PNC Bank 2005 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.25

2004. The 21% revenue growth was primarily driven by

growth in the commercial mortgage servicing portfolio and

related services.

Revenue from equipment leasing products was $69 million

for 2005 and $84 million for 2004. The decline was

primarily due to the interest cost of funding the potential tax

exposure on the cross-border leasing portfolio. The impact

of cross-border leasing is expected to continue to have a

negative impact on leasing revenue in 2006. See Cross-

Border Leases and Related Tax and Accounting Matters in

the Consolidated Balance Sheet Review section of this Item

7 for further information.

As a component of our advisory services to clients, we

provide a select set of insurance products to fulfill specific

customer financial needs. Primary insurance offerings

include:

• Annuities,

• Life,

• Credit life,

• Health,

• Disability, and

• Commercial lines coverage.

Client segments served by these insurance solutions include

those in Retail Banking and Corporate & Institutional

Banking. Insurance products are sold by PNC-licensed

insurance agents and through licensed third-party

arrangements. We recognized revenue from these products

of $61 million in 2005 and $65 million in 2004. The

decrease reflected a decline in annuity fee revenue driven

primarily by the sale of our modified coinsurance contracts

in 2004.

PNC, through subsidiary companies, Alpine Indemnity

Limited and PNC Insurance Corp., participates as a

reinsurer for its general liability, automobile liability and

workers’ compensation programs and as a direct writer for

its property and certified domestic terrorism programs.

In the normal course of business, PNC Insurance Corp. and

Alpine Indemnity Limited maintain insurance reserves for

reported claims and for claims incurred but not reported

based on actuarial assessments. We believe these reserves

were adequate at December 31, 2005.

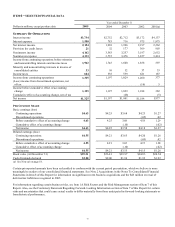

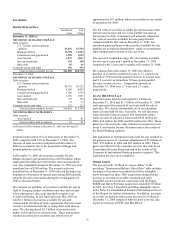

NONINTEREST EXPENSE

Total noninterest expense was $4.333 billion for 2005, an

increase of $598 million compared with 2004. The

efficiency ratio was 69% for 2005 and 68% for 2004.

We expect noninterest expense to be flat in 2006 compared

with 2005 except for the increase in our ownership in the

Merchant Services business and the impact of the Harris

Williams acquisition.

Noninterest expense for 2005 included the following:

• An increase of $325 million in BlackRock non-

LTIP operating expenses that reflected the impact

of costs resulting from the first quarter 2005 SSRM

acquisition and other investments to fund growth;

• Costs totaling approximately $132 million resulting

from our Riggs acquisition, including

approximately $16 million of integration costs;

• BlackRock LTIP charges of $64 million;

• Implementation costs totaling $53 million related

to the One PNC initiative;

• Contributions of BlackRock stock to the PNC

Foundation of $40 million; and

• Costs totaling $17 million related to the Harris

Williams acquisition.

The effect of these increases was partially offset by cost

reductions of approximately $90 million realized in 2005

from the One PNC initiative. The impact of the Riggs

integration and One PNC implementation costs was

reflected in several noninterest expense items in the

Consolidated Income Statement.

Noninterest expense for 2004 included a $110 million

charge associated with the BlackRock LTIP and conversion-

related and other nonrecurring costs totaling approximately

$11 million related to our acquisition of United National

Bancorp, Inc.

Apart from the impact of these items, noninterest expense

increased $178 million, or 5%, in 2005 compared with

2004. These higher expenses were driven by investments in

our businesses and increased sales incentives.

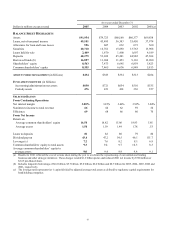

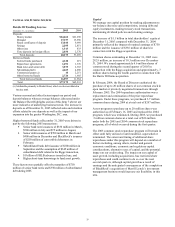

EFFECTIVE TAX RATE

Our effective tax rate was 30.8% for both 2005 and 2004.

Several factors contributed to a relatively low effective tax

rate for each year.

The low effective rate for 2005 was primarily attributable to

the impact of the reversal of deferred tax liabilities in

connection with the transfer of our ownership in BlackRock

to our intermediate bank holding company. This transaction

reduced our first quarter 2005 tax provision by $45 million,

or $.16 per diluted share. See Note 2 Acquisitions in the

Notes To Consolidated Financial Statements in Item 8 of

this Report for additional information.

The following favorably impacted the effective tax rate for

2004:

• A reduced state and local tax expense due to tax

benefits of $18 million recorded in connection with

New York state and city audit findings, primarily

associated with BlackRock, and

• A $14 million reduction in income tax expense

following our determination that we no longer

required an income tax reserve related to bank-

owned life insurance.

We expect the effective tax rate in 2006 to be closer to the

statutory tax rate.