PNC Bank 2005 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2005 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 19

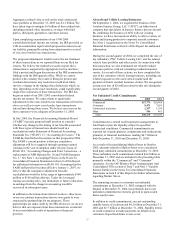

ITEM 7 - MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIA L CONDITION AND

RESULTS OF OPERATIONS

EXECUTIVE SUMMARY

THE PNC FINANCIAL SERVICES GROUP, INC.

PNC is one of the largest diversified financial services

companies in the United States, operating businesses

engaged in retail banking, corporate and institutional

banking, asset management and global fund processing

services. We operate directly and through numerous

subsidiaries, providing many of our products and services

nationally and others in our primary geographic markets in

Pennsylvania, New Jersey, Delaware, Ohio, Kentucky and

the greater Washington, D.C. area. We also provide certain

asset management and global fund processing services

internationally.

KEY STRATEGIC GOALS

Our strategy to enhance shareholder value centers on

achieving revenue growth in our various businesses

underpinned by prudent management of risk, capital and

expenses. In each of our business segments, the primary

drivers of growth are the acquisition, expansion and

retention of customer relationships. We strive to achieve

such growth in our customer base by providing convenient

banking options, leading technological systems and a broad

range of asset management products and services. We also

intend to grow through appropriate and targeted acquisitions

and, in certain businesses, by expanding into new

geographical markets.

In recent years, we have managed our interest rate risk to

achieve a moderate risk profile with limited exposure to

earnings volatility resulting from interest rate fluctuations.

Our actions have created a balance sheet characterized by

strong asset quality and significant flexibility to take

advantage, where appropriate, of changing interest rates and

to adjust to changing market conditions.

On February 15, 2006, we announced that BlackRock and

Merrill Lynch had entered into a definitive agreement

pursuant to which Merrill Lynch will contribute its

investment management business to BlackRock in exchange

for newly issued BlackRock common and preferred stock.

Upon the closing of this transaction, which we expect to

occur on or around September 30, 2006, BlackRock’ s assets

under management will increase to almost $1 trillion and

Merrill Lynch will own an approximate 49% economic

interest in BlackRock. We will continue to own

approximately 44.5 million shares of BlackRock common

stock, representing an ownership interest of approximately

34%. In addition, upon closing, our investment in

BlackRock will increase resulting in an after-tax gain of

approximately $1.6 billion, subject to adjustments through

closing. This gain will significantly improve our capital

position.

This transaction must be approved by BlackRock

shareholders and is subject to obtaining appropriate

regulatory and other approvals. We currently control more

than 80% of the voting interest in BlackRock and will vote

our interest in support of the transaction. Additional

information on this transaction is included in Note 26

Subsequent Event in the Notes To Consolidated Financial

Statements in Item 8, in our Current Reports on Form 8-K

filed February 15, 2006 and February 22, 2006 and in

BlackRock’ s Current Reports on Form 8-K filed February

15, 2006 and February 22, 2006. To the extent that

statements we make in this Report about our expectations

for future results include results from BlackRock, those

expectations do not give any effect to the impact to PNC

from the change in accounting for PNC’ s interest in

BlackRock that would take place when BlackRock and

Merrill Lynch close this transaction.

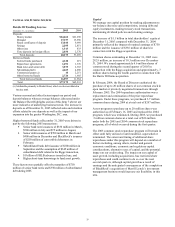

On October 11, 2005, we acquired Harris Williams & Co.

(“Harris Williams”), one of the nation’ s largest firms

focused on providing merger and acquisition advisory and

related services to middle market companies, including

private equity firms and private and public companies. This

acquisition should provide opportunities for commercial

lending as well as wealth management and capital markets

business growth.

In May 2005, we successfully completed our acquisition of

Riggs National Corporation (“Riggs”), a Washington, D.C.-

based banking company. The transaction gives us a

substantial presence on which to build a market leading

franchise in the affluent Washington metropolitan area.

We include additional information on Riggs, as well as the

first quarter 2005 acquisition of SSRM Holdings, Inc.

(“SSRM”) by our majority-owned subsidiary, BlackRock,

Inc. (“BlackRock”), in Note 2 Acquisitions in the Notes To

Consolidated Financial Statements in Item 8 of this Report

and here by reference. We also note that the SSRM and

Harris Williams transactions were accretive to earnings in

2005 and we expect that the Riggs acquisition will be

accretive to earnings beginning in 2006.

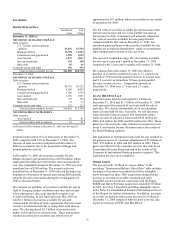

THE ONE PNC INITIATIVE

The One PNC initiative, which began in January 2005, is an

ongoing, company-wide initiative with goals of moving

closer to the customer, improving our overall efficiency and

targeting resources to more value-added activities. PNC

expects to realize $400 million of total pretax earnings

benefit by 2007 from this initiative.

As a result of this intensive process, we have reorganized

our banking businesses to streamline and to better serve our

customer base. The initiative has resulted in a simplified and

a more centrally managed organization. As further described

in our Current Reports on Form 8-K dated September 30,

2005 and December 28, 2005, and in Note 21 Segment

Reporting in the Notes To Consolidated Financial

Statements in Item 8 of this Report, our banking businesses

have been reorganized into two units, Retail Banking and

Corporate & Institutional Banking, and we have aligned our

reporting accordingly.

PNC plans to achieve approximately $300 million of cost

savings initiatives through a combination of workforce

reduction and other efficiencies. Of the approximately 3,000

positions to be eliminated, approximately 1,800 had been