PNC Bank 2005 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300

|

|

106

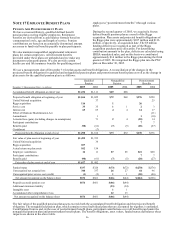

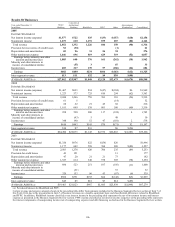

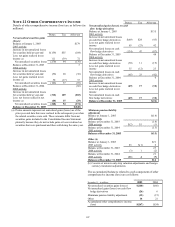

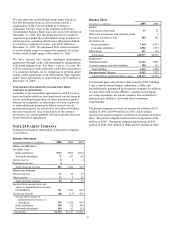

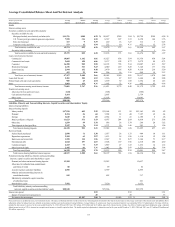

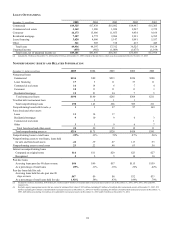

Results Of Businesses

Year ended December 31

In millions

Retail

Banking

Corporate &

Institutional

Banking

BlackRock

PFPC

Other

Intercompany

Eliminations Consolidated

2005

INCOME STATEMENT

Net interest income (expense) $1,577

$722 $35 $(33)

$(137)

$(10) $2,154

Noninterest income 1,275

610 1,191 879 287 (80) 4,162

Total revenue 2,852

1,332 1,226 846 150 (90) 6,316

Provision for (recoveries of) credit losses 52

(30) (1)

21

Depreciation and amortization 69

26 31 56 94 276

Other noninterest expense 1,646

696 819 629 319 (52) 4,057

Earnings before minority and other

interests and income taxes 1,085

640 376 161 (262)

(38) 1,962

Minority and other interests in

income of consolidated entities

(57) 3 87 33

Income taxes 403

217 139 57 (186)

(26) 604

Earnings $682

$480 $234 $104 $(163)

$(12) $1,325

Inter-segment revenue $13

$11 $32 $4 $30 $(90)

AVERAGE ASSETS (a) $27,862

$25,907 $1,848 $2,128 $32,473 $(1,670) $88,548

2004

INCOME STATEMENT

Net interest income (expense) $1,467

$693 $34 $(47)

$(184)

$6 $1,969

Noninterest income 1,223

573 725 810 294 (62) 3,563

Total revenue 2,690

1,266 759 763 110 (56) 5,532

Provision for (recoveries of) credit losses 61

5 (14)

52

Depreciation and amortization 60

22 21 45 68 216

Other noninterest expense 1,611

649 538 601 180 (60) 3,519

Earnings before minority and other

interests and income taxes 958

590 200 117 (124)

4 1,745

Minority and other interests in

income of consolidated entities

(43) 5 48 10

Income taxes 348

190 52 47 (101)

2 538

Earnings $610

$443 $143 $70 $(71)

$2 $1,197

Inter-segment revenue $10

$7 $33 $6 $(56)

AVERAGE ASSETS (a) $24,496

$22,073 $1,145 $2,572 $26,863 $(1,883) $75,266

2003

INCOME STATEMENT

Net interest income (expense) $1,326

$676 $22 $(54)

$26 $1,996

Noninterest income 1,177

602 598 760 209 $(89) 3,257

Total revenue 2,503

1,278 620 706 235 (89) 5,253

Provision for credit losses 43

121 13 177

Depreciation and amortization 47

20 21 21 73 182

Other noninterest expense 1,527

614 348 578 305 (78) 3,294

Earnings before minority and other

interests and income taxes 886

523 251 107 (156)

(11) 1,600

Minority and other interests in

income of consolidated entities (21) 53 32

Income taxes 320

153 96 43 (67)

(6) 539

Earnings $566

$391 $155 $64 $(142)

$(5) $1,029

Inter-segment revenue $45

$5 $18 $7 $14 $(89)

AVERAGE ASSETS (a) $19,463

$21,023 $967 $1,885 $25,839 $(1,898) $67,279

(a) Period-end balances for BlackRock and PFPC.

Certain revenue and expense amounts shown in the preceding table differ from amounts included in the Business Segments Review section of Item 7 of

this Form 10-K due to the presentation in Item 7 of business revenues on a taxable-equivalent basis and classification differences related to BlackRock

and PFPC. In addition, BlackRock income classified as net interest income in the preceding table represents the net of investment income and interest

expense as presented in the Business Segments Review section. PFPC income classified as net interest income (expense) in the preceding table represents

the interest components of nonoperating income (net of nonoperating expense) and debt financing as disclosed in the Business Segments Review section.