PNC Bank 2005 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

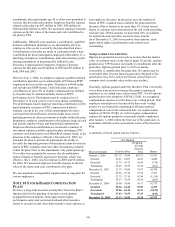

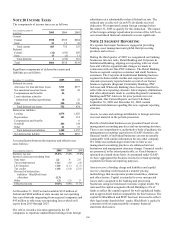

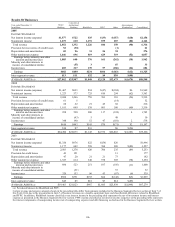

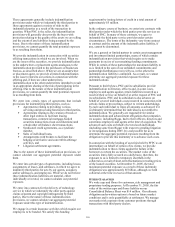

NOTE 20 INCOME TAXES

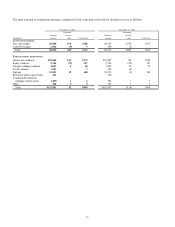

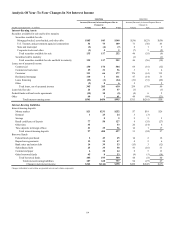

The components of income taxes are as follows:

Year ended December 31

In millions 2005

2004

2003

Current

Federal

$550

$720

$284

State

53

12

39

Total current

603

732

323

Deferred

Federal

(12)

(192)

205

State

13

(2)

11

Total deferred 1

(194)

216

Total $604

$538

$539

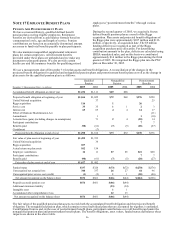

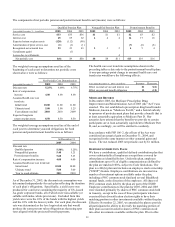

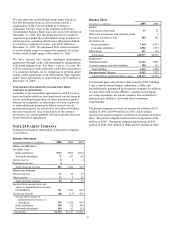

Significant components of deferred tax assets and

liabilities are as follows:

December 31

-

in millions

2005

2004

Deferred tax assets

Allowance for loan and lease losses

$311

$277

Net unrealized securities losses

135

42

Compensation and benefits

56

Loan valuations related to

institutional lending repositioning 10 25

Other

240

130

Total deferred tax assets 752 474

Deferred tax liabilities

Leasing 1,078 1,022

Depreciation 103 114

Compensation and benefits

6

Goodwill

206

144

Other

21

71

Total deferred tax liabilities 1,408 1,357

Net deferred tax liability $656 $883

A reconciliation between the statutory and effective tax

rates follows:

Year ended December 31 2005 2004 2003

Statutory tax rate 35.0%

35.0%

35.0%

Increases (decreases) resulting from

State taxes 2.2 .4 2.0

Tax-exempt interest (1.1) (.8) (.4)

Life insurance (1.0) (1.1) (1.3)

Tax credits (1.8) (2.4) (2.5)

Reversal of deferred tax

liabilities – BlackRock basis

allocation (2.3)

Other (.2) (.3) .9

Effective tax rate 30.8%

30.8%

33.7%

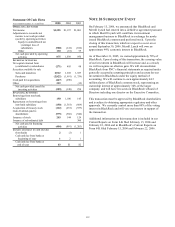

At December 31, 2005 we had available $135 million of

federal and $280 million of state income tax net operating

loss carryforwards originating from acquired companies and

$45 million in other state net operating losses which will

expire from 2019 through 2025.

The AJCA created a one-time opportunity for US

companies to repatriate undistributed earnings from foreign

subsidiaries at a substantially reduced federal tax rate. The

reduced rate is achieved via an 85% dividends received

deduction. We repatriated certain foreign earnings before

December 31, 2005 to qualify for this deduction. The impact

of the foreign earnings repatriation provision of the AJCA on

our consolidated financial statements was not significant.

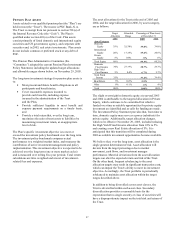

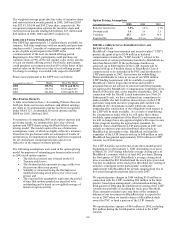

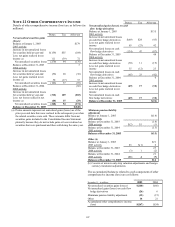

NOTE 21 SEGMENT REPORTING

We operate four major businesses engaged in providing

banking, asset management and global fund processing

products and services.

During the third quarter of 2005 we reorganized our banking

businesses into two units, Retail Banking and Corporate &

Institutional Banking, aligning our reporting with our client

base and with the organizational changes we made in

connection with our One PNC initiative. The Retail Banking

business segment comprises consumer and small business

customers. The Corporate & Institutional Banking business

segment includes middle market and corporate customers.

Amounts previously reported under several of our former

business segments (Regional Community Banking, PNC

Advisors and Wholesale Banking) have been reclassified to

reflect this new reporting structure. Intercompany eliminations

and other adjustments made to combine Regional Community

Banking and PNC Advisors for prior periods were not

significant. Our Current Reports on Form 8-K dated

September 30, 2005 and December 28, 2005 contain

additional information regarding this new segment reporting

structure.

Assets, revenue and earnings attributable to foreign activities

were not material in the periods presented.

Results of individual businesses are presented based on our

management accounting practices and our operating structure.

There is no comprehensive, authoritative body of guidance for

management accounting equivalent to GAAP; therefore, the

financial results of individual businesses are not necessarily

comparable with similar information for any other company.

We refine our methodologies from time to time as our

management accounting practices are enhanced and our

businesses and management structure change. Financial results

are presented, to the extent practicable, as if each business

operated on a stand-alone basis. As permitted under GAAP,

we have aggregated the business results for certain operating

segments for financial reporting purposes.

Assets receive a funding charge and liabilities and capital

receive a funding credit based on a transfer pricing

methodology that incorporates product maturities, duration

and other factors. Capital is intended to cover unexpected

losses and is assigned to the banking and processing

businesses using our risk-based economic capital model. We

increased the capital assigned to Retail Banking to 6% of

funds to reflect the capital required for well-capitalized banks

and to approximate market comparables for this business. The

capital for BlackRock and PFPC has been increased to reflect

their legal entity shareholders’ equity. BlackRock’ s capital is

consistent with its separate public company financial

statement disclosures.