PNC Bank 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

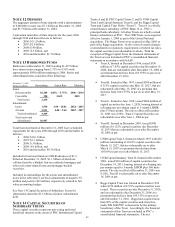

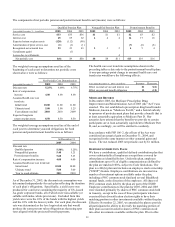

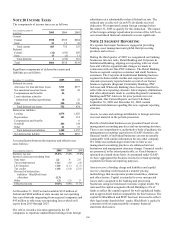

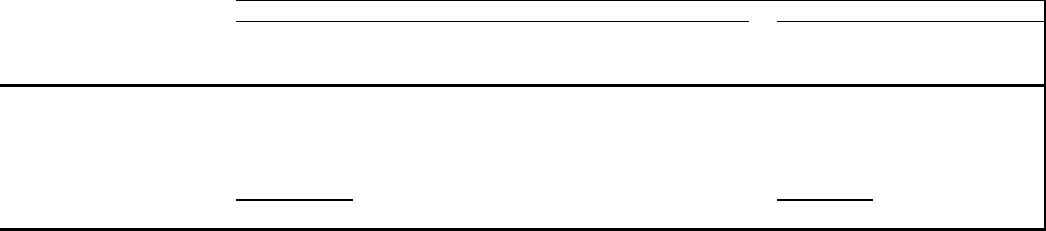

Information about stock options outstanding at December 31, 2005 follows:

Options Outstanding Options Exercisable

December 31, 2005

Shares in thousands

Range of exercise prices Shares

Weighted-

average exercise

price

Weighted-average remaining

contractual life (in years) Shares

Weighted-average

exercise price

$31.13 – $42.99 1,389 $41.18 4.5 1,389 $41.18

43.00 – 52.99 4,640 46.45 5.6 3,382 46.92

53.00 – 59.99 8,655 55.17 6.6 5,248 56.05

60.00 – 76.00 3,608 72.42 4.7 3,563 72.55

Total 18,292 $55.30 5.8 13,582 $56.58

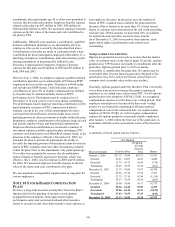

Options granted in 2005, 2004 and 2003 include options for

30,000 shares that were granted to non-employee directors

in each year.

The weighted-average grant-date fair value of options

granted in 2005, 2004 and 2003 was $8.72, $9.64, and $8.11

per option, respectively. At December 31, 2004 and 2003

options for 12,693,000 and 10,426,000 shares of common

stock, respectively, were exercisable at a weighted-average

price of $56.41 and $55.21, respectively.

There were no options granted in excess of market value in

2005, 2004 or 2003. Shares of common stock available

during the next year for the granting of options and other

awards under the Incentive Plan were 10,584,683 at

December 31, 2005, 2004 and 2003.

As discussed in Note 1 Accounting Policies, we adopted the

fair value recognition provisions of SFAS 123 prospectively

to all employee awards including stock options granted,

modified or settled after January 1, 2003. As permitted

under SFAS 123, we recognize compensation expense for

stock options on a straight-line basis over the pro rata

vesting period. Compensation expense for stock options

recognized in 2005 was $31 million compared with $22

million in 2004 and $12 million in 2003.

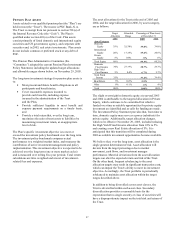

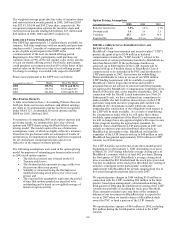

INCENTIVE SHARE AND RESTRICTED STOCK AWARDS

In 2003, we granted incentive share awards representing a

maximum of 659,250 shares of PNC common stock to

certain senior executives pursuant to the Incentive Plan.

Issuance of shares pursuant to these incentive awards was

subject to the achievement of one or more financial and

other performance goals over a three-year period that ended

December 31, 2005 and the approval of the Personnel and

Compensation Committee of the Board of Directors. In

February 2006, the Committee approved the issuance of

549,375 shares of common stock to satisfy these incentive

awards. One-half of the shares vested immediately while the

other half were issued as restricted shares with a vesting

period ending December 31, 2006. Expense related to

incentive share awards is recognized over the performance

period and the employee service period.

In 2004, we granted incentive share awards representing a

maximum of 879,000 shares of PNC common stock to

certain senior executives pursuant to the Incentive Plan. In

addition, awards under this grant would be increased by the

amount of phantom dividends on the awards during the

performance period converted to incentive shares and added

to the award amount. Issuance of shares pursuant to these

incentive awards was subject to the achievement of one or

more financial and other performance goals over a two-year

period that ended December 31, 2005 and the approval of

the Personnel and Compensation Committee of the Board of

Directors. Any shares awarded under this grant, other than

those related to the conversion of phantom dividends, would

be reduced on a share-for-share basis for shares issued

pursuant to the 2003 incentive share awards discussed above.

In February 2006, the Committee approved the issuance of

110,812 shares of common stock to satisfy the incentive

awards under this grant. One-half of the shares vested

immediately while the other half were issued as restricted

shares with a vesting period ending December 31, 2006.

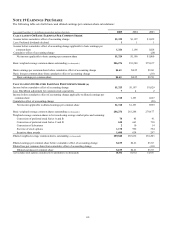

In 2000, we granted 245,000 shares of restricted stock to

senior executives with a three-year vesting period. Of these,

35,000 shares were forfeited in 2002. The restricted period for

all but 40,000 of the restricted shares ended November 15,

2003.

In 2002, we granted 109,138 shares of restricted stock to

senior executives with vesting periods ranging from 24

months to 50 months. There were 737 and 1,551 restricted

shares forfeited during 2004 and 2002 respectively. The

restricted period for all but 48,686 shares ended during 2005.

In 2003, we granted 520,446 shares of restricted stock to

senior executives with vesting periods ranging from 24

months to 47 months. There were 8,456, 2,607 and 7,062

restricted shares forfeited in 2005, 2004 and 2003,

respectively.

In 2004, we granted 342,188 shares of restricted stock to

senior executives with vesting periods ranging from 17

months to 43 months. Of these, 3,712 shares were forfeited in

2005 and 1,610 shares were forfeited in 2004. Additionally,

we granted 369,854 shares of restricted stock to certain key

employees. These shares vest 100% after three years. Of these,

26,934 shares were forfeited in 2005 and 11,232 shares were

forfeited in 2004.

In 2005, we granted 440,631 shares of restricted stock to

senior executives with vesting periods ranging from 36

months to 48 months. Of these, 3,245 restricted shares were

forfeited in 2005. Additionally, we granted 339,110 shares of

restricted stock to certain key employees. These shares vest

100% after three years. Of these, 24,635 restricted shares

were forfeited in 2005.

We also granted 37,500, 63,500 and 67,900 shares of restricted

stock to certain key employees in 2005, 2004 and 2003,

respectively. These shares vest 25% after three years, 25% after

four years and 50% after five years. Shares forfeited were

11,500, 11,375 and 10,975 in 2005, 2004 and 2003,

respectively.