PNC Bank 2005 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

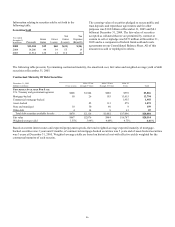

uncertain about the borrower’ s ability to comply with

existing repayment terms over the next six months totaled

$67 million and zero, respectively, at December 31, 2005,

compared with $65 million and zero, respectively, at

December 31, 2004. Approximately 89% of these loans are in

the Corporate & Institutional Banking portfolio.

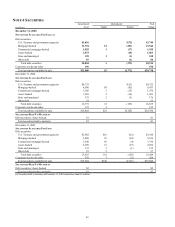

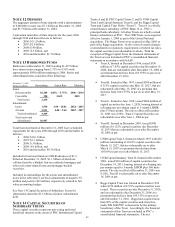

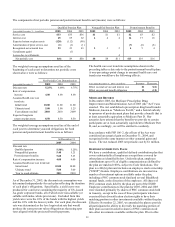

NOTE 9 GOODWILL AND OTHER INTANGIBLE

ASSETS

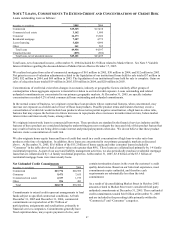

A summary of the changes in goodwill by business during 2005

follows:

Goodwill

In millions

Dec. 31

2004

Additions/

Adjustments

Dec. 31

2005

Retail Banking $1,144

$327 $1,471

Corporate & Institutional

Banking 679

256 935

BlackRock 177

177

PFPC 945

23 968

Other 56

(1) 55

Total $3,001

$605 $3,606

We added $420 million of goodwill and $74 million of

customer-related intangible assets in connection with our May

2005 acquisition of Riggs. Goodwill arising from the Riggs

transaction is reflected in the Retail Banking and Corporate &

Institutional Banking business segments in the table above.

Substantially all of the other intangible assets recorded in

connection with the Riggs acquisition are included in the Retail

Banking segment.

BlackRock recorded $293 million of customer-related and $13

million of other intangible assets as described below in

connection with its January 2005 SSRM acquisition.

Our Harris Williams acquisition resulted in the addition of $144

million of goodwill and $32 million of other intangible assets in

2005, all of which are reflected in the Corporate & Institutional

Banking business segment.

Note 2 Acquisitions contains further information on the Riggs,

SSRM and Harris Williams transactions.

The increase in PFPC’ s goodwill during 2005 was primarily

due to an additional $24 million of goodwill and a

corresponding liability recognized in connection with the

achievement of the contingent consideration threshold related to

its 2003 ADVISORport acquisition. The additional

consideration is expected to be paid in 2006.

Our ownership of BlackRock continues to change primarily

when BlackRock repurchases its shares in the open market and

issues shares for an acquisition or pursuant to its employee

compensation plans. We recognize goodwill because

BlackRock repurchases its shares at an amount greater than

book value and this results in an increase in our percentage

ownership interest. The net impact of BlackRock’ s stock

activity during 2005, including the issuance of shares in the

SSRM acquisition, did not have a significant impact on

goodwill.

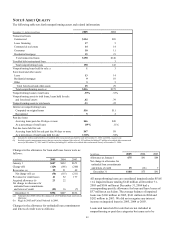

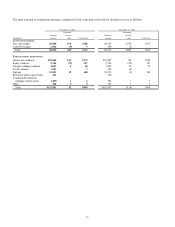

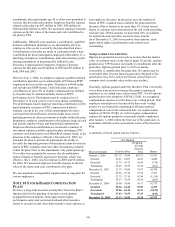

The gross carrying amount, accumulated amortization and net

carrying amount of other intangible assets by major category

consisted of the following:

Other Intangible Assets

December 31 - in millions 2005 2004

Customer-related and other intangibles

Gross carrying amount $659 $214

Accumulated amortization (143) (102)

Net carrying amount $516 $112

Mortgage and other loan

servicing rights

Gross carrying amount (a) $511 $408

Accumulated amortization (a) (167) (166)

Net carrying amount $344 $242

Total $860 $354

(a) Amounts for 2005 were reduced by retirements totaling $32

million, comprised of $25 million for Corporate & Institutional

Banking and $7 million for Retail Banking.

Most of our other intangible assets have finite lives and are

amortized primarily on a straight-line basis or, in the case of

mortgage and other loan servicing rights and certain core

deposit intangibles, on an accelerated basis. In connection with

the SSRM acquisition, BlackRock recorded $293 million of

management contracts during 2005, of which approximately

$229 million are considered to have indefinite lives.

For customer-related intangibles, the estimated remaining

useful lives range from approximately one year to 20 years,

with a weighted-average remaining useful life of

approximately 7 years. Our mortgage and other loan servicing

rights are amortized primarily over a period of seven to ten

years in proportion to the estimated net servicing income from

the related loans.

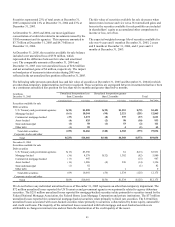

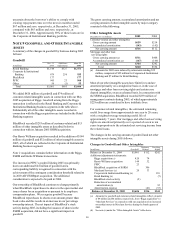

The changes in the carrying amount of goodwill and net other

intangible assets during 2005 follows:

Changes in Goodwill and Other Intangibles

In millions Goodwill

Customer-

Related

Servicing

Rights

Balance at December 31, 2004 $3,001 $112 $242

Additions/adjustments/retirements:

Riggs acquisition (a) 420 74

Harris Williams acquisition 144 32

PFPC 23

BlackRock acquisition of SSRM

306

Merchant Services (a) 20 33

Corporate & Institutional Banking (b) 110

Retail Banking (b) (7)

BlackRock stock activity (2)

Reduction of accumulated

amortization (b)

32

Amortization expense (41)

(33)

Balance at December 31, 2005 $3,606 $516 $344

(a) Amounts for goodwill and customer-related intangibles reflect a transfer

of $9 million and $4 million, respectively, from “Riggs acquisition” to

“Merchant Services” in connection with our acquisition of an increased

ownership interest in Merchant Services during the fourth quarter of

2005.

(b) See note (a) under the “Other Intangible Assets” table above.