PNC Bank 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

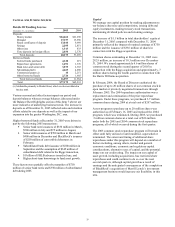

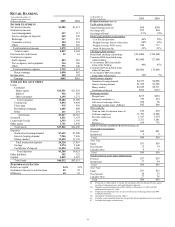

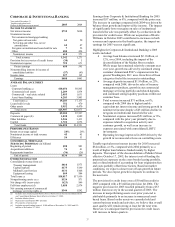

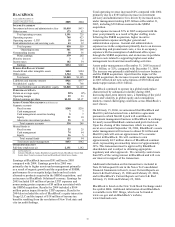

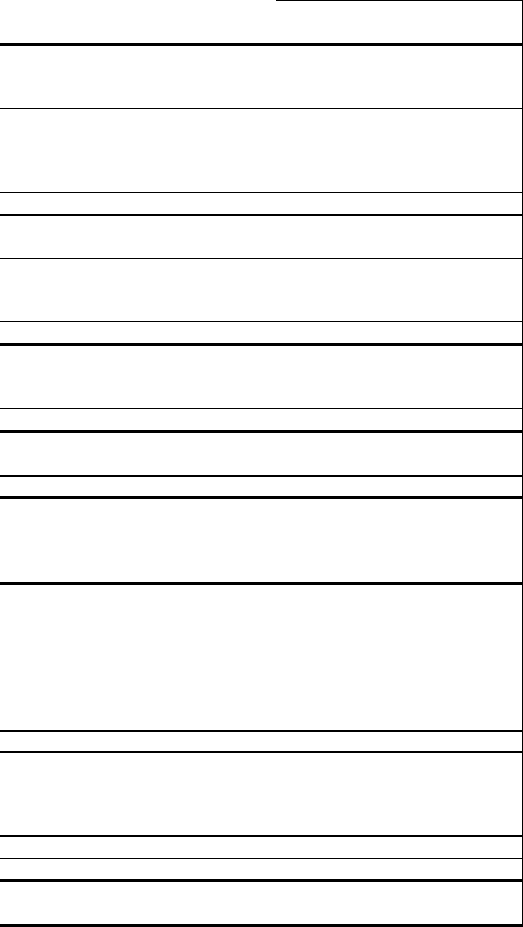

BLACKROCK

Year ended December 31

Taxable-equivalent basis

Dollars in millions except as noted 2005 2004

INCOME STATEMENT

Investment advisory and administrative fees $1,018 $633

Other income 173 92

Total operating revenue 1,191 725

Operating expense 748 423

Operating expense - LTIP 59 104

Fund administration and servicing costs 43 32

Total expense 850 559

Operating income 341 166

Nonoperating income 38 36

Pretax earnings 379 202

Minority interest 3 5

Income taxes 142 54

Earnings $234 $143

PERIOD-END BALANCE SHEET

Goodwill and other intangible assets $484 $184

Other assets 1,364 961

Total assets $1,848 $1,145

Liabilities and minority interest $926 $377

Stockholders’ equity 922 768

Total liabilities and stockholders’ equity $1,848 $1,145

PERFORMANCE DATA

Return on average equity 28% 19%

Operating margin 29 23

Diluted earnings per share $3.50 $2.17

ASSETS UNDER MANAGEMENT (in billions) (a)

Separate accounts

Fixed income $280 $216

Cash management 7 7

Cash management-securities lending 5 7

Equity 21 10

Alternative investment products 25 8

Total separate accounts 338 248

Mutual funds (b)

Fixed income 25 25

Cash management 74 64

Equity 16 5

Total mutual funds 115 94

Total assets under management $453 $342

OTHER INFORMATION

Full-time employees (a) 2,151 1,142

(a) At December 31.

(b) Includes BlackRock Funds, BlackRock Liquidity Funds, BlackRock Closed End

Funds, Short Term Investment Fund and BlackRock Global Series Funds.

