PNC Bank 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

• Dennis F. Strigl, 59, President and Chief Executive

Officer of Verizon Wireless, Inc. and Executive Vice

President of Verizon Communications Inc.

(telecommunications), (2001),

• Stephen G. Thieke, 59, Retired Chairman, Risk

Management Committee of JP Morgan Incorporated

(financial and investment banking services), (2002),

• Thomas J. Usher, 63, Retired Chairman of United

States Steel Corporation (integrated steelmaker),

(1992),

• Milton A. Washington, 70, President and Chief

Executive Officer of Allegheny Housing

Rehabilitation Corporation (housing rehabilitation

and construction), (1994), and

• Helge H. Wehmeier, 63, Retired President and Chief

Executive Officer of Bayer Corporation (healthcare,

crop protection, and chemicals), (1992).

Unless we indicate otherwise, all directors have held the

positions indicated or another senior executive position with

the same entity or one of its affiliates or a predecessor entity

for at least the past five years.

PART II

ITEM 5 – MARKET FOR REGISTRANT’S COMMON

EQUITY, RELATED STOCKHOLDER MATTERS AND

ISSUER PURCHASES OF EQUITY SECURITIES

(a) Our common stock is listed on the New York Stock

Exchange and is traded under the symbol “PNC.” At the close

of business on February 28, 2006, there were 43,120 common

shareholders of record.

Holders of PNC common stock are entitled to receive

dividends when declared by the Board of Directors out of

funds legally available for this purpose. Our Board of

Directors may not pay or set apart dividends on the common

stock until dividends for all past dividend periods on any

series of outstanding preferred stock have been paid or

declared and set apart for payment. The Board presently

intends to continue the policy of paying quarterly cash

dividends. However, the amount of any future dividends will

depend on earnings, our financial condition and other factors,

including contractual restrictions and applicable government

regulations and policies (such as those relating to the ability of

bank and non-bank subsidiaries to pay dividends to the parent

company).

The Federal Reserve has the power to prohibit us from paying

dividends without its approval. For further information

concerning dividend restrictions and restrictions on loans or

advances from bank subsidiaries to the parent company, you

may review “Supervision and Regulation” in Item 1 of this

Report, “Liquidity Risk Management” in the Risk

Management section of Item 7 of this Report, and Note 4

Regulatory Matters in the Notes To Consolidated Financial

Statements in Item 8 of this Report, which we include here by

reference.

We include here by reference additional information relating

to PNC common stock under the caption “Common Stock

Prices/Dividends Declared” in the Statistical Information

(Unaudited) section of Item 8 of this Report.

We include here by reference the information regarding our

compensation plans under which PNC equity securities are

authorized for issuance as of December 31, 2005 in the table

(with introductory paragraph and notes) that appears under

Item 12 of this Report.

Our registrar, stock transfer agent, and dividend disbursing

agent is:

Computershare Investor Services, LLC

2 North LaSalle Street

Chicago, Illinois 60602

(800) 982-7652

(b) Not applicable.

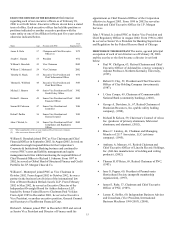

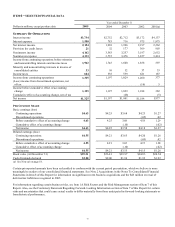

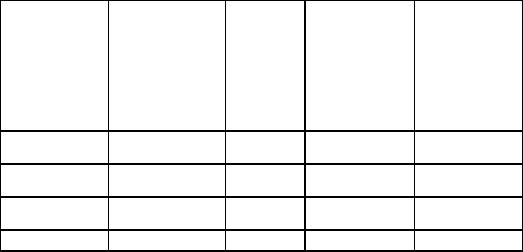

(c) Details of our repurchases of PNC common stock during

the fourth quarter of 2005 are included in the following table:

In thousands, except per share data

2005 period

Total shares

purchased (a)

Average

price

paid per

share

Total shares

purchased as

part of

publicly

announced

programs (b)

Maximum

number of

shares that

may yet be

purchased

under the

programs (b)

October 1 –

October 31 122 $57.71 -- 19,522

November 1 –

November 30 271 $63.26 -- 19,522

December 1 –

December 31 203 $63.73 -- 19,522

Total 596 $62.28 --

(a) Includes PNC common stock purchased under the program referred to in

note (b) to this table, if any, and PNC common stock purchased in

connection with our various employee benefit plans.

(b) Our current stock repurchase program, which was authorized as of

February 16, 2005, allows us to purchase up to 20 million shares on the

open market or in privately negotiated transactions. This program will

remain in effect until fully utilized or until modified, superseded or

terminated. We did not purchase any shares under this program during

the fourth quarter of 2005.