PNC Bank 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

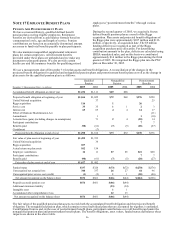

NOTE 17 EMPLOYEE BENEFIT PLANS

PENSION AND POSTRETIREMENT PLANS

We have a noncontributory, qualified defined benefit

pension plan covering eligible employees. Retirement

benefits are derived from a cash balance formula based on

compensation levels, age and length of service. Pension

contributions are based on an actuarially determined amount

necessary to fund total benefits payable to plan participants.

We also maintain nonqualified supplemental retirement

plans for certain employees. All retirement benefits

provided under these plans are unfunded and we make any

payments to plan participants. We also provide certain

health care and life insurance benefits for qualifying retired

employees (“postretirement benefits”) through various

plans.

During the second quarter of 2005, we acquired a frozen

defined benefit pension plan as a result of the Riggs

acquisition. Plan assets and projected benefit obligations of

the Riggs plan were approximately $107 million and $116

million, respectively, at acquisition date. The $9 million

funding deficit was recognized as part of the Riggs

acquisition purchase price allocation. For determining

contribution amounts to the plan, deficits are calculated using

ERISA-mandated rules, and on this basis we contributed

approximately $16 million to the Riggs plan during the third

quarter of 2005. We integrated the Riggs plan into the PNC

plan on December 30, 2005.

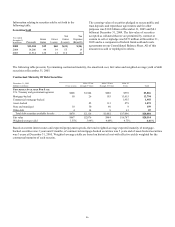

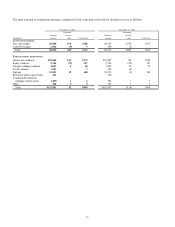

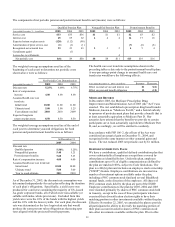

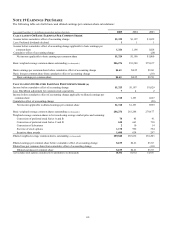

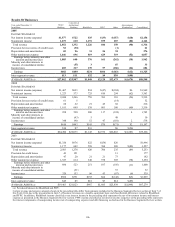

We use a measurement date of December 31 for plan assets and benefit obligations. A reconciliation of the changes in the

projected benefit obligation for qualified and nonqualified pension plans and postretirement benefit plans as well as the change in

plan assets for the qualified pension plan is as follows:

Qualified

Pension

Nonqualified

Pension

Postretirement

Benefits

December

31 (Measurement Date)

–

in millions

2005

2004

2005

2004

2005

2004

Accumulated benefit obligation at end of year $1,232 $1,111 $69 $68

Projected benefit obligation at beginning of year

$1,166

$1,025

$72

$68

$276

$258

United National acquisitio

n

37

25

Riggs acquisition

116

1

26

Service cost

33

35

1

1

2

3

Interest cost

65

65

4

4

14

17

Effect of Medicare Modernization Act

(11)

Amendments

1

1

(10)

Actuarial loss (gain) (including changes in assumptions)

71

2

4

(28)

14

Participant contributions 7 7

Benefits paid (90) (61) (7) (5) (28) (27)

Curtailment (7)

Projected benefit obligation at end of year

$1,290

$1,166

$73

$72

$270

$276

Fair value of plan assets at beginning of year $1,492 $1,352

United National acquisition 36

Riggs acquisition 107

Actual return on plan assets 102 154

Employer contribution 16 11 $7 $5 $21 $20

Participant contributions 7 7

Benefits paid (90) (61) (7) (5) (28) (27)

Fair value of plan assets at end of ye

ar

$1,627

$1,492

Funded status

$337

$326

$(73)

$(72)

$(270)

$(276)

Unrecognized net actuarial loss 340 337 26 27 64 96

Unrecognized prior service cost (credit) (1) (2) 1 1 (38) (46)

Net amount recognized on the balance sheet

$676

$661

$(46

)

$(44)

$(244)

$(226)

Prepaid (accrued) pension cost $676 $661 $(46) $(44)

Additional minimum liability (23) (24)

Intangible asset 1 1

Accumulated other comprehensive loss 22 23

Net amount recognized on the balance sheet $676 $661 $(46) $(44)

The fair value of the qualified pension plan assets exceeds both the accumulated benefit obligation and the projected benefit

obligation. The nonqualified pension plan, which contains several individual plans that are accounted for together, is unfunded.

Contributions from us and, in the case of postretirement benefit plans, participant contributions cover all benefits paid under the

nonqualified pension plan and postretirement benefit plans. The benefit obligations, asset values, funded status and balance sheet

impacts are shown in the above table.