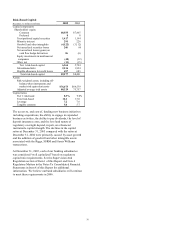

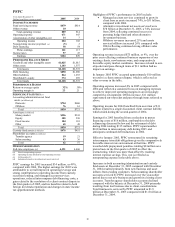

Earnings at BlackRock increased $91 million in 2005

compared with 2004. Earnings growth in 2005 was

primarily due to higher assets under management primarily

as a result of organic growth and the acquisition of SSRM;

performance fees on equity hedge funds and real estate

alternative products acquired in the SSRM acquisition; and

an increase in BlackRock Solutions revenue. Earnings for

2005 included $59 million of pretax LTIP expenses and

nonrecurring pretax expenses of $9 million associated with

the SSRM acquisition. Results for 2004 included a $104

million pretax impact from the LTIP expenses. Results for

2004 also included the sale of BlackRock’ s equity interest in

Trepp LLC and the impact of $18 million of income tax

benefits resulting from the resolution of New York state and

city tax audit findings.

Total operating revenue increased 64% compared with 2004

primarily due to a $385 million increase in investment

advisory and administrative fees driven by increased assets

under management totaling $453 billion at December 31,

2005, including $50 billion assumed in the SSRM

acquisition.

Total expense increased 52% in 2005 compared with the

prior year primarily as a result of higher staffing levels

following the SSRM acquisition, higher incentive

compensation expense and higher general and

administration expense. General and administration

expense rose in the comparison primarily due to an increase

in marketing and promotional costs, a rise in occupancy

expense with the assumption of additional office space

through the SSRM acquisition, and an increase in portfolio

services costs related to supporting higher asset under

management levels and increased trading activities.

Assets under management at December 31, 2005 increased

$111 billion, or 32%, compared with December 31, 2004.

The increase was primarily attributable to net new business

and the SSRM acquisition. Apart from the impact of the

SSRM acquisition, the increase in assets under management

in 2005 reflected net new subscriptions of $50 billion and

market appreciation of $11 billion.

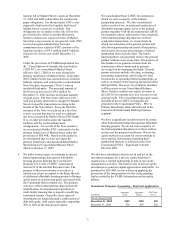

BlackRock continued to operate in a global marketplace

characterized by substantial volatility during 2005.

Increasing short-term interest rates, a flattening of the yield

curve and volatility in global equity and commodities

markets created challenging conditions across BlackRock’ s

asset classes.

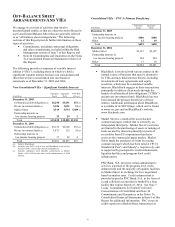

On February 15, 2006, we announced that BlackRock and

Merrill Lynch had entered into a definitive agreement

pursuant to which Merrill Lynch will contribute its

investment management business to BlackRock in exchange

for newly issued BlackRock common and prefe rred stock.

Upon the closing of this transaction, which we expect to

occur on or around September 30, 2006, BlackRock’ s assets

under management will increase to almost $1 trillion and

Merrill Lynch will own an approximate 49% economic

interest in BlackRock. We will continue to own

approximately 44.5 million shares of BlackRock common

stock, representing an ownership interest of approximately

34%. This transaction must be approved by BlackRock

shareholders and is subject to obtaining appropriate

regulatory and other approvals. We currently control more

than 80% of the voting interest in BlackRock and will vote

our interest in support of the transaction.

Additional information on this transaction is included in

Note 26 Subsequent Event in the Notes To Consolidated

Financial Statements in Item 8, in our Current Reports on

Form 8-K filed February 15, 2006 and February 22, 2006,

and in BlackRock’ s Current Reports on Form 8-K filed

February 15, 2006 and February 22, 2006.

BlackRock is listed on the New York Stock Exchange under

the symbol BLK. Additional information about BlackRock

is available in its SEC filings, which can be found at

www.sec.gov and on BlackRock’ s website,

www.blackrock.com.