PNC Bank 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

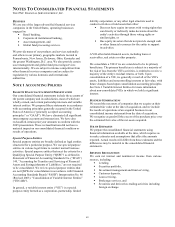

In May 2004, the FASB issued FSP 106-2, “Accounting and

Disclosure Requirements Related to the Medicare

Prescription Drug, Improvement and Modernization Act of

2003.” FSP 106-2 provides guidance on accounting for the

federal subsidy and other provisions of The Medicare

Prescription Drug, Improvement and Modernization Act of

2003. We adopted FSP 106-2 in the third quarter of 2004.

See Note 17 Employee Benefit Plans for additional

information.

In December 2003, the American Institute of Certified Public

Accountants issued Statement of Position 03-3, “Accounting

for Loans and Debt Securities Acquired in a Transfer” (“SOP

03-3”). SOP 03-3 addresses accounting for differences

between contractual cash flows and cash flows expected to be

collected from an initial investment in loans or debt securities

acquired in a transfer if those differences relate, at least in

part, to a deterioration of credit quality. SOP 03-3 prohibits

companies from carrying over valuation allowances in the

initial accounting for such loans and limits the yield that may

be accreted to the excess of undiscounted expected cash

flows over the initial investment in the loan. Decreases in

expected cash flows are recognized as impairment and

increases are recognized prospectively through an adjustment

of the loan yield. SOP 03-3 was effective for loans and debt

securities acquired by PNC on or after January 1, 2005.

Application of this guidance did not have a significant effect

on our financial condition or results of operations in 2005.

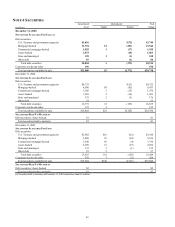

NOTE 2 ACQUISITIONS

2005 ACQUISITIONS

SSRM HOLDINGS, INC.

Effective January 31, 2005, our majority-owned subsidiary,

BlackRock, closed the acquisition of SSRM Holdings, Inc.

(“SSRM”), the holding company of State Street Research &

Management Company and SSR Realty Advisors Inc., from

MetLife, Inc. (“MetLife”) for an adjusted purchase price of

approximately $265 million in cash and approximately

550,000 shares of BlackRock restricted class A common

stock valued at $37 million. SSRM, through its subsidiaries,

actively manages stock, bond, balanced and real estate

portfolios for both institutional and individual investors.

Substantially all of SSRM’ s operations were integrated into

BlackRock as of the closing date. BlackRock acquired assets

under management totaling $50 billion in connection with

this transaction.

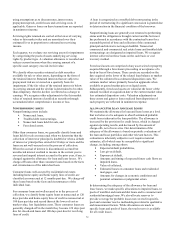

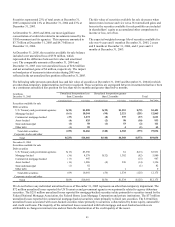

The stock purchase agreement for the SSRM transaction

provides for an additional payment to MetLife of up to $75

million based on BlackRock achieving specified retention

levels of assets under management and run-rate revenue for

the year ended January 31, 2006. Based on assets under

management levels and run-rate revenue as of January 31,

2006, the additional liability on this contingency is $50

million. In addition, the stock purchase agreement provides

for two other contingent payments. MetLife will receive 32.5%

of any performance fees earned, as of March 31, 2006, on a

certain large institutional real estate client. As of December 31,

2005, no performance fees had been earned on this

institutional real estate client as the measurement period had

not concluded. In addition, on the fifth anniversary of the

closing of the SSRM transaction, MetLife could receive an

additional payment up to a maximum of $10 million based on

BlackRock’ s retained assets under management associated

with the MetLife defined benefit and defined contribution

plans.

As of December 31, 2005, BlackRock was unable to estimate

the potential obligations under these contingent payments

because it was unable to predict at that time what specific

retention levels of run-rate revenue would be for certain

acquired accounts on the first anniversary of closing the SSRM

transaction, what performance fees would be earned on the

institutional real estate client and what BlackRock’ s retained

assets under management would be on the fifth anniversary of

the closing date of the SSRM transaction.

Contingent payments settled subsequent to the SSRM closing

on January 31, 2005 but prior to December 31, 2005 reduced

the contingent liability established at the closing to $39.5

million at December 31, 2005. The $50 million contingency

payment due January 31, 2006 eliminated this contingent

liability balance. The $10.5 million excess of the January 31,

2006 contingency payment over the contingent liability

balance at December 31, 2005 and additional contingency

payments, if any, will be reflected as additional purchase price

and recorded as goodwill.

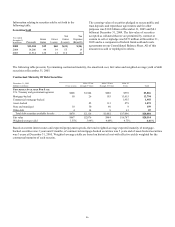

On January 18, 2005, our ownership in BlackRock was

transferred from PNC Bank, N.A. to PNC Bancorp, Inc., our

intermediate bank holding company. The transfer was effected

primarily to give BlackRock more operating flexibility,

particularly in connection with its acquisition of SSRM. As a

result of the transfer, certain deferred tax liabilities recorded by

PNC were reversed in the first quarter of 2005 in accordance

with SFAS 109, “Accounting for Income Taxes.” The reversal

of deferred tax liabilities increased our earnings by $45 million,

or approximately $.16 per diluted share, in the first quarter of

2005.

In January 2005, BlackRock issued a bridge promissory note

for $150 million, using the proceeds to fund a portion of the

purchase price for the SSRM acquisition. In February 2005,

BlackRock issued $250 million aggregate principal amount of

convertible debentures. BlackRock used a portion of the net

proceeds from this issuance to retire the bridge promissory

note. These convertible debentures are included with bank

notes and senior debt on our Consolidated Balance Sheet at

December 31, 2005.