PNC Bank 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 43

liability has been incurred and that the amount of loss can be

reasonably estimated. We regularly review and adjust the

reserves as appropriate to reflect changes in the status of the

proceedings and claims.

The reserves that we establish for these types of

contingencies are based upon our opinion regarding the

future outcome of legal and regulatory proceedings and

claims at the time. The final resolution of legal and

regulatory proceedings and claims is frequently different,

possibly significantly, from the resolution we anticipated.

Also, we may not be able to reasonably estimate a potential

loss from a proceeding even if some liability is probable and

an actual loss is later incurred. As a result, our ultimate

financial exposure to legal and regulatory proceedings and

claims may be substantially different from what is reflected

in the related reserves.

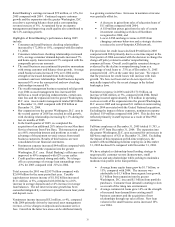

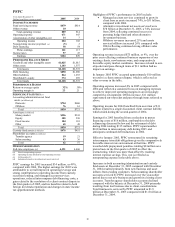

2002 BLACKROCK LONG-TERM

RETENTION AND INCENTIVE PLAN

See Note 18 Stock-Based Compensation Plans in the Notes

To Consolidated Financial Statements in Item 8 of this

Report for a description of BlackRock’ s LTIP.

Under the BlackRock LTIP, awards vest at the end of any

three-month period beginning on or after January 1, 2005

and ending on or prior to March 30, 2007 during which the

average closing price of BlackRock’ s common stock is at

least $62 per share. During the first quarter of 2005,

BlackRock’ s average closing stock price exceeded the $62

threshold and the stock price provision was met. In addition

to the stock price threshold, the vesting of awards is

contingent on the participants’ continued employment with

BlackRock for periods ranging from two to five years

through the payment date in early 2007.

We reported pretax charges in 2004 totaling $110 million in

connection with the LTIP, including $96 million in the third

quarter, based upon management’ s determination during the

third quarter of 2004 that the likelihood of vesting of the

LTIP awards was probable of reaching the stock price

threshold. These amounts included a pro rata share of the

estimated dilution of our investment in BlackRock that is

expected to occur in 2007 when we transfer shares of

BlackRock stock owned by PNC to fund a portion of the

LTIP awards.

We reported pretax expense of $64 million in 2005,

including $16 million during the fourth quarter, related to

the LTIP awards.

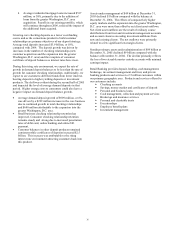

RECENT ACCOUNTING

PRONOUNCEMENTS

See Note 1 Accounting Policies in the Notes To

Consolidated Financial Statements in Item 8 of this Report

for additional information on the following recent

accounting pronouncements that are relevant to our

business, including a description of each new

pronouncement, the required date of adoption, our planned

date of adoption and the expected impact on our

consolidated financial statements. All of the following

pronouncements were issued by the FASB unless otherwise

noted.

Issued in February 2006: SFAS 155, “Accounting for

Certain Hybrid Financial Instruments-an amendment of

FASB Statements No. 133 and 140.”

Issued in November 2005: FASB Staff Position No. (“FSP”)

115-1, “The Meaning of Other-Than-Temporary

Impairment and Its Application to Certain Investments.”

In June 2005, the FASB’ s Emerging Issues Task Force

(“EITF”) issued EITF Issue 04-5, “Determining Whether a

General Partner, or the General Partners as a Group,

Controls a Limited Partnership or Similar Entity When the

Limited Partners Have Certain Rights.”

Issued in May 2005: SFAS 154, “Accounting Changes and

Error Corrections – a replacement of APB Opinion No. 20

and FASB Statement No. 3.”

Issued in December 2004:

• SFAS 123 (Revised), “Share -Based Payment,”

• FSP 109-2, “Accounting and Disclosure Guidance

for the Foreign Earnings Repatriation Provision

within the American Jobs Creation Act of 2004,”

and

• SFAS 153, “Exchanges of Nonmonetary Assets, an

amendment of APB Opinion No. 29, Accounting

for Nonmonetary Transactions.”

Issued in May 2004: FSP 106-2, “Accounting and

Disclosure Requirements Related to the Medicare

Prescription Drug, Improvement and Modernization Act of

2003.”

In December 2003, the American Institute of Certified

Public Accountants issued Statement of Position 03-3,

“Accounting for Loans and Debt Securities Acquired in a

Transfer.”