 374 269

Total funds $2,128 $2,572

PERFORMANCE RATIOS

Return on average equity 32% 30%

Operating margin (b) 23 21

SERVICING STATISTICS (C)

Accounting/administration net fund

assets (in billions) (d)

Domestic $754 $660

Offshore 76 61

Total $830 $721

Asset type (in billions)

Money market $356 $341

Equity 305 230

Fixed income 104 101

Other 65 49

Total $830 $721

Custody fund assets (in billions) $476 $451

Shareholder accounts (in millions)

Transfer agency 19 21

Subaccounting 43 36

Total 62 57

OTHER INFORMATION

Full-time employees (c) 4,391 4,460

(a) Net of nonoperating expense.

(b) Operating income divided by total operating revenue.

(c) At December 31.

(d) Includes alternative investment net assets serviced.

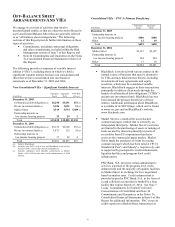

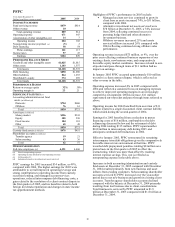

PFPC earnings for 2005 increased $34 million, or 49%,

compared with 2004. The higher earnings for 2005 were

attributable to overall improved operating leverage and

strong contributions to operating income from custody,

securities lending, and managed account services

operations, reduced intercompany debt financing costs, a

gain related to the resolution of a client contract dispute in

the first quarter of 2005, and tax benefits related to both

foreign dividends repatriation and changes in state income

tax apportionment methods.

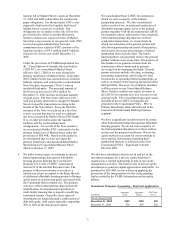

Highlights of PFPC’ s performance in 2005 include:

• Managed account services continued to grow its

client base as assets increased 74%, to $51 billion,

compared with 2004.

• Alternative investment net assets serviced were

$78 billion at December 31, 2005, a 74% increase

from 2004, reflecting continued success in

pursuing hedge fund and other alternative

investment business.

• Offshore revenues increased 25% and assets

serviced offshore increased 26% compared with

2004 reflecting continued strong offshore sales

performance.

Operating revenue increased $75 million, or 9%, over the

prior year reflecting continued business expansion of our

existing clients, new business wins, and comp aratively

favorable equity market conditions. Increases related to out-

of-pocket and pass-through items of $11 million had no

impact on earnings.

In January 2005 PFPC accepted approximately $10 million

to resolve a client contract dispute, which is reflected as

other revenue in the table.

Operating expense increased 4% in 2005 compared with

2004 and reflected a sustained focus on managing expenses

to achieve improved operating margins in an increasingly

competitive environment. Of this increase, $11 million

represented out-of-pocket and pass-through items referred to

above.

Operating income for 2004 benefited from accretion of $11

million related to a single discounted client contract liability

which ended during the second quarter of 2004.

Earnings for 2005 benefited from a reduction in pretax

financing costs of $16 million, attributable to the debt

refinancing discussed below and the retirement of debt

during 2004 totaling $115 million. PFPC repaid another

$160 million in intercompany debt during 2005 and

anticipates continued debt reductions in 2006.

Effective January 2005, PFPC restructured its remaining

intercompany term debt obligations given the comparatively

favorable interest rate environment at that time. PFPC

recorded debt prepayment penalties totaling $8 million on a

pretax basis in the first quarter of 2005 to effect the

restructuring, which was more than offset by resulting

interest expense savings. This cost is reflected as

nonoperating expense in the table above.

Increases in both accounting/administration and custody

fund assets at December 31, 2005 compared with December

31, 2004 resulted primarily from new business and asset

inflows from existing customers. Subaccounting shareholder

accounts serviced by PFPC increased over the year-earlier

period due to net new business and growth in existing client

accounts. Transfer agency shareholder accounts declined

compared with the balance at December 31, 2004 primarily

resulting from lost business due to client consolidations.

Total fund assets serviced by PFPC amounted to $1.9

trillion at December 31, 2005 compared with $1.8 trillion at

December 31, 2004.