PNC Bank 2005 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

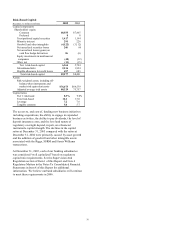

eliminated as of December 31, 2005. We estimate that these

changes will result in employee severance and other

implementation costs of approximately $74 million,

including $54 million recognized during the second half of

2005. We expect that the remaining charges will be

incurred in 2006 and early 2007. The initiatives

implemented to date have required approximately $11

million lower costs than originally expected, and we expect

to maintain that variance over the remainder of the One

PNC program. In addition, PNC intends to achieve at least

$100 million in net revenue growth through the

implementation of various pricing and business growth

enhancements driven by the One PNC initiative. Initiatives

to achieve this growth are progressing according to plan.

We realized a net pretax financial benefit from the One PNC

program of approximately $90 million in 2005, primarily in

the latter half of the year and primarily in our banking

businesses, which was $55 million more than we had

previously estimated. We achieved this benefit by

accelerating some of the 2006 initiatives into 2005. We

expect to capture approximately $265 million in value by

the end of 2006 as originally planned.

KEY FACTORS AFFECTING FINANCIAL PERFORMANCE

Our financial performance is substantially affected by

several external factors outside of our control, including:

• General economic conditions,

• Loan demand and utilization of credit

commitments,

• Interest rates, and the shape of the interest rate

yield curve,

• The performance of the capital markets, and

• Customer demand for other products and services.

In addition to changes in general economic conditions,

including the direction, timing and magnitude of movement

in interest rates and the performance of the capital markets,

our success in 2006 will depend, among other things, upon:

• Further success in the acquisition, growth and

retention of customers,

• Successful execution of the One PNC initiative,

• Revenue growth,

• A sustained focus on expense management and

improved efficiency,

• Maintaining strong overall asset quality, and

• Prudent risk and capital management.

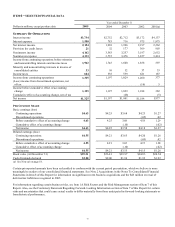

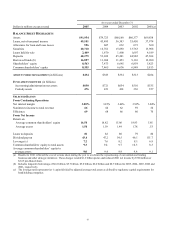

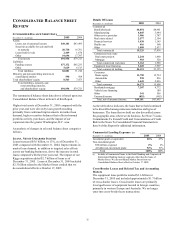

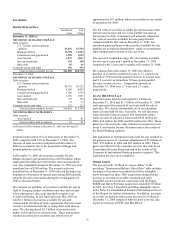

SUMMARY FINANCIAL RESULTS

Year ended December 31

In billions, except for

per share data 2005

2004

Net income $1.325 $1.197

Diluted earnings per share $4.55 $4.21

Return on

Average common

shareholders’ equity 16.58%

16.82%

Average assets 1.50% 1.59%

Results for 2005 included the impact of the following items:

• Implementation costs totaling $35 million after-tax,

or $.12 per diluted share, related to the One PNC

initiative;

• Integration costs of $20 million after-tax, or $.07

per diluted share, comprised of provision for credit

losses, noninterest expense and deferred taxes,

related to the May 2005 acquisition of Riggs;

• The reversal of deferred tax liabilities that

benefited earnings by $45 million, or $.16 per

diluted share, in the first quarter related to our

transfer of ownership in BlackRock from PNC

Bank, National Association (“PNC Bank, N.A.”) to

our intermediate bank holding company, PNC

Bancorp, Inc., in January 2005; and

• The $34 million after-tax benefit of a second

quarter 2005 loan recovery.

Results for 2004 reflected the impact of charges totaling $49

million after taxes, or $.17 per diluted share, related to the

2002 BlackRock Long-Term Retention and Incentive Plan

(“LTIP”). This LTIP is described under 2002 BlackRock

Long-Term Retention and Incentive Plan in Item 7 of this

Report.

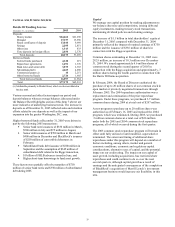

Our performance in 2005 included the following

accomplishments:

• Total taxable-equivalent revenue for 2005

increased 14% compared with the prior year,

driven by continued growth in fee-based businesses

and net interest income.

• Average deposits for the year increased $7.9

billion, or 16%, compared with 2004, driven by

higher money market deposits, certificates of

deposit and other time deposits as well as growth in

demand deposit balances, including the impact of

our expansion into the greater Washington, D.C.

area.

• Average loans for 2005 increased $6.4 billion, or

16%, compared with 2004, driven by consumer and

commercia l loan demand, as well as an increase in

residential mortgages, and the impact of our

expansion into the greater Washington, D.C. area.

• We have begun to realize benefits from the One

PNC initiative sooner than originally anticipated

and we remain on track to capture $400 million in

value from One PNC by 2007.

• PNC invested more than $1 billion in 2005 to build

scale and expand its presence into attractive

markets and products. These investments include:

expanding into the greater Washington, D.C. area

with our Riggs acquisition; BlackRock’ s

acquisition of SSRM to build scale; and the

addition of Harris Williams.

• Asset quality remained very strong. Although some

ratios increased, all remained at low levels. The

ratio of nonperforming assets to total loans, loans

held for sale and foreclosed assets was .42% at

December 31, 2005 compared with .39% at

December 31, 2004.