PNC Bank 2005 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

121

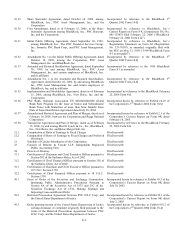

ITEM 11 - EXECUTIVE COMPENSATION

The information required by this item is included under the

captions “Board Of Directors And Committees Of The Board –

Compensation Of Directors, Deferred Compensation Plans, and

Other Director Benefits” and “Compensation Of Executive

Officers” in our Proxy Statement to be filed for the annual

meeting of shareholders to be held on April 25, 2006 and is

incorporated herein by reference. In accordance with Item 402(a)

(8) and (9) of Regulation S-K, we exclude the information set

forth under the captions “Personnel and Compensation

Committee Report” and “Common Stock Performance Graph”

in such Proxy Statement from this Report.

ITEM 12 - SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT AND

RELATED STOCKHOLDER MATTERS

The information required by this item regarding security

ownership of certain beneficial owners and management is

included under the caption “Security Ownership Of Directors,

Nominees, And Executive Officers” in our Proxy Statement to

be filed for the annual meeting of shareholders to be held on

April 25, 2006 and is incorporated herein by reference.

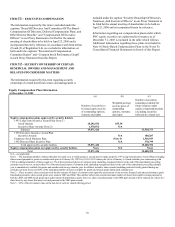

Information regarding our compensation plans under which

PNC equity securities are authorized for issuance as of

December 31, 2005 is included in the table which follows.

Additional information regarding these plans is included in

Note 18 Stock-Based Compensation Plans in the Notes To

Consolidated Financial Statements in Item 8 of this Report.

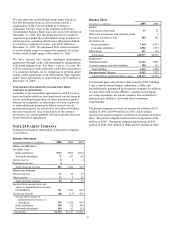

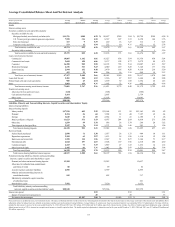

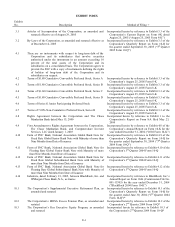

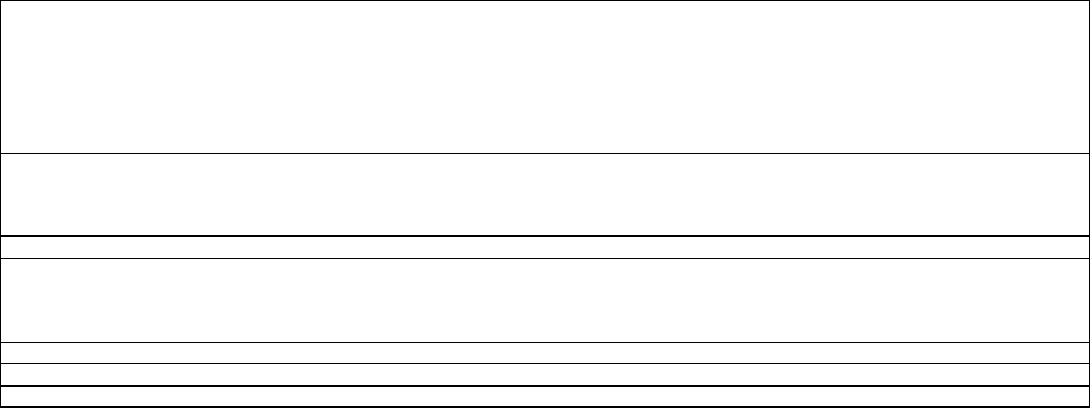

Equity Compensation Plan Information

At December 31, 2005

(a) (b) (c)

Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

Weighted-average

exercise price of

outstanding

options, warrants

and rights

Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a))

Equity compensation plans approved by security holders

1997 Long-Term Incentive Award Plan (Note 1)

Stock Options 18,292,554 $55.30

Incentive Share Awards (Note 2) 1,578,872 N/A

Subtotal 19,871,426 13,530,373

1996 Executive Incentive Award Plan

Incentive Awards N/A 180,287

Employee Stock Purchase Plan (Note 3) 1,518,933

1992 Director Share Incentive Plan N/A 370,799

Total approved by security holders 19,871,426 15,600,392

Equity compensation plans not approved by security holders None N/A None

Total 19,871,426 15,600,392

N/A – not applicable

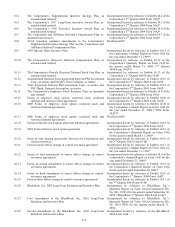

Note 1 – The maximum number of shares that may be issued or as to which grants or awards may be made under the 1997 Long-Term Incentive Award Plan (excluding

shares issued pursuant to grants or awards made prior to February 20, 1997) is (i) 10,141,853 shares plus (ii) as of January 1 of each calendar year commencing with

1998 an additional number of shares equal to 1.5% of the total issued shares of common stock (including reacquired shares) at the end of the immediately preceding

calendar year. However, no more than 3% of the total issued shares of common stock (including reacquired shares) at the end of the immediately preceding calendar

year is cumulatively available for grants and awards made in any calendar year. In addition, incentive share awards (including restricted stock) granted during any

calendar year may not exceed 20% of the maximum number of shares available for grants and awards made during such calendar year.

Note 2 – These incentive share awards provide for the issuance of shares of common stock upon the achievement of one or more financial and other performance goals.

Outstanding incentive share award grants were made in 2003 and 2004. This number reflects the current maximum number of shares that could be issued pursuant to

both the 2003 and 2004 award grants upon achievement of performance goals; however, shares issued pursuant to the 2004 grant awards will be reduced on a share-for-

share basis by any shares that may be issued pursuant to the 2003 grant awards.

Note 3 – 95% of the fair market value on the last day of each six -month offering period.