PNC Bank 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 53

Private equity investments are reported at fair value. Changes

in the values of private equity investments are reflected in our

results of operations. Due to the nature of the direct

investments, we must make assumptions as to future

performance, financial condition, liquidity, availability of

capital, and market conditions, among other factors, to

determine the estimated fair value of the investments. Market

conditions and actual performance of the investments could

differ from these assumptions. Accordingly, lower valuations

may occur that could adversely impact earnings in future

periods. Also, the valuations may not represent amounts that

will ultimately be realized from these investments. See Private

Equity Asset Valuation in the Critical Accounting Policies

And Judgments section of Item 7 of this Report for additional

information.

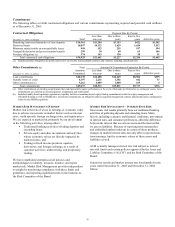

At December 31, 2005, private equity investments carried at

estimated fair value totaled $449 million compared with $470

million at December 31, 2004. As of December 31, 2005,

approximately 38% of the amount is invested directly in a

variety of companies and approximately 62% is invested in

various limited partnerships. Private equity unfunded

commitments totaled $78 million at December 31, 2005

compared with $119 million at December 31, 2004.

Additionally, in October 2005, we committed $200 million to

PNC Mezzanine Partners III, L.P., a $350 million mezzanine

fund, that will invest principally in subordinated debt

securities with an equity component. Funding of this

investment is expected to occur over a five-year period. The

limited partnership will be consolidated for financial reporting

purposes as PNC will have a 57% ownership interest.

Other Investments

We also make investments in affiliated and non-affiliated

funds with both traditional and alternative investment

strategies. As of December 31, 2005, major investments of

this type included low income housing tax credits and

capitalized servicing rights for commercial mortgage loans.

Other investments include BlackRock’ s mutual funds, hedge

funds, and CDOs for which the economic values could be

driven by either the fixed-income market or the equity

markets, or both.

IMPACT OF INFLATION

Our assets and liabilities are primarily monetary in nature.

Accordingly, future changes in prices do not affect the

obligations to pay or receive fixed and determinable amounts of

money. During periods of inflation, monetary assets lose value in

terms of purchasing power and monetary liabilities have

corresponding purchasing power gains. The concept of

purchasing power, however, is not an adequate indicator of the

effect of inflation on banks because it does not take into account

changes in interest rates, which are an important determinant of

our earnings.

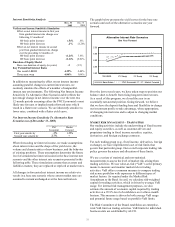

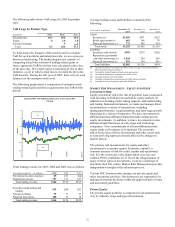

FINANCIAL DERIVATIVES

We use a variety of financial derivatives as part of the overall

asset and liability risk management process to help manage

interest rate, market and credit risk inherent in our business

activities. Substantially all such instruments are used to

manage risk related to changes in interest rates. Interest rate

and total return swaps, interest rate caps and floors and futures

contracts are the primary instruments used by us for interest

rate risk management.

Financial derivatives involve, to varying degrees, interest rate,

market and credit risk. For interest rate swaps and total return

swaps, options and futures contracts, only periodic cash

payments and, with respect to options, premiums, are

exchanged. Therefore, cash requirements and exposure to

credit risk are significantly less than the notional amount on

these instruments.

Not all elements of interest rate, market and credit risk are

addressed through the use of financial or other derivatives, and

such instruments may be ineffective for their intended

purposes due to unanticipated market characteristics, among

other reasons.

Accounting Hedges - Fair Value Hedging Strategies

We enter into interest rate and total return swaps, interest rate

caps, floors and futures derivative contracts to hedge

designated commercial mortgage loans held for sale,

commercial loans, bank notes, senior debt and subordinated

debt for changes in fair value primarily due to changes in

interest rates. Adjustments related to the ineffective portion of

fair value hedging instruments are recorded in interest income,

interest expense or noninterest income depending on the

hedged item.

Accounting Hedges - Cash Flow Hedging Strategy

We enter into interest rate swap contracts to modify the

interest rate characteristics of designated commercial loans

from variable to fixed in order to reduce the impact of interest

rate changes on future interest income. The fair value of these

derivatives is reported in other assets or other liabilities and

offset in accumulated other comprehensive income (loss) for

the effective portion of the derivatives. When the hedged

transaction culminates, any unrealized gains or losses related

to these swap contracts are removed from accumulated other

comprehensive income (loss) and are included in interest

income. Any ineffectiveness of the strategy, as defined by our

documented policies and procedures, is reported in interest

income.