PNC Bank 2005 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

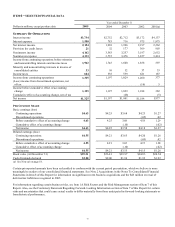

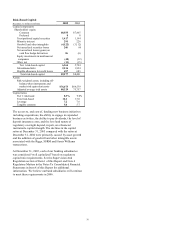

LINE OF BUSINESS HIGHLIGHTS

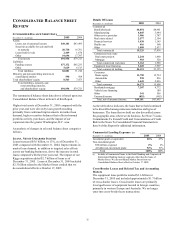

We refer you to Item 1 of this Report for an overview of our

business segments in Review of Lines of Business. Total

business segment earnings were $1.5 billion for 2005 and

$1.3 billion for 2004.

Retail Banking

Retail Banking’ s earnings totaled $682 million for 2005, an

increase of $72 million, or 12%, compared with 2004.

Continued organic customer growth and the expansion into

the greater Washington, D.C. area drove a growing balance

sheet and a corresponding revenue increase of 6%. A

sustained focus on expense management and improving

credit quality also contributed to the 12% earnings growth.

Corporate & Institutional Banking

Earnings from Corporate & Institutional Banking were $480

million for 2005 and $443 million for 2004. The 8%

increase in earnings compared with 2004 was driven by

balance sheet growth, improved fee income despite

significantly lower gains on sales of institutional loans held

for sale, and a reduction in the provision for credit losses.

Our acquisition of Harris Williams in October 2005

contributed to increases in both revenues and expenses.

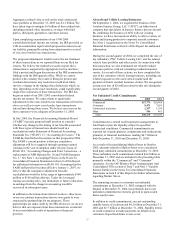

BlackRock

BlackRock reported earnings of $234 million for 2005 and

$143 million for 2004. Earnings growth in 2005 was

primarily due to performance fees on equity hedge fund and

real estate equity alternative products; higher assets under

management primarily as a result of organic growth and the

acquisition of SSRM; and an increase in BlackRock

Solutions revenue. Earnings for 2005 included $59 million

of pretax LTIP expenses and nonrecurring pretax expenses

of $9 million associated with the SSRM acquisition. Results

for 2004 included a $104 million pretax impact from the

LTIP expenses. See the 2002 BlackRock Long-Term

Retention and Incentive Plan section of Item 7 of this

Report for additional information regarding the BlackRock

LTIP. BlackRock’ s assets under management totaled $453

billion at December 31, 2005, an increase of 32% compared

with the prior year-end level. The increase was attributable

to the impact of the SSRM acquisition, net new

subscriptions and market appreciation.

PNC owns approximately 70% of BlackRock and we

consolidate BlackRock into our financial statements.

Accordingly, approximately 30% of BlackRock’ s earnings

are recognized as minority interest expense in the

Consolidated Income Statement. BlackRock financial

information in Item 7 of this Report is presented on a stand-

alone basis. The market value of our BlackRock shares was

approximately $4.8 billion at December 31, 2005, while the

book value at that date was approximately $700 million.

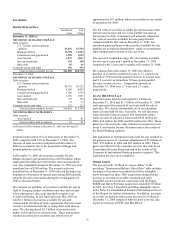

PFPC

PFPC earned $104 million for 2005 and $70 million for

2004. The 49% increase in earnings in 2005 was attributable

to improved operating leverage and strong performances

from custody, securities lending, and managed account

services operations, reduced intercompany debt financing

costs, a gain related to the resolution of a client contract

dispute in the first quarter of 2005, and tax benefits related

to foreign dividends repatriation and changes in state

income tax apportionment methods.

PFPC’ s accounting/administration net fund assets increased

15% and custody fund assets increased 6% as of December

31, 2005 compared with the balances at December 31, 2004.

The increases were driven by new business and asset

inflows from existing customers, as well as comparatively

favorable market conditions.

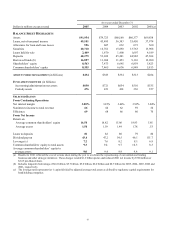

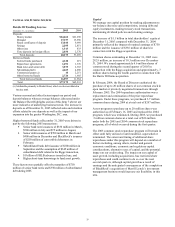

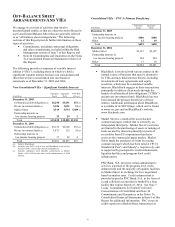

Other

The “Other” net loss for 2005 was $104 million compared with

a net loss of $27 million for 2004. The following factors, on an

after-tax basis, contributed to the higher net loss in 2005 within

“Other”:

• Net securities losses in 2005 of $27 million compared

with net securities gains of $38 million in 2004;

• Implementation costs related to the One PNC initiative

totaling $35 million in 2005;

• Riggs acquisition integration costs recognized in 2005

totaling $20 million; and

• The comparative impact of the first quarter 2004 gain

of $22 million from the sale of our modified

coinsurance contracts.

Partially offsetting the factors above were the following, on an

after-tax basis:

• The first quarter 2005 benefit of the $45 million

deferred tax liability reversal related to the internal

transfer of our investment in BlackRock, as referred to

above under “Summary Financial Results”; and

• The $19 million comparative increase in equity

management gains in 2005.