PNC Bank 2005 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.24

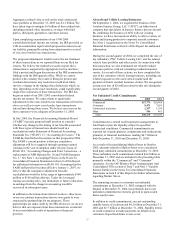

fees at BlackRock, and other growth in assets managed and

serviced.

Assets under management at December 31, 2005 totaled

$494 billion compared with $383 billion at December 31,

2004. In addition to the impact of net new business during

2005, the acquisition of SSRM added $50 billion of assets

under management during the first quarter of 2005. PFPC

provided fund accounting/administration services for $830

billion of net fund assets and provided custody services for

$476 billion of fund assets at December 31, 2005, compared

with $721 billion and $451 billion, respectively, at

December 31, 2004. These increases were driven by net new

business and asset inflows from existing customers, as well

as comparatively favorable market conditions.

Service charges on deposits increased $21 million for 2005

compared with 2004. Although growth in service charges

has been limited due to our offering of free checking in both

the consumer and small business channels, free checking

has positively impacted customer and demand deposit

growth as well as other deposit-related fees.

Brokerage fees increased $6 million, to $225 million, for

2005 compared with the prior year. The increase was

primarily due to higher mutual fund-related revenues in

2005.

Consumer services fees increased $23 million, to $287

million, in 2005 compared with 2004. Higher fees reflected

additional fees from debit card transactions, primarily due to

higher volumes and the expansion into the greater

Washington, D.C. area.

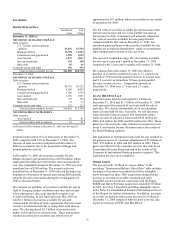

Corporate services revenue was $511 million for 2005,

compared with $493 million in 2004. Corporate services

revenue in 2005 benefited from the impact of higher net

gains on commercial mortgage loan sales, higher fees

related to commercial mortgage servicing activities,

increased loan syndication fees and higher capital markets

revenues, including revenues attributable to Harris

Williams, compared with the prior year. These increases

were partially offset by a $45 million decline in 2005 of net

gains in excess of valuation adjustments related to our

liquidation of institutional loans held for sale. Our

liquidation of institutional loans held for sale is now

complete.

Equity management (private equity) net gains on portfolio

investments totaled $96 million for 2005 and $67 million

for 2004.

Net securities losses amounted to $41 million for 2005

compared with net securities gains of $55 million in 2004.

Our discussion under the Consolidated Balance Sheet

Review section of this Item 7 provides additional

information on the impact on net securities losses of actions

taken during the second quarter of 2005 regarding our

securities portfolio.

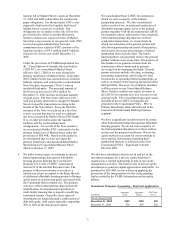

Noninterest revenue from trading activities totaled $157

million for 2005 and $113 million for 2004. While customer

activity represented the majority of trading revenue, the

increase compared with 2004 was primarily the result of

proprietary trading activities. We provide additional

information on our trading activities under Market Risk

Management – Trading Ris k in the Risk Management

section of this Item 7.

Other noninterest income increased $52 million, to $341

million, in 2005 compared with 2004. Other noninterest

income typically fluctuates from period to period depending

on the nature and magnitude of transactions completed.

Other noninterest income for 2005 included the following

pretax items:

• A $33 million gain related to contributions of

BlackRock stock to the PNC Foundation,

transactions that also impacted noninterest

expense, and

• Income related to the 2005 SSRM and Riggs

acquisitions.

These factors more than offset the impact of the following

pretax gains in 2004:

• A first quarter $34 million gain related to the sale

of our modified coinsurance contracts, and

• A second quarter $13 million gain recognized in

connection with BlackRock’ s sale of its interest in

Trepp LLC, a provider of commercial mortgage-

backed security information, analytics and

technology.

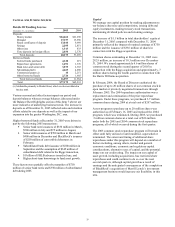

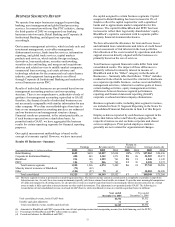

PRODUCT REVENUE

Corporate & Institutional Banking offers treasury

management and capital markets-related products and

services, commercial loan servicing and equipment leasing

products that are marketed by several businesses across

PNC.

Treasury management revenue, which includes fees as well

as net interest revenue from customer deposit balances,

totaled $410 million for 2005 and $373 million for 2004.

The 10% increase in revenue reflected the longer-term

nature of treasury management deposits along with the

rising interest rate environment, strong deposit growth,

continued expansion and client utilization of commercial

card services, and a steady increase in business-to-business

processing volumes. The acquisition of Riggs also

contributed to the revenue growth in 2005.

Revenue from capital markets products and services was

$175 million for 2005, compared with $140 million in 2004.

The acquisition of Harris Williams and increases in loan

syndication fees and other client-related activity drove the

25% increase in capital markets revenue.

Midland Loan Services offers servicing, real estate advis ory

and technology solutions for the commercial real estate

finance industry. Midland’ s revenue, which includes fees

and net interest income from servicing portfolio deposit

balances, totaled $131 million for 2005 and $108 million